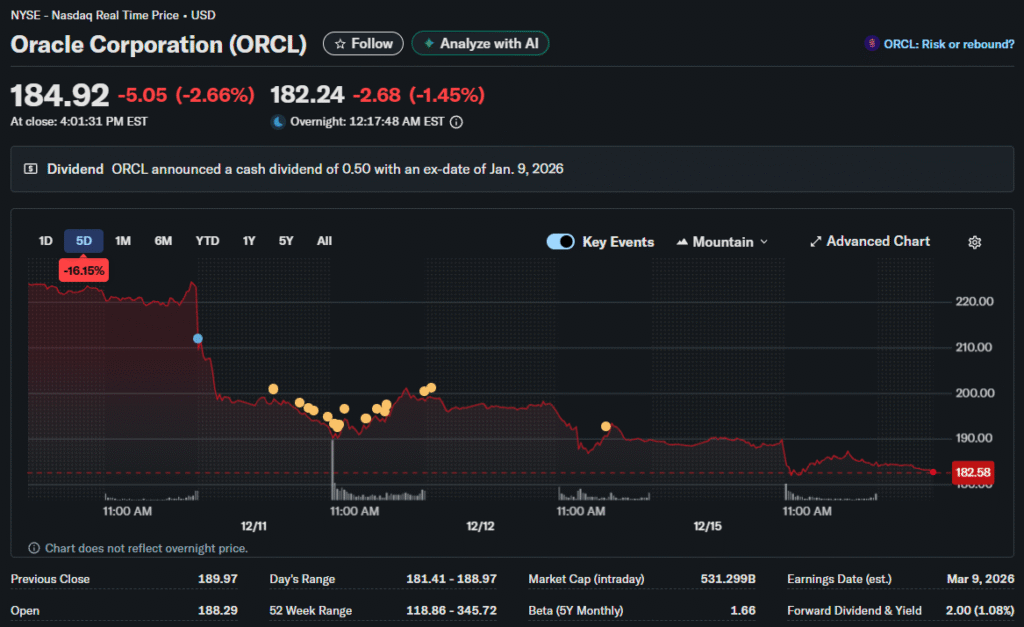

Database giant’s disappointing revenue miss triggered an 11% after-hours plunge despite soaring AI infrastructure demand. The selloff questions whether enterprise software can justify sky-high valuations.

Fimatron‘s finance expert explores why Oracle shares cratered even as remaining performance obligations exploded higher. The disconnect between booked business and recognized revenue creates confusion about growth sustainability.

The Numbers Tell Two Stories

Revenue of $16.06 billion missed the $16.21 billion consensus estimate. This shortfall disappointed investors expecting AI-driven acceleration to offset traditional database weakness.

Adjusted earnings of $2.26 per share crushed the $1.64 expectation by substantial margins. The beat-and-miss combination created conflicting signals about business health.

Remaining performance obligations soared 438% to $523 billion, topping analyst estimates of $501.8 billion. This massive backlog theoretically converts to future revenue over contract periods.

Why Markets Reacted Badly

Exceptional RPO growth should excite investors about multiyear revenue visibility. However, the timing of revenue recognition matters for near-term earnings.

Cloud infrastructure deals involve long implementation periods. Customers commit to spending but consumption ramps gradually. This creates a backlog that may not flow through income statements for quarters or years.

Third-quarter guidance projected revenue growth of 19% to 21% year-over-year. While respectable, this failed to show meaningful acceleration despite record contract signings.

AI Hype Meets Reality

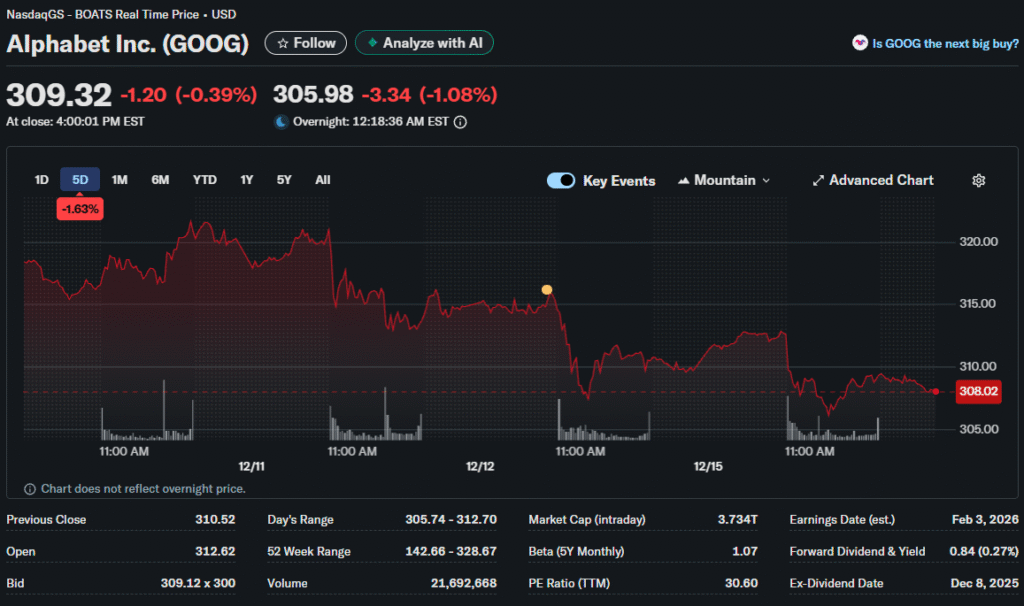

Hyperscale cloud providers like AWS, Azure, and Google Cloud dominate AI infrastructure buildouts. Oracle competes as a second-tier player lacking the scale advantages.

Database licensing faces pressure as companies internalize more functions. Building proprietary systems reduces dependence on Oracle’s expensive products.

Open-source alternatives erode market share in price-sensitive segments. PostgreSQL and MySQL offer sufficient functionality for many workloads at dramatically lower cost.

Margin Pressure Concerns

Analysts highlighted muddled commentary on backlog conversion and profitability. Executives struggled to articulate how massive contract wins translate to operating leverage.

Cloud infrastructure carries lower margins than software licensing. Oracle’s shift from high-margin licenses to usage-based cloud revenue pressures overall profitability.

Competition from AWS and Azure forces aggressive pricing. Customers negotiate hard when viable alternatives exist, reducing Oracle’s pricing power.

Valuation Reset Required

The stock traded at premium multiples reflecting optimism about AI-driven acceleration. A UBS analyst noted “very crowded investor positioning” vulnerable to disappointment.

Sell-the-news dynamics often follow earnings when expectations run ahead of reality. Even solid results disappoint if priced for perfection.

Extended selloffs occurred Thursday and Friday, pushing total declines to approximately 17% from recent highs. This magnitude suggests fundamental reassessment rather than temporary profit-taking.

Competitive Dynamics

Microsoft and Google leverage integrated ecosystems. Customers running applications on Azure or GCP find it convenient to use native database services rather than adding Oracle complexity.

AWS offers managed database options that reduce administrative burden. Many companies prefer cloud-native solutions to legacy on-premises architectures.

Snowflake and Databricks disrupt traditional data warehousing with modern architectures. These upstarts attract customers seeking analytics capabilities beyond Oracle’s core transactional strengths.

Customer Migration Patterns

Cloud transition creates one-time revenue disruptions. Customers moving from perpetual licenses to subscriptions reduce upfront payments while potentially increasing lifetime value.

However, the transition period penalizes near-term results. Investors discount future benefits when faced with current weakness.

Multi-cloud strategies reduce vendor lock-in. Enterprises increasingly spread workloads across providers to avoid dependence and negotiate better terms.

What Analysts Say

Arcuri’s “muddled” description captured market frustration. Clear communication matters when business models shift and growth drivers evolve.

Price target cuts likely follow as analysts reassess margin trajectories and competitive positioning. Downgrades create negative momentum.

Some bulls argue the selloff creates opportunity. Long-term cloud adoption trends remain intact despite near-term execution challenges.

Technical Damage

The stock broke through support levels that held during previous pullbacks. Technical traders view this as confirming distribution rather than temporary weakness.

Volume surged during the decline. High-volume selloffs suggest institutional liquidation rather than retail panic that quickly reverses.

Momentum indicators turned decisively negative. RSI dropped from overbought to neutral territory within days, showing exhausted buying pressure.

Broader Tech Rotation

Oracle’s struggles fit a pattern of mega-cap technology underperformance. Broadcom and Nvidia faced similar selling despite strong fundamentals.

Investors question whether AI capital expenditures generate sufficient returns. Hundreds of billions invested must eventually produce corresponding revenue growth.

Valuation compression occurs when multiples contract even if earnings grow. This double whammy devastates stock prices as both numerator and denominator move unfavorably.

Enterprise Software Outlook

Digital transformation continues driving cloud adoption. Pandemic accelerated migrations that persist post-crisis as companies realize efficiency benefits.

Legacy systems represent massive installed bases generating recurring revenue. However, switching costs decline as cloud alternatives mature.

Investment Considerations

Value investors might view the selloff as an opportunity. The stock trades at lower multiples than during its peak, potentially offering entry points.

Growth concerns warrant caution. If cloud competition intensifies and margins compress, the story deteriorates beyond temporary weakness.

Risk-reward depends on conviction about Oracle’s cloud strategy. Believers see transition pain masking long-term value. Skeptics question whether the company can compete against better-positioned rivals.

The market’s harsh verdict sends a warning to enterprise software broadly. AI hype must eventually translate to financial results that justify premium valuations. Oracle’s stumble reminds investors that transformation is difficult and success is not guaranteed.