Rineplex senior financial analyst examines how silver smashed through the $60 barrier and touched $65 per ounce in mid-December, marking the precious metal’s strongest performance in modern trading history. The surge represents a 115% gain year-to-date, dwarfing gold’s already impressive rally.

Industrial Hunger Meets Investment Mania

The silver market entered 2025 with a structural deficit for the fifth consecutive year. Mine production flatlined around 813 million ounces annually while demand exploded across renewable energy sectors. Solar panel manufacturers consumed record volumes as the global push for clean energy intensified.

Electric vehicle production created additional pressure on supplies. Data centers building AI infrastructure require massive amounts of silver for connectivity hardware. The metal’s superior conductivity made it irreplaceable in these applications despite climbing prices.

Investment flows reversed dramatically from previous years. Silver-backed ETFs recorded net inflows exceeding 134 million ounces through early December. This marked a sharp turnaround from the steady outflows that characterized 2023 and 2024.

The Critical Minerals Wild Card

Silver’s inclusion on the US critical minerals list in 2025 added a geopolitical dimension to price discovery. The designation opened possibilities for supply-chain security measures and potential trade protections. Markets began pricing in stockpiling demand from both the government and private sector entities.

The classification coincided with growing anxiety about import dependencies. America sources roughly two-thirds of its silver from international suppliers. Any future trade tensions could trigger scrambles for domestic inventory.

Professional money managers started viewing silver differently than in past cycles. The metal evolved from a volatile speculation to a strategic commodity with genuine scarcity dynamics.

Supply Side Constraints Bite Harder

Mining companies faced a persistent problem that kept supply tight. Most silver comes as a byproduct of zinc, lead, copper, and gold operations. Primary silver mines account for less than 30% of total production.

This meant higher silver prices alone couldn’t trigger massive supply responses. Mining companies would need to dramatically increase base metal production to flood the market with silver. Current economics didn’t support such expansion, given softer conditions in those markets.

The Silver Institute highlighted this structural challenge in recent reports. Their projections showed deficits continuing through 2026 with no quick fixes available. Annual shortfalls approached 117 million ounces in their baseline scenarios.

Gold’s Shadow No Longer

Silver historically traded at ratios to gold between 60:1 and 80:1. Those relationships broke down as silver asserted independence. The white metal attracted buyers who found gold too expensive after its own record-breaking run.

Portfolio managers discovered silver offered similar inflation protection at more accessible entry points. A $60 silver purchase felt more manageable than $4,000 gold positions for smaller institutional players and retail investors.

Technical analysts pointed to decades-old resistance levels getting demolished. The previous peaks around $50 from 1980 and 2011 barely slowed the 2025 advance. Markets entered genuine price discovery above those historical ceilings.

The $100 Question

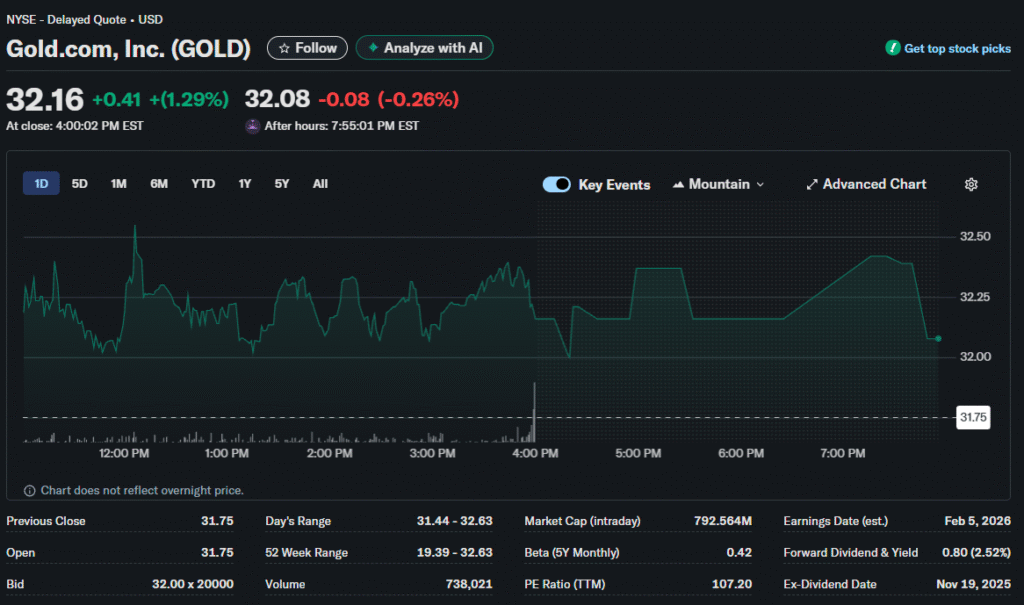

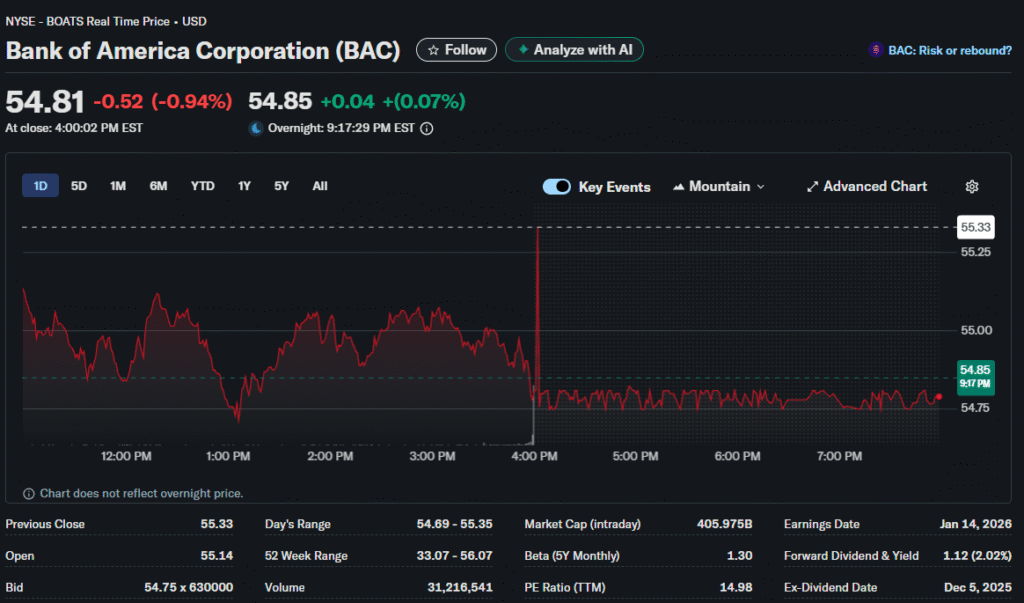

Multiple major investment banks raised long-term targets substantially. Bank of America set its sights on $65 in 12-month forecasts. More aggressive voices like BNP Paribas suggested triple-digit prices could materialize by the end of 2026.

The bull case rested on supply deficits persisting while industrial adoption accelerated. Solar installations showed no signs of slowing. EV production continued expanding globally despite economic headwinds in certain regions.

Critics warned about stretched valuations relative to gold. Some traditional metrics suggested silver had run too far, too fast. However, structural deficit believers countered that old valuation frameworks didn’t capture the new supply-demand reality.

Volatility As Feature Not Bug

A junior broker points out silver’s path won’t be smooth. The metal demonstrated its volatile nature with sharp 3-5% daily swings during the December rally. Profit-taking episodes triggered brief selloffs before buyers returned.

This characteristic made silver unsuitable for conservative portfolios seeking stability. Active traders found the volatility attractive for short-term positioning. Longer-term holders needed strong conviction to weather inevitable drawdowns.

Market depth remained relatively thin compared to gold or major currency pairs. Large orders could move prices several percentage points in minutes. This liquidity profile meant careful execution mattered for institutional-sized trades.

Strategic Positioning for 2026

Investors weighing silver exposure faced tactical decisions about implementation. Physical bullion required secure storage and insurance costs. ETFs offered convenience but carried management fees and lacked the tangibility some preferred.

Mining stocks provided leveraged plays on silver prices but introduced company-specific risks. Production costs, jurisdictional challenges, and management quality varied widely across the sector. Comprehensive due diligence separated winners from disappointments.

Options markets reflected divided sentiment on near-term direction. Put volume at $55 support levels increased as holders sought downside protection. Call interest is concentrated around $70-75 strikes for first-quarter 2026 expiration dates.

The silver story heading into 2026 balanced genuine supply constraints against elevated valuations and momentum-chasing behavior. Markets would need to reconcile unprecedented industrial demand with speculative fervor to determine sustainable price levels. Position sizing remained critical given the metal’s propensity for sharp reversals during profit-taking cycles.