A senior broker at Rineplex analyzes how the Federal Reserve delivered its expected 25 basis point cut on December 10, bringing rates to 3.50-3.75%, but shocked traders with projections showing just one reduction planned for 2026. The mixed message sent markets scrambling to reprice expectations.

The Split Decision

The Federal Open Market Committee vote revealed growing internal divisions. Three members dissented in unusual fashion from both directions. Chicago Fed President Austan Goolsbee and Kansas City’s Jeff Schmid preferred holding rates steady, while Fed Governor Stephen Miran pushed for a 50 basis point cut.

This nine-to-three split represented the most contentious vote in years. Previous meetings featured near-unanimous agreement on policy direction. The fracturing signaled genuine disagreement about economic trajectory and appropriate responses.

Chair Jerome Powell acknowledged the challenging environment in his press conference. Dual mandate tensions between employment and inflation created difficult tradeoffs. Neither side of the equation provided clear directional signals.

Dot Plot Disappointment

The Summary of Economic Projections carried the real surprise. The median forecast showed only one rate cut in 2026, matching September’s projection despite three months of additional labor market softening. Seven officials indicated they wanted zero cuts next year.

Market pricing had anticipated at least two quarter-point reductions in 2026. The gap between trader expectations and Fed guidance widened significantly. This disconnect suggested either markets or policymakers would need a major reassessment.

GDP growth forecasts rose by half a percentage point to 2.3% for 2026. This upgrade undermined arguments for aggressive easing. Strong economic momentum reduced urgency for additional accommodation despite cooling employment trends.

Inflation Persistence Problem

Core PCE inflation held at 2.8% annually through the September data. This level remained stubbornly above the Fed’s 2% target despite moderating from peak levels. Policymakers projected inflation staying elevated until 2028.

Services sector prices showed particular stickiness. Wages continued climbing at rates inconsistent with 2% inflation absent productivity miracles. Housing costs, comprising significant portions of inflation indexes, declined slowly.

Treasury buying program resumption added complexity. The Fed announced $40 billion in bill purchases starting December 13. This technical adjustment aimed at managing liquidity rather than easing policy, but markets struggled to differentiate nuances.

Labor Market Crosscurrents

November’s 64,000 jobs added disappointed expectations. October saw a revised 105,000 job loss. However, these figures came with massive asterisks due to government shutdown disruptions in data collection.

The unemployment rate jumped to 4.6%, the highest since October 2021. This represented a meaningful deterioration from 4.2% a year earlier. Jobless claims and continuing unemployment benefits suggested genuine cooling rather than statistical noise.

Yet job openings remained elevated by historical standards. Layoff rates stayed low outside specific struggling sectors. Wage growth moderated but continued outpacing inflation. These mixed signals complicated policy calibration significantly.

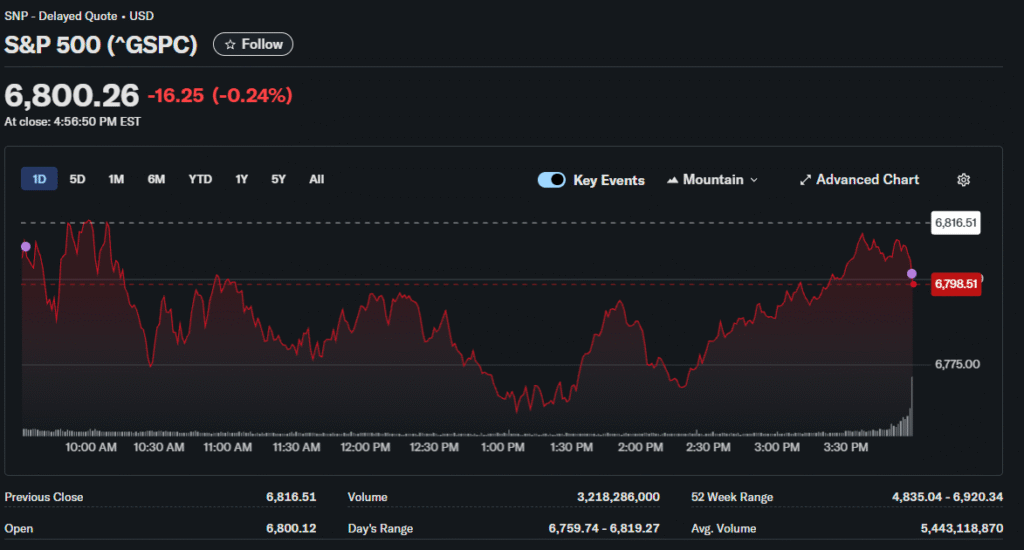

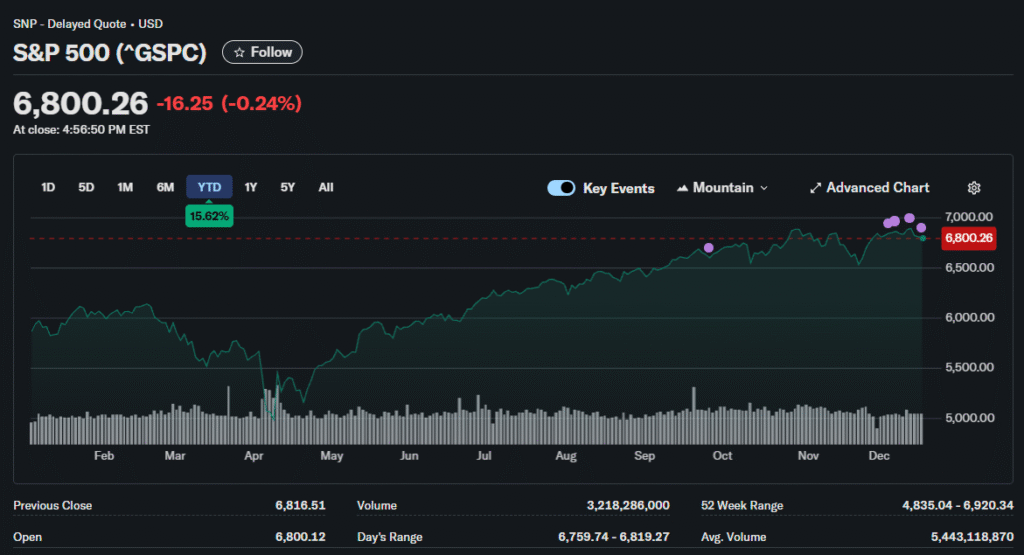

Market Reactions Diverge

Equity markets initially rallied on Powell’s assurance that rate hikes weren’t in the base case. The S&P 500 gained 0.67% while the Dow surged 497 points. However, bond markets told a different story.

Treasury yields climbed as traders repriced fewer rate cuts ahead. The 10-year note pushed higher within its established 4.00-4.50% range. Duration assets suffered as the yield curve steepened modestly.

Currency markets saw the dollar strengthen against most major pairs. Interest rate differentials favored US assets compared to European and Japanese alternatives. Emerging market currencies faced pressure from reduced carry trade attractiveness.

Consumer Impact Lag

Financial experts emphasize that rate cuts take time flowing through to consumer borrowing costs. Auto loans fell by only half a percentage point since September 2024. Average rates remained around 7% for new cars and higher for used vehicles.

Mortgage rates disappointed homebuyers expecting dramatic relief. The 30-year fixed average of 6.19% represented improvements from peaks but stayed well above pre-pandemic norms. Housing affordability challenges persisted across most metropolitan areas.

Credit card APRs declined modestly while remaining near 20% on average. High-yield savings accounts dropped faster than lending rates, squeezing savers. This asymmetry benefited banks’ net interest margins at consumer expense.

Global Central Bank Divergence

The Fed’s cautious stance contrasted with global peers. The European Central Bank prepared for easing while the Bank of England debated timing. Most dramatically, the Bank of Japan telegraphed rate hikes with all 50 economists expecting a 25 basis point increase to 0.75% creating global carry trade implications.

The US President publicly criticized the Fed’s modest cut. Speculation intensified about Fed leadership changes, with National Economic Council Director Kevin Hassett emerging as a potential successor to Powell. Markets fretted about central bank independence erosion, though Powell emphasized that the data-driven approach remained intact.

Forward Guidance Fog

Markets entered 2026 with unusual uncertainty about the Fed’s reaction function. Traditional relationships between economic data and policy responses seemed less reliable. The committee’s internal disagreements added unpredictability.

Traders focused attention on January employment data and CPI releases. These reports would provide the first signals about whether December’s hawkish tone proved appropriate. Options positioning reflected divided views, with some betting on recession requiring aggressive cuts, while others anticipated sustained strength keeping rates elevated.