The EUR/USD currency pair has continued its upward momentum, reaching its highest level since September 14, as the US dollar softened following the release of the latest US jobs numbers. The pair surged to 1.1765, significantly above the November low of 1.1470, as market attention shifted toward the upcoming European Central Bank (ECB) interest rate decision.

Traders and analysts are closely monitoring both macroeconomic data and technical indicators to gauge potential volatility in the forex market. In this article, Tarillium brokers examine the key aspects of the topic with clarity.

ECB Interest Rate Decision in Focus

The EUR/USD pair maintained its gains as the market anticipated the ECB interest rate decision scheduled for Thursday. Economists polled by Reuters widely expect the central bank to leave its key interest rate unchanged at 2%, citing inflation levels that have remained near the ECB’s 2% target.

The ECB decision will come just a day after Eurostat releases the latest inflation report, providing further insight into price stability across the Eurozone. Analysts forecast that the report will show the headline Consumer Price Index (CPI) rising from 2.1% in October to 2.2% in November, while the core CPI remains stable at 2.4%.

Looking ahead, most economists predict that the ECB will initiate interest rate hikes in the fourth quarter of next year, signaling a gradual tightening of monetary policy. This potential divergence in monetary policy stances between the ECB and the Federal Reserve is expected to have significant implications for the EUR/USD pair.

US Jobs Data Influences EUR/USD

Investor sentiment in the forex market has been influenced by the latest US Bureau of Labor Statistics (BLS) jobs report. According to the report, the US economy lost 105,000 jobs in October, followed by a rebound of 64,000 jobs in November. Additionally, the unemployment rate climbed to 4.6%, marking its highest level in more than four years.

This weaker labor market data may encourage the Federal Reserve (Fed) to consider continued interest rate cuts in the upcoming year. In its previous meeting, the Fed reduced interest rates by 0.25% and launched a quantitative easing program, purchasing $40 billion of short-term government bonds per month to support economic growth and stabilize financial markets.

Looking forward, the BLS is set to release the latest consumer inflation report on Thursday, with expectations that headline and core inflation remain at 3%, above the Fed’s 2% target. This combination of slower job growth and persistent inflation could influence the Fed’s monetary policy stance, further impacting the EUR/USD exchange rate.

Implications for Traders and Investors

For forex traders and investors, the current EUR/USD trend presents both opportunities and risks. With the pair approaching the year-to-date high, traders should monitor liquidity conditions and volatility spikes around key economic releases, including the ECB rate decision and US inflation data. Positioning strategies may include long positions on anticipated euro strength or hedging against potential dollar rebounds.

Additionally, the alignment of technical indicators such as EMAs, RSI, and Stochastic Oscillator with fundamental catalysts can help traders identify optimal entry and exit points, ensuring a disciplined approach to risk management in a dynamic market environment.

Technical Analysis of EUR/USD

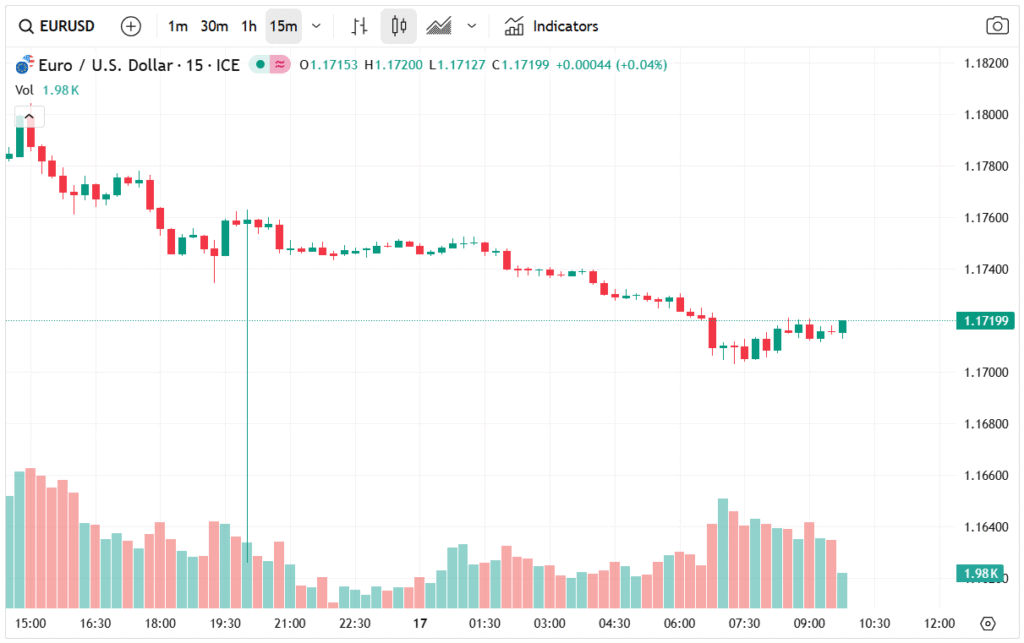

From a technical perspective, the EUR/USD pair has rebounded strongly over the past few weeks, driven by market expectations of policy divergence between the Federal Reserve and the ECB.

The pair has consistently stayed above the 50-day and 100-day Exponential Moving Averages (EMA), indicating that bullish momentum has prevailed. Moreover, the Relative Strength Index (RSI) has approached the overbought level, while the Stochastic Oscillator is also nearing overbought territory. These signals suggest that while bulls are in control, traders should watch for potential short-term pullbacks.

Key resistance levels are now in focus. Technical analysts identify 1.1850 as the next major resistance target, while support levels around 1.1700 may act as a floor for downside corrections. The interplay between fundamental catalysts, such as the ECB rate decision and US inflation data, and technical levels will likely determine the next significant move in EUR/USD.

Market Outlook

The EUR/USD Forex signal points toward continued upside potential, driven by fundamental factors and technical momentum. The softening US dollar, combined with expectations that the ECB will maintain its interest rates in the near term, has bolstered investor confidence in the euro.

However, traders should remain cautious ahead of the ECB announcement and the Eurostat inflation report, as market volatility could spike in response to any unexpected data or policy statements. Short-term traders may capitalize on price swings, while long-term investors should consider the potential implications of interest rate divergence between the Fed and the ECB on the EUR/USD trend.