The final trading stretch of 2025 could reshape market expectations. Three consecutive days of delayed economic releases are set to test whether the Federal Reserve can continue easing policy without reigniting inflation.

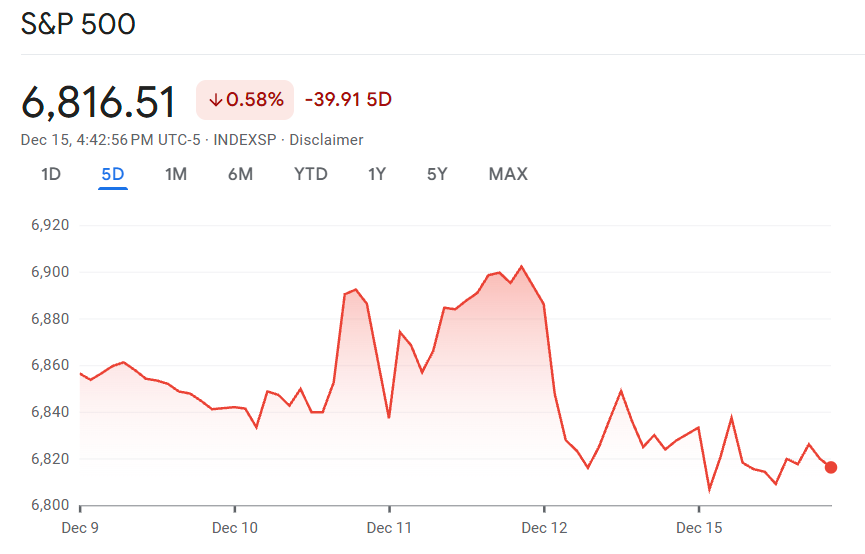

A senior financial analyst at Fimatron examines why December 16 through 18 represents a potential inflection point for equity markets. The S&P 500 has climbed over 17.5% year-to-date, positioning 2025 as the third straight year of substantial gains. However, the government shutdown pushed several data releases into a compressed window that could trigger significant volatility.

The Data Deluge Begins

Tuesday’s labor market snapshot combines October and November non-farm payrolls into a single release. This unusual dual-month report makes trend analysis more complex. Economists expect the unemployment rate to hold at 4.4%, though the combined format introduces uncertainty about seasonal patterns and underlying momentum.

Retail sales data follows across Tuesday and Wednesday, with advance estimates preceding the comprehensive report. The timing matters. Consumer spending accounts for roughly 70% of economic activity, and the holiday shopping season traditionally drives fourth-quarter performance.

Inflation Remains the Wild Card

Thursday brings the November Consumer Price Index, which the Fed watches closely for signs inflation is moving back to the 2% target. There will be no October CPI report due to the shutdown, creating a data gap that amplifies the importance of November’s reading.

Average hourly earnings growth within the payrolls report could signal whether wage pressures persist. Persistent wage increases without corresponding productivity gains often translate to service-sector inflation, which has proven stickier than goods pricing.

Fed’s Balancing Act

The Federal Reserve wants to support the labor market through rate cuts. Lower borrowing costs stimulate economic activity and job creation. Yet the central bank risks overheating the economy if it eases too aggressively while inflation remains elevated.

Stagflation represents the nightmare scenario where high unemployment and persistent inflation occur simultaneously. This environment handcuffs policymakers who cannot address the labor market without worsening price pressures, or vice versa.

Data showing labor market weakness combined with soft inflation readings would give the Fed room to continue cutting. Markets would likely respond positively to such an outcome. Conversely, strong hiring alongside elevated price growth could force a policy pause that disappoints equity investors.

Market Positioning Matters

The S&P 500 sits less than 2% below its late October record. This proximity to all-time highs suggests investors remain constructive despite recent choppiness. Technology stocks have seen rotation into cyclical sectors, but the broader market structure appears healthy.

Small-cap stocks via the Russell 2000 have outperformed recently, gaining 1.3% in December despite Monday’s pullback. This breadth expansion typically signals confidence in economic resilience rather than concentrated leadership vulnerable to abrupt reversals.

Treasury yields have risen despite three Fed rate cuts, with the 10-year note trading around 4.16%. This yield climb reflects inflation concerns and fiscal debt worries that could constrain how much further rates can fall even if the Fed cuts.

The Shutdown’s Shadow

The government shutdown created an information vacuum that forced both policymakers and market participants to operate with incomplete data. Catching up requires processing multiple reports simultaneously, which increases the risk of misreading underlying trends.

Combined data releases make it harder to distinguish signal from noise. Was October weak due to temporary factors, or does it reflect genuine softening? Did November rebound, or simply return to trend? These questions become more difficult when examining aggregated figures.

Trading Around Events

Attempting to trade ahead of major data releases often proves counterproductive. Markets frequently move in unpredictable directions regardless of whether the data meets, beats, or misses expectations. The initial reaction sometimes reverses as participants digest the full implications.

The compressed release schedule this week amplifies that unpredictability. Three days of market-moving data means multiple opportunities for whipsaw price action that traps both bulls and bears. Position sizing and risk management become paramount.

What Comes Next

Beyond this week’s data cascade, investors face year-end positioning dynamics. Many institutional managers finalize portfolio allocations before the holidays. This can create technical flows unrelated to fundamental developments.

January typically brings fresh capital deployment as new fiscal year budgets activate. The setup heading into 2026 will depend heavily on whether the Fed maintains an easing bias or signals patience after observing economic resilience.

The Bigger Picture

While individual data points matter, the broader trend shows an economy operating near full employment with inflation gradually moderating. This Goldilocks scenario supports risk assets if it persists.

The challenge lies in transition periods when either growth or inflation deviates from comfortable ranges. Markets hate uncertainty more than bad news, and concentrated data releases create temporary uncertainty spikes.

Investors should focus on medium-term fundamentals rather than day-to-day noise. The labor market remains the key variable. As long as employment holds up, consumer spending should support corporate earnings growth that justifies current equity valuations.