Precious metals rocketed to fresh record highs while manufacturing data collapsed and geopolitical tensions escalated. The yellow metal’s historic surge reflects deep concerns about economic stability and currency debasement.

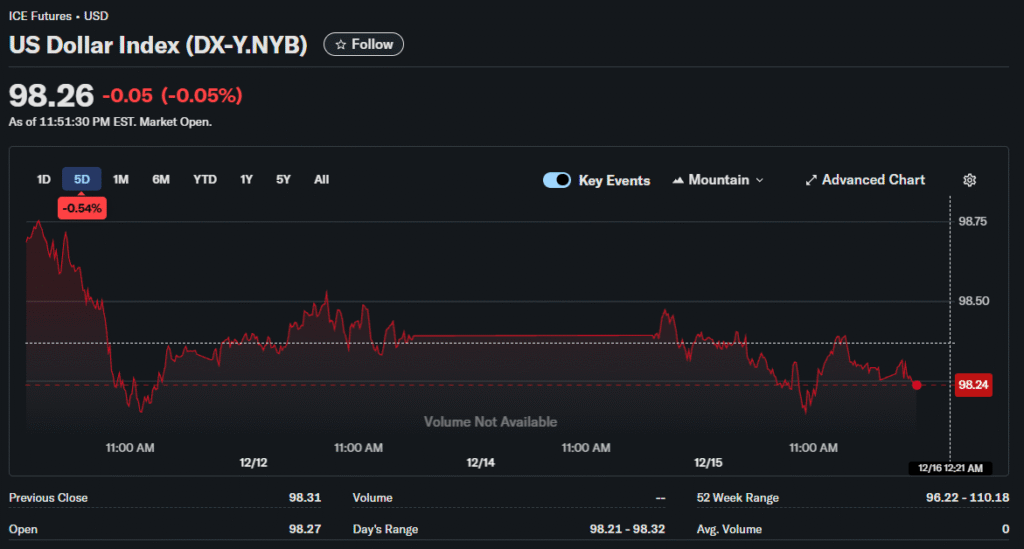

A financial expert at Fimatron examines why gold broke through $4,300 per ounce, cementing gains exceeding 62% year-over-year. The rally accelerated on December 15 as weak economic indicators hammered the U.S. Dollar Index and collapsed real yields.

Manufacturing Shock Triggers Rally

The Empire State Manufacturing Survey showed deeper contraction than economists anticipated. Regional factory activity deteriorated significantly, raising recession fears and expectations for aggressive Federal Reserve easing.

Monetary policy loosening reduces the opportunity cost of holding non-yielding assets like gold. When interest rates fall, bonds become less attractive relative to precious metals that offer inflation protection without generating income.

Real yields measure nominal interest rates minus expected inflation. These turned sharply negative as manufacturing weakness suggested economic deceleration that might force Fed action despite inflation remaining above the 2% target.

Silver Outperforms Dramatically

Silver smashed through psychological resistance at $60, surging 3.35% to reach $63.94 per ounce. The industrial-monetary metal’s explosive move signals tight physical inventories as buyers scramble to secure immediate supply.

The gold-silver ratio compressed to 67.72, indicating capital flows aggressively into the more volatile metal. Silver’s dual nature as both industrial input and monetary asset creates leveraged exposure to both economic growth and inflation hedging demand.

Industrial buyers face supply constraints in key hubs where electronics and solar panel manufacturers compete for available metal. Premium pricing for immediate delivery versus futures contracts confirms physical tightness rather than purely speculative positioning.

Central Bank Accumulation

China continues adding to reserves despite record prices. The People’s Bank of China views gold as strategic portfolio diversification away from dollar-denominated assets and geopolitical hedge against Western sanctions.

Other emerging market central banks follow similar strategies. India, Turkey, and Poland increased holdings substantially over the past year. This institutional demand provides a bid under markets that historically relied more on jewelry and investment flows.

Central bank buying differs from speculative trading. These purchases represent structural shifts in reserve composition that persist regardless of short-term price movements. The steady accumulation supports higher price floors.

Currency Debasement Concerns

Fiscal deficits across major economies fuel worries about long-term currency purchasing power. Government debt levels relative to GDP reached peacetime records in many countries, raising questions about sustainability.

Money supply expansion during recent crises flooded systems with liquidity that eventually filters into asset prices and consumer inflation. Gold offers protection against this debasement as its supply increases slowly and predictably through mining.

The dollar weakened to the mid-98s on the DXY index as markets reassessed American exceptionalism. Higher yields in other currencies attract capital flows that pressure the greenback despite the Fed’s hawkish rhetoric.

Technical Breakout Confirmed

Gold’s move through $4,300 breaks above October’s previous record high near $4,260. This confirms the uptrend remains intact despite a brief consolidation that tested investor resolve.

Momentum indicators show strengthening buying pressure rather than exhaustion. RSI readings moved into neutral zones with room to run higher before reaching overbought territory. MACD flattened after bearish crossovers, suggesting downside momentum evaporated.

Support levels now exist at $4,200 and $4,100, representing areas where buyers previously stepped in aggressively. These zones should provide cushions during inevitable profit-taking pullbacks.

Inflation Hedge Performance

Year-to-date gains exceeding 25% significantly outpaced traditional inflation metrics. This outperformance reflects not just current price pressures but expectations of sustained elevated inflation or even acceleration.

CPI readings remain above Fed targets across most major economies. Services inflation proves particularly stubborn as wage growth supports pricing power. Goods deflation from supply chain normalization offsets only partially.

Gold historically lags during the initial inflation surge as interest rates rise to combat price pressures. However, once real rates stabilize or turn negative, precious metals catch up rapidly and often overshoot based on inflation-adjusted fundamentals.

ETF Flows Mixed

Gold ETFs saw modest outflows earlier in the quarter as rising yields made bonds more attractive. However, physical buying accelerated, particularly in Asian markets where households traditionally favor bullion over paper products.

This divergence between Western financial products and Eastern physical demand creates interesting dynamics. ETF selling provides metal for physical buyers at prices below where pure investment demand would trade.

Jewelry consumption remains robust in India and China despite record prices. Cultural affinity for gold runs deep, with weddings and festivals driving seasonal patterns that layer atop investment flows.

Looking Ahead

Gold bulls target $5,000 as the next major psychological milestone. Supply constraints from declining ore grades and limited major discoveries support higher prices needed to incentivize production growth.

Demand from ETFs, central banks, jewelry consumers, and industrial users creates diverse support that reduces dependence on any single buyer category. This broad-based interest underpins market stability even during temporary corrections.

Geopolitical tensions show no signs of abating. Ukraine conflict, Middle East instability, and great power competition drive safe-haven flows that traditionally benefit precious metals over other asset classes.