A lead broker at Rineplex explores how technology stocks stumbled in mid-December as Oracle’s disappointing cloud revenue triggered a sector-wide selloff. The Nasdaq surrendered gains built over consecutive winning sessions, raising questions about stretched valuations entering 2026.

The Oracle Warning

Oracle’s cloud infrastructure sent shockwaves through the tech investor community. The database giant reported revenue falling short of expectations despite massive AI infrastructure spending. Capital expenditures continued climbing while returns disappointed.

Management commentary about competitive pressures from custom chips alarmed investors. Hyperscalers like major cloud providers increasingly design proprietary silicon rather than buying third-party solutions. This shift threatened Oracle’s positioning in AI data center buildouts.

The stock plunged over 6% in response, dragging semiconductor names lower. Nvidia and Broadcom shed gains as traders questioned whether demand for AI chips could sustain current growth trajectories. The selloff demonstrated concentration risk within technology indexes.

Magnificent Seven Divergence

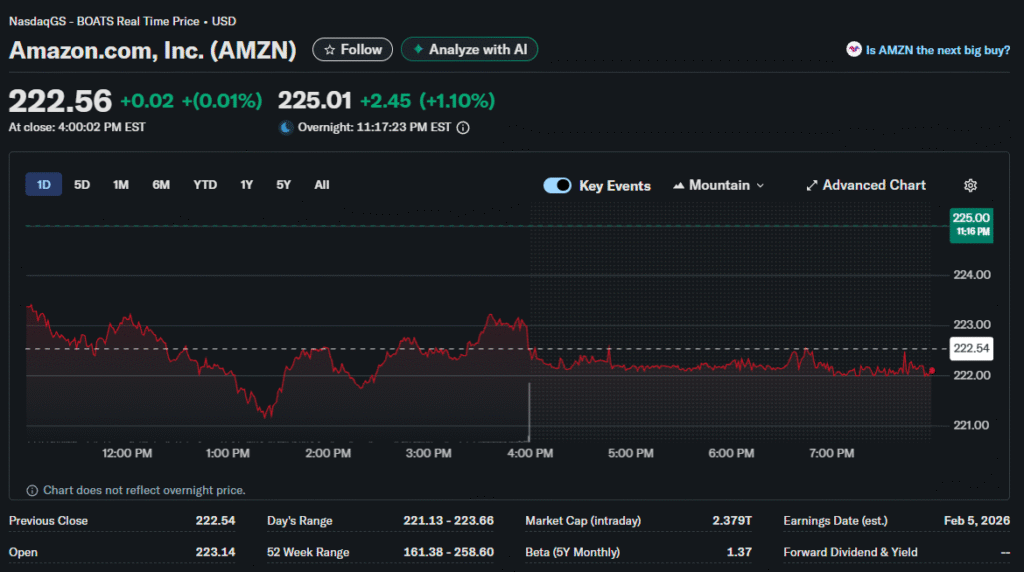

The mega-cap club, historically moving together, showed cracks. Apple slipped 0.7% while Microsoft managed modest 0.2% gains. Alphabet, Amazon, and Meta recorded mixed performance, suggesting stock-specific factors matter more than sector momentum.

AI-heavy semiconductor plays suffered disproportionate losses. The correlation between AI narrative strength and chip stock performance became impossible to ignore. Any cooling in artificial intelligence enthusiasm would hit this segment hardest.

Tesla faced unique pressures unrelated to AI developments. Production concerns and competitive dynamics in electric vehicles are weighed separately from technology trends. The classification as a Magnificent Seven member increasingly seemed misaligned with fundamentals.

Valuation Concerns Mount

Forward price-to-earnings ratios for the Nasdaq 100 approached 30 times, well above long-run averages. Bulls argued the AI revolution justified premium multiples. Bears countered that historical patterns suggested mean reversion ahead.

OECD, major investment banks, and independent analysts flagged AI-driven exuberance as a key 2026 risk. The warnings grew louder as year-end approached. Institutional investors began questioning whether to maintain heavy technology allocations at current levels.

Small-cap and value stocks outperformed growth names in recent weeks. This rotation suggested investors sought safety outside expensive technology. The Russell 2000 hit record highs while the Nasdaq consolidated, demonstrating meaningful style divergence.

Earnings Season Lens

MongoDB surged 26% after crushing quarterly estimates. The database provider’s strong results showed pockets of genuine AI-driven demand existed. Atlas cloud platform growth validated management’s strategic positioning.

However, one winner couldn’t offset broader skepticism. Investors demanded proof that AI investments would generate returns matching the hype. General Mills and Micron reports received significant attention for insights into different economic segments.

Semiconductor equipment makers faced particular scrutiny. Advanced Micro Devices’ volatility reflected uncertainty about the datacenter chip market shares. Custom silicon development by cloud providers threatens to disrupt established supplier relationships.

Fed Policy Implications

Technology stocks demonstrated heightened sensitivity to interest rate expectations. The December FOMC meeting’s hawkish tone initially pressured growth equities before markets stabilized. Duration risk in long-dated cash flows mattered more as the rate cut timeline extended.

Financial analysts note that bond yields climbing within the 4.00-4.50% range created competition for technology equity allocations. Fixed income offered attractive risk-adjusted returns compared to expensive stocks sporting execution risk.

Higher rates for longer scenarios particularly challenged unprofitable technology companies burning cash. The zero-rate environment that supported speculative ventures ended. Discipline around the path to profitability became essential for investor credibility.

Crypto Crosscurrents

Bitcoin’s stabilization around $85,000 removed one source of technology volatility. Coinbase and MicroStrategy shares recovered from Monday’s crypto-induced selloff. However, the correlation between crypto and growth stocks remained uncomfortably high.

Blockchain-adjacent technology names experienced whiplash following digital asset price swings. This linkage highlighted speculative elements within the technology sector. Institutional investors questioned exposure to assets displaying such correlation.

Mining companies pivoting to AI datacenter operations demonstrated technology adaptability. Converting infrastructure from cryptocurrency mining to machine learning applications showed business model flexibility under changing market conditions.

International Competition

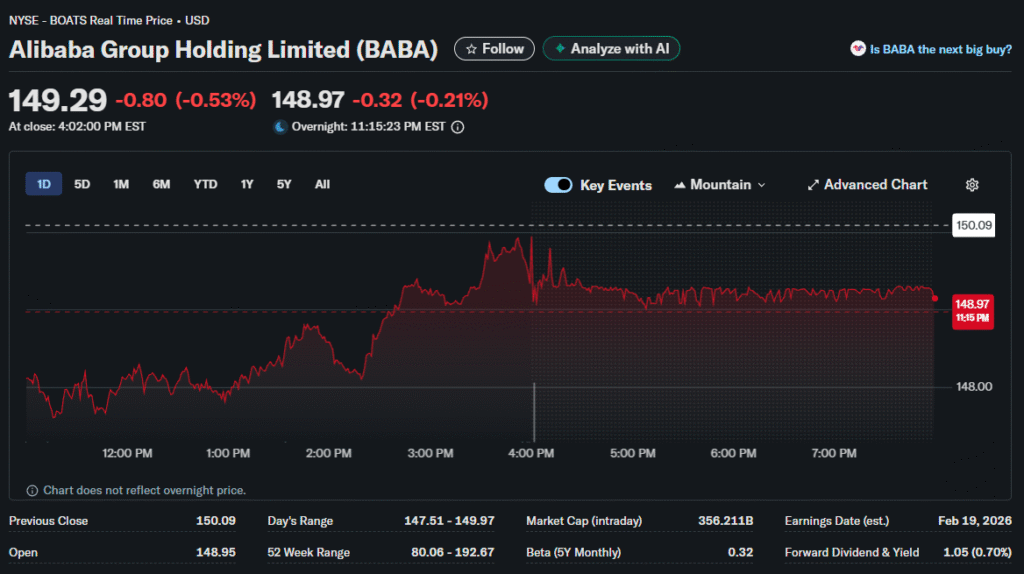

Chinese technology giants made aggressive inroads in artificial intelligence despite trade restrictions. Alibaba, Tencent, and Baidu invested heavily in competing with American AI leaders. Geopolitical tensions complicated global technology leadership assumptions. The

The European regulatory environment created headwinds for American platforms. Digital Markets Act enforcement targeted large technology companies’ business practices. Compliance costs and operational restrictions pressured international revenue growth.

Semiconductor export controls implemented throughout 2025 reshaped competitive dynamics. Advanced chip sales to China faced restrictions, forcing architectural workarounds. This regulatory fragmentation increased costs across technology supply chains.

SaaS Sector Stress

Software companies faced margin pressure from AI integration costs. ServiceNow demonstrated strong execution but highlighted investment requirements. Customer acquisition costs climbed as markets matured, while consolidation speculation increased among mid-tier providers struggling against well-capitalized giants.

Power availability emerged as a genuine constraint on AI infrastructure buildout. Applied Digital surged 265% year-to-date on capacity scarcity. Energy bottlenecks created opportunities for companies to solve infrastructure challenges, while utilities gained alongside technology in electricity demand projections.

Looking Ahead

The technology sector’s 2026 outlook hinged on separating genuine innovation value from speculative excess. Differentiation between companies with real AI advantages versus those simply riding the narrative became critical. Options markets showed elevated implied volatility reflecting uncertainty about direction but confidence in eventual resolution.