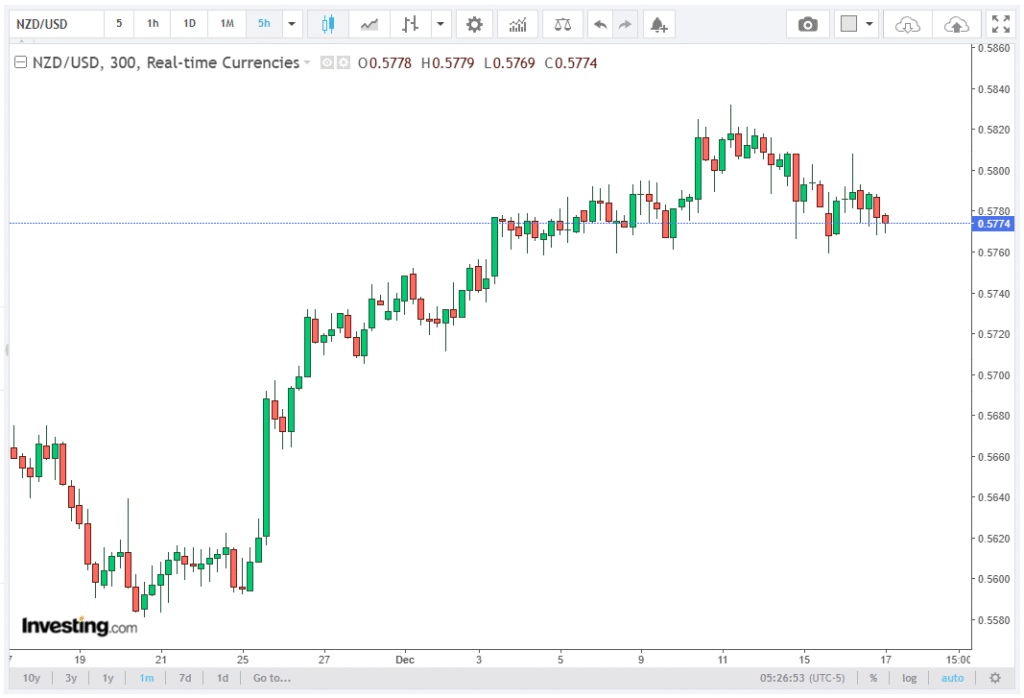

The NZD/USD pair continues to navigate a corrective phase, trading near 0.5775 during the European trading session on Wednesday. The pair faces pressure as the US Dollar (USD) recovers sharply following recent US economic data, while investors await critical New Zealand (NZ) Q3 GDP figures and upcoming US inflation data. Tarillium professionals unpack the complexities of the topic through a detailed analysis.

NZD/USD Under Pressure Amid US Dollar Recovery

The New Zealand Dollar (NZD) is slightly lower, down 0.15%, as the US Dollar strengthens in global markets. At the time of writing, the US Dollar Index (DXY), which tracks the Greenback against six major currencies, trades 0.33% higher near 98.50, highlighting robust USD demand.

The USD recovery comes despite a higher-than-expected US Unemployment Rate, which jumped to 4.6% in November, the highest reading since September 2021. This release has fueled speculation that the Federal Reserve (Fed) may maintain a cautious approach to monetary policy, especially ahead of the Consumer Price Index (CPI) data for November scheduled on Thursday.

The market’s focus remains split between US labor data and NZ economic indicators, creating a volatile backdrop for the NZD/USD pair.

Investors Await Key Economic Data

Investor attention is firmly on the New Zealand Q3 GDP report, set for release on Thursday. Analysts expect a 0.9% expansion, following a 0.9% contraction in Q2. A stronger-than-expected GDP reading could provide relief to the Kiwi, potentially limiting downside risks, while weaker numbers could intensify the corrective pressure against the USD.

Simultaneously, US CPI data will play a crucial role in shaping short-term USD momentum. Higher inflation could reinforce dollar strength, while softer inflation may weigh on the Greenback, offering NZD/USD an opportunity to recover.

The upcoming economic data highlights the importance of fundamental analysis in trading this pair, as macroeconomic releases often trigger sharp FX market moves.

NZD/USD Technical Analysis

From a technical perspective, NZD/USD remains in a corrective phase despite an overall bullish bias. The pair trades near 0.5775, supported by the upward-sloping 20-day Exponential Moving Average (EMA) at 0.5753. This moving average acts as a key dynamic support level, providing traders with a potential entry point for long positions.

The 14-day Relative Strength Index (RSI) has pulled back to 58, retreating from overbought levels. This decline signals that the pair is undergoing consolidation, with momentum temporarily pausing after recent gains. However, the overall technical structure remains constructive for the NZD, suggesting that any retracement could be limited unless key support levels are breached.

Support levels are critical to watch: immediate support at 0.5753 (20-day EMA) and further support at the December low of 0.5711, which may act as a strong corrective floor. Resistance levels also define the upside potential, with near-term resistance at the December 11 high of 0.5832, and a break above 0.5900 potentially signaling a resumption of bullish momentum, targeting round-level psychological barriers.

Market Sentiment and Risk Factors

Current market sentiment remains cautious. The NZD faces headwinds from a resurgent USD, which has regained safe-haven appeal amid mixed US labor market signals. However, New Zealand-specific catalysts, particularly the Q3 GDP data, could shift sentiment in favor of the Kiwi if results exceed expectations.

Other risk factors include global economic uncertainty, which may support the USD as a risk-off currency; interest rate differentials between the RBNZ and the Fed, influencing carry trade flows; and technical triggers around support and resistance levels, which could accelerate corrective moves or signal trend continuation.

Outlook

The NZD/USD pair is likely to remain in a consolidation phase until major economic releases provide a clear direction. Key points for traders include monitoring the NZ Q3 GDP and US CPI as potential market catalysts, using the 20-day EMA at 0.5753 as a technical guide for short-term support, and watching the December high of 0.5832 as a potential bullish breakout level.

During the corrective phase, short-term traders may look for pullback opportunities while remaining cautious around USD-driven volatility. Momentum indicators such as RSI and EMA support the notion of a temporary retracement, but the long-term technical bias remains positive for the NZD.

Conclusion

In summary, NZD/USD trades near 0.5775, facing corrective pressure amid a rebounding US Dollar. The market awaits key economic releases, including NZ Q3 GDP and US CPI, which could define the next leg of the pair’s movement.

Technical indicators suggest short-term consolidation, with critical support at 0.5753 and resistance near 0.5832. Traders should stay alert to economic surprises and FX market shifts as they navigate this volatile yet technically structured market.

The current phase highlights the interplay between fundamental and technical analysis, emphasizing the importance of economic data, momentum indicators, and support/resistance levels in shaping NZD/USD trading decisions.