The final week before holidays delivers a condensed barrage of delayed reports that could reshape Federal Reserve expectations. Government shutdown fallout creates unprecedented uncertainty as critical numbers arrive simultaneously.

A lead broker at Fimatron discusses why December 16-18 presents exceptional volatility risk. Three consecutive days bring labor market snapshots, consumer spending figures, and inflation readings that typically space out across weeks.

The Tuesday Double Header

Non-farm payrolls for both October and November release simultaneously at 8:30 a.m. Eastern on December 16. This unusual combined report makes interpretation challenging for analysts accustomed to isolating monthly trends.

Economists expect the unemployment rate to hold at 4.4%, though the dual-month format introduces uncertainty. Seasonal adjustment factors become more complex when aggregating data across different months.

Average hourly earnings growth matters enormously for inflation outlook. Wage pressures feed into service-sector costs that proved stickier than goods pricing. The Fed watches this metric closely when assessing whether inflation will moderate sustainably.

The labor force participation rate provides clues about hidden slack in employment markets. Workers sitting on the sidelines represent potential supply that could meet demand without triggering wage spirals.

Retail Sales Revelations

Advance Monthly Retail Sales arrive Tuesday afternoon, followed by the comprehensive report Wednesday morning. This one-two punch shows whether consumer spending momentum carried through the critical holiday season.

Spending accounts for roughly 70% of economic activity. Strong retail numbers suggest economic resilience that might reduce urgency for additional Fed rate cuts. Weak readings would validate concerns about slowing growth.

Holiday shopping patterns shifted significantly in recent years. More purchases occur online rather than in physical stores. Earlier promotions spread spending across October and November instead of concentrating in December.

Weather impacts complicate analysis. Unseasonably warm temperatures reduce cold-weather apparel sales but extend outdoor dining and recreation spending. Analysts must adjust for these factors when assessing underlying trends.

Inflation Remains Critical

Thursday brings the November Consumer Price Index at 8:30 a.m. The October CPI won’t publish due to shutdown disruption, creating a data gap that amplifies the importance of available readings.

The 2% target remains elusive as certain categories show persistent price pressures. Services inflation proves particularly stubborn, driven by wages and commercial rents that adjust slowly.

Core CPI excluding food and energy often provides clearer signals about underlying trends. However, headline numbers affect consumer psychology and political pressures on policymakers.

Initial jobless claims also arrive Thursday, offering the most recent labor market snapshot. Weekly claims data captures turning points faster than monthly employment reports, making it valuable for real-time assessment.

Combined Impact Analysis

Processing three major report categories simultaneously challenges even sophisticated market participants. Each data point affects Fed rate expectations, but the combined signal might prove contradictory.

Strong employment with elevated inflation argues against further rate cuts. Weak jobs with soft prices support easing. Mixed signals create maximum uncertainty and volatility as traders reassess positions.

The Federal Reserve already cut rates three times in 2025. Markets debate whether the easing cycle continues or pauses while officials assess economic conditions.

Historical Context

Data blackouts rarely occur outside government shutdowns or major disasters. The compressed release schedule creates artificial volatility disconnected from actual economic changes.

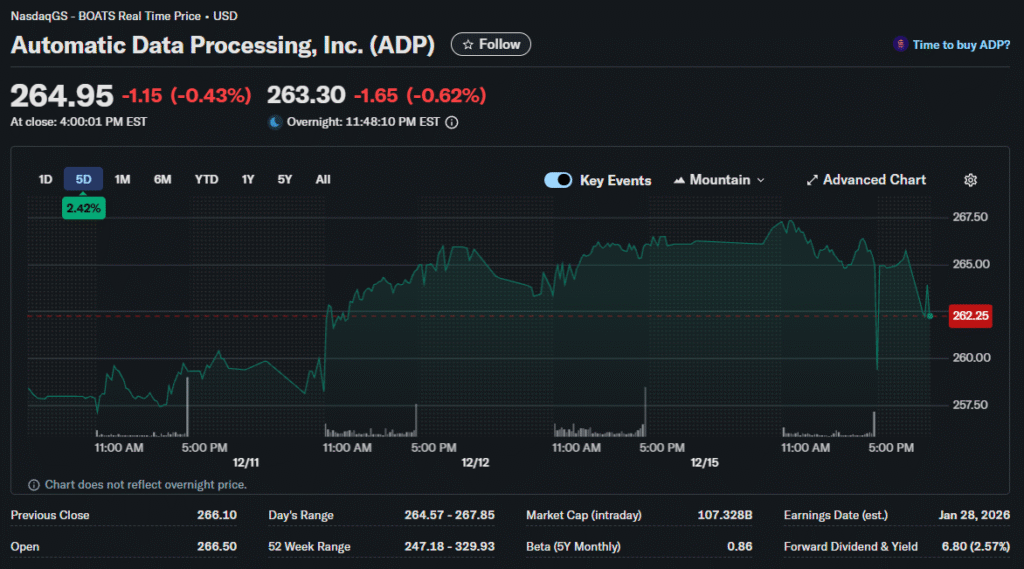

Market participants operate with incomplete information when key statistics go missing. This forces reliance on alternative indicators like ADP employment or regional Fed surveys that may not accurately predict official figures.

ADP showed private sector jobs fell 32,000 in November, the biggest decline since March 2023. This conflicted with other evidence suggesting labor market resilience, highlighting the danger of over-relying on any single indicator.

Fed Watch Intensifies

Futures markets price roughly 90% probability of another rate cut at the next Fed meeting. However, this assumes data doesn’t dramatically alter the economic outlook.

Surprisingly strong numbers could push pause odds higher. Markets hate uncertainty more than bad news, so clarity in either direction might reduce volatility after initial reactions.

Treasury yields moved higher despite recent Fed cuts, with the 10-year note near 4.16%. This reflects inflation concerns and fiscal debt worries that constrain how much further rates can fall.

Trading Considerations

Attempting to position ahead of major data releases often backfires. Market reactions frequently defy logic as algorithms and programmatic flows amplify moves regardless of fundamental implications.

The compressed release window multiplies this unpredictability. Three separate opportunities exist for sharp reversals that whipsaw both bullish and bearish positions.

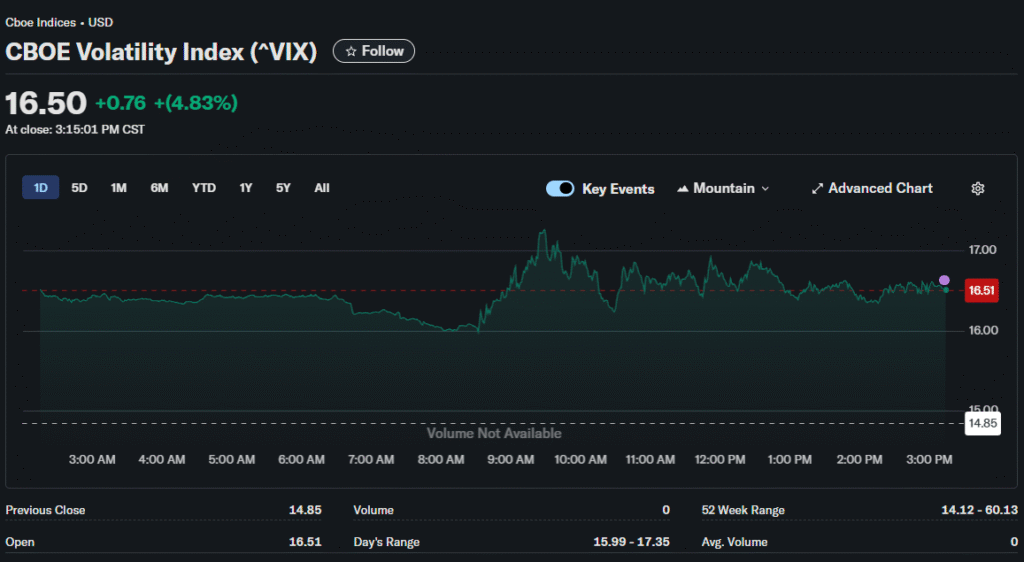

Volatility indices like VIX often spike around major events regardless of actual price movement magnitude. Options sellers capture premiums from elevated implied volatility if realized movement disappoints.

What Investors Should Watch

Focus on employment data first given Fed emphasis on labor market health. Job growth and wage trends matter more for monetary policy than retail sales or inflation given current conditions.

Consumer spending provides the next priority. Economic expansions die when households stop spending, making retail sales a leading indicator of potential recessions.

Inflation rounds out the trifecta. Elevated prices constrain Fed easing regardless of growth concerns, while deflationary pressures raise different worries about demand destruction.

The combined picture matters more than any individual release. Markets need coherent narratives, and contradictory data creates confusion that manifests as volatility.