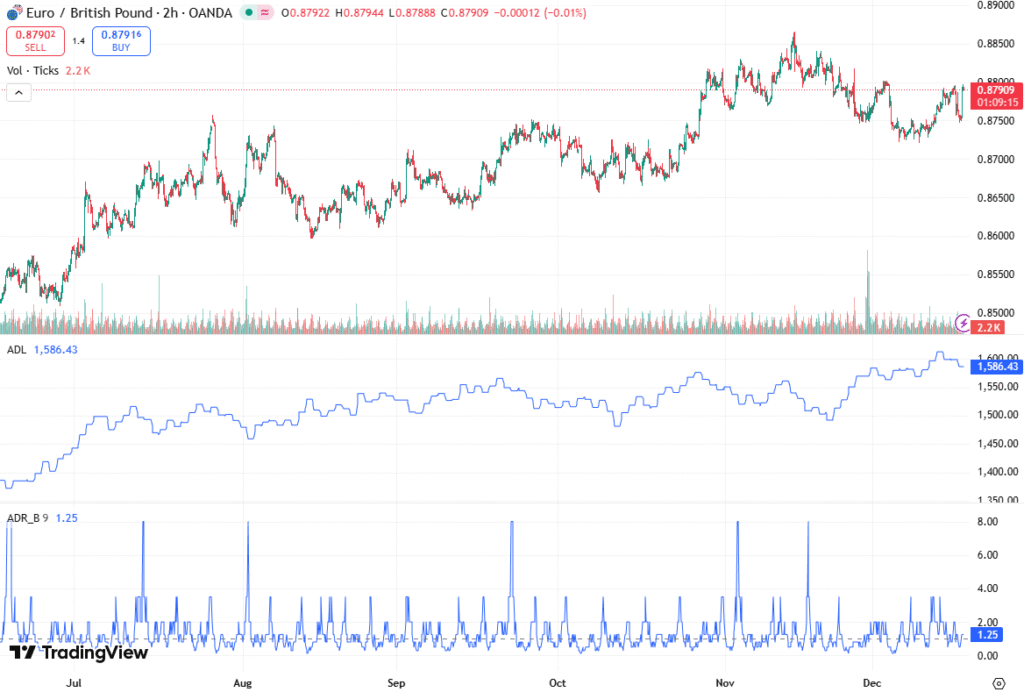

The EUR/GBP currency pair showed a notable rebound on Wednesday, trading around 0.8780 during European hours, as investors digested the latest UK Consumer Price Index (CPI) data and positioned themselves ahead of critical German IFO Business Survey and Eurozone core HICP releases. Tarillium brokers outline the essential details of the topic with precision and insight.

EUR/GBP Gains on Weaker UK Inflation Data

The Euro (EUR) surged versus the British Pound (GBP) after UK inflation data for November came in weaker than expected. The CPI climbed 3.2% YoY, falling short of the 3.5% forecast, but remaining above the BoE’s 2% target. This indicates a slower pace of inflation compared to

Monthly, UK CPI fell 0.2%, compared to a 0.4% increase in October, signaling softer price pressures. Meanwhile, the core CPI, which strips out volatile food and energy components, also showed moderation, rising 3.2% YoY against October’s 3.4% and the forecast of 3.4%. The annual Retail Price Index (RPI) came in at 3.8%, lower than the expected 4.3% and the previous month’s reading.

These figures highlighted a slower inflation trajectory in the UK, reinforcing the market view that the BoE may adopt a dovish stance in the coming months. Traders interpreted the data as increasing the probability of a 25-basis-point rate cut to 3.75%, which would mark the lowest level since 2022. The combination of rising unemployment and economic stagnation further supports the expectation of easing monetary policy.

Market Reaction: Pound Weakness and Euro Strength

Following the CPI release, the GBP weakened, allowing EUR/GBP to recover from recent session losses. The Euro gained ground amid scaled-back expectations for European Central Bank (ECB) easing, after ECB officials signaled that further cuts may not be necessary in 2026.

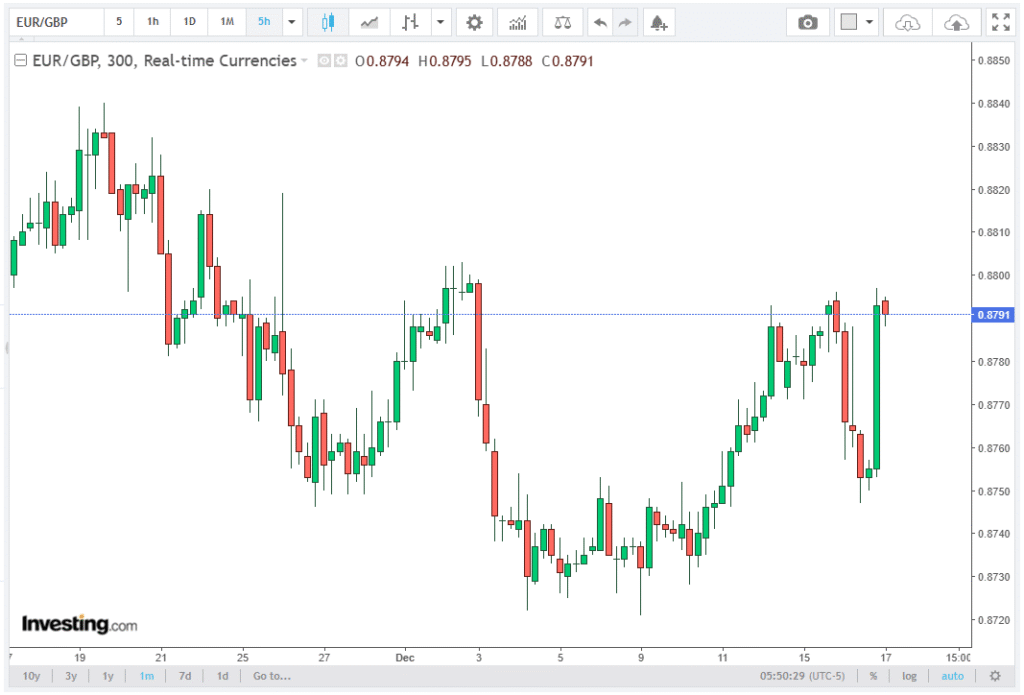

Traders in the foreign exchange (FX) market quickly adjusted short-term positioning, with EUR/GBP trading toward the 0.8800 resistance level. Market participants are closely watching central bank guidance, inflation trends, and economic indicators to gauge the next steps in monetary policy.

Focus Shifts to Germany’s IFO Business Survey

Looking ahead, investors are turning their attention to Germany’s IFO Business Survey, a key sentiment indicator for the Eurozone’s largest economy. The IFO Survey tracks business confidence, expectations, and current conditions, offering insights into the economic health of Germany and potential policy implications for the ECB.

A strong IFO reading could provide support for the EUR, signaling resilient economic activity in Germany. Conversely, softer-than-expected data may reignite concerns over sluggish growth in the Eurozone, affecting EUR/GBP sentiment and broader FX flows.

Eurozone Core HICP Data in Focus

Later in the day, Eurozone core HICP (Harmonized Index of Consumer Prices) data will be released, providing a crucial gauge of underlying inflation pressures across the region. Analysts are particularly attentive to the core HICP, which excludes energy and unprocessed food prices, offering a clearer picture of structural inflation trends.

Stronger-than-expected core inflation could bolster EUR strength, as investors adjust ECB policy expectations, anticipating a more cautious approach to future rate cuts. Conversely, softer data may fuel speculation about potential easing, putting upward pressure on GBP relative to the Euro.

Technical Outlook for EUR/GBP

From a technical perspective, EUR/GBP is approaching the 0.8800 level, a key resistance point that has capped gains in recent months. A break above this threshold could open the way for further Euro appreciation toward 0.8850, while support remains near 0.8750, reflecting recent consolidation zones.

Short-term traders are likely to monitor volatility spikes around macro releases, particularly the IFO Survey and Eurozone HICP, which could trigger sharp FX movements. Meanwhile, long-term investors remain focused on central bank policy trajectories, inflation dynamics, and geopolitical risks, all of which influence EUR/GBP trends.

Summary: Key Drivers for EUR/GBP

Key drivers for EUR/GBP include UK CPI data, where weaker headline and core inflation pressures suggest a potential BoE rate cut, contributing to GBP weakness.

Eurozone economic indicators, such as the IFO Survey and core HICP, will influence EUR strength and overall market sentiment. Central bank policy, including ECB guidance and BoE expectations, remains central to FX positioning. From a technical perspective, the 0.8800 resistance and 0.8750 support levels are crucial for near-term trading strategies.

Conclusion

EUR/GBP has rebounded sharply in response to soft UK inflation data, signaling dovish expectations for the Bank of England (BoE), while the Euro remains well-supported amid tempered ECB easing forecasts.

Traders will continue to closely monitor Germany’s IFO Business Climate Survey and Eurozone core HICP, as these key economic indicators are likely to drive the next directional moves in this highly traded FX pair. Market sentiment remains sensitive to inflation and central bank signals, suggesting potential volatility in the near term.