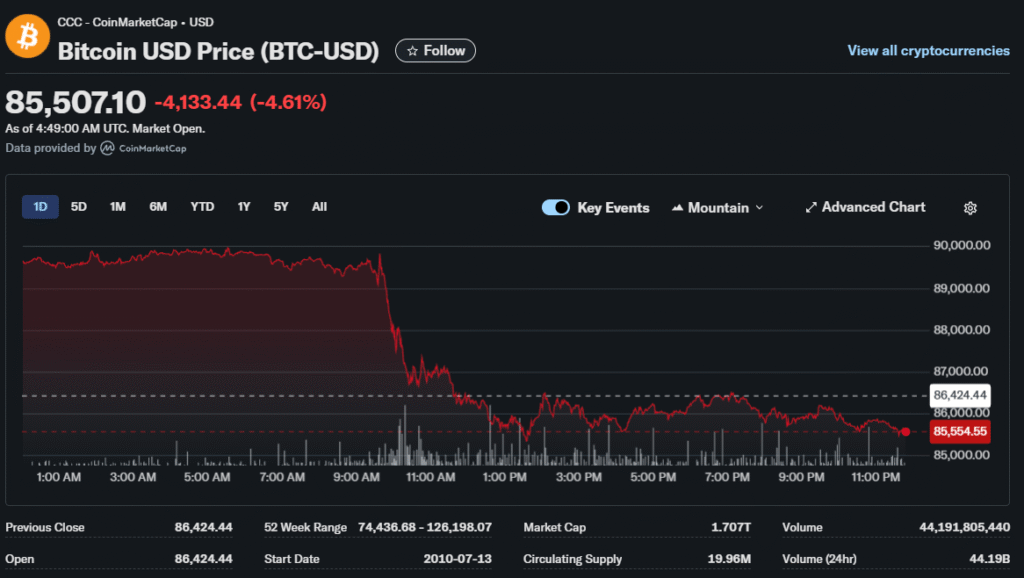

The cryptocurrency market’s brutal December selloff deepened as regulatory uncertainty and macro headwinds triggered cascading liquidations. Digital assets face their toughest test since last year’s banking crisis.

A financial analyst at Fimatron breaks down why Bitcoin tumbled through key support levels while institutional sentiment sours. The flagship cryptocurrency traded around $86,000 on Monday after plunging more than 6% in 24 hours, extending losses from its October high near $126,000.

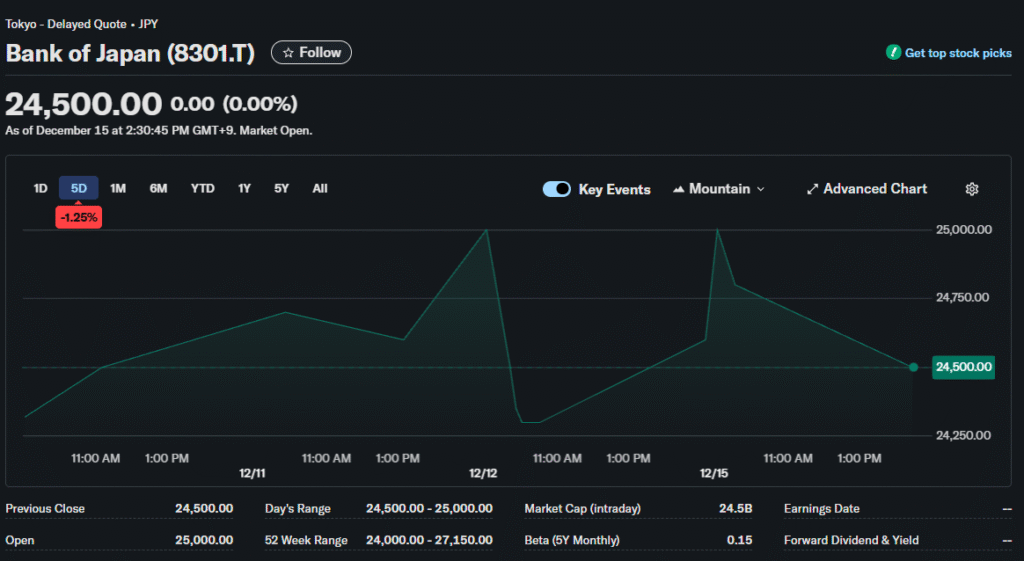

Yen Carry Trade Unwinds

The Bank of Japan‘s expected rate hike is disrupting a profitable trading strategy that supported crypto markets. For years, investors borrowed cheap Japanese yen to purchase higher-yielding assets including cryptocurrencies. Now that trade is reversing.

Japan’s two-year bond yield reached a 17-year high, making yen borrowing less attractive. As traders unwind positions, they sell cryptocurrencies to repay yen-denominated loans. This creates selling pressure disconnected from crypto-specific developments.

The BOJ signals it could raise rates at its December meeting, with all 50 economists in a Bloomberg survey expecting a move to 0.75%. This would mark the highest policy rate since 1995 and represents significant tightening for a country accustomed to ultra-low rates.

Leverage Amplifies Volatility

Crypto exchanges allow leverage up to 200 times in some cases, meaning small price moves trigger massive liquidations. An estimated $787 billion in outstanding leverage exists across perpetual futures contracts, dwarfing the roughly $135 billion in exchange-traded funds.

When prices fall, leveraged positions get automatically liquidated as they hit margin requirements. This forced selling pushes prices lower, triggering additional liquidations in a cascading effect. Monday’s decline liquidated nearly $1 billion in leveraged positions.

Ethereum dropped more than 8% to around $2,776, performing even worse than Bitcoin. The second-largest cryptocurrency has fallen 36% over seven weeks, reflecting concerns about network activity and competition from faster, cheaper blockchains.

Altcoin Massacre

Smaller cryptocurrencies suffered catastrophic losses. A MarketVector index tracking the bottom half of the top 100 digital assets has dropped almost 70% this year. These tokens attracted traders during rallies due to higher volatility and potential for outsized gains.

That same volatility works against them during downturns. Many altcoins lack the liquidity to absorb selling pressure, creating exaggerated price moves. Projects with questionable fundamentals face existential threats when speculative interest evaporates.

Solana fell more than 9%, trading below $125. The blockchain platform had rallied on hopes of becoming an Ethereum alternative for decentralized applications, but network outages and governance concerns weighed on sentiment.

China Adds Regulatory Pressure

The People’s Bank of China issued warnings about illegal activities relating to digital currencies. While China banned cryptocurrency trading years ago, the fresh statement pressured Hong Kong-listed digital asset companies that serve international markets.

Regulatory uncertainty remains a persistent headwind for cryptocurrencies. Unclear rules about taxation, custody, and permissible activities make institutional adoption difficult. Many potential corporate and government buyers wait for regulatory clarity before committing capital.

ETF Flows Tell the Story

Bitcoin ETF outflows accelerated despite initial optimism about mainstream investment products. Institutional investors who bought exposure through ETFs now reduce allocations amid broader risk-off sentiment and disappointing price action.

The disparity between perpetual futures leverage and ETF holdings shows retail speculation dominates cryptocurrency markets. Retail traders react more emotionally than institutions, amplifying both rallies and selloffs through momentum-chasing behavior.

Correlation with Tech Stocks

Bitcoin showed increasing correlation with the Nasdaq index, particularly during periods of stress. This challenges the narrative of cryptocurrencies as uncorrelated alternative assets that diversify traditional portfolios.

When digital assets move in lockstep with technology stocks, they lose their appeal as portfolio ballast during equity market turbulence. Investors seeking true diversification gravitate toward gold, commodities, or alternative strategies instead.

Vanguard’s Reversal

Vanguard reversed its longstanding ban on crypto ETFs, potentially opening access to 50 million brokerage customers. This development provided brief optimism, pushing Bitcoin back above $90,000 before the rally faded.

The temporary nature of the bounce highlights weak underlying demand. Positive news fails to generate sustained buying when macro conditions remain hostile. Markets need more than announcements; they need actual capital deployment.

Fear Index Plummets

The Crypto Fear & Greed Index sits at 23/100, deep in “Extreme Fear” territory. This gauge combines volatility, market momentum, social media sentiment, and trading volumes to measure investor psychology.

Extreme fear readings sometimes signal oversold conditions ripe for rebounds. However, they can also persist during genuine bear markets when fundamentals deteriorate. The current reading reflects genuine concern about crypto’s near-term prospects.

The Path Forward

Bitcoin bulls argue the asset’s fixed supply of 21 million coins provides long-term value as fiat currencies depreciate. This scarcity narrative resonates during inflation concerns but struggles when deflation or disinflation dominates.

The cryptocurrency needs to stabilize above $80,000 to prevent further technical deterioration. A drop below that level could trigger another wave of selling toward $70,000 or lower, where some analysts see stronger support.

Blockchain technology continues developing regardless of price action. Decentralized finance applications, non-fungible tokens, and central bank digital currencies advance independently from speculative trading. The infrastructure being built may eventually support sustainable value growth.