A financial analyst at Rineplex examines how major bank stocks climbed for three consecutive weeks through mid-December, with the KBW Bank Index gaining 4% weekly and closing higher in 13 of 14 sessions. The rally outpaced the S&P 500’s performance significantly.

Yield Curve Tailwinds

The steepening yield curve created favorable conditions for traditional banking models. The widening spread between short and long-term rates enhanced net interest margins meaningfully. Banks borrow short-term at lower rates while lending long-term at higher yields.

JPMorgan Chase projected net interest income of around $95 billion for 2026, representing 3% growth from current levels. This guidance exceeded analyst expectations despite concerns about economic softening. Management emphasized disciplined lending standards and deposit franchise strength.

Regional banks benefited disproportionately from curve dynamics. Their business models relied heavily on interest rate differentials. Community banks saw margins expand after years of compression during the flat curve environment.

Capital Markets Revival

Investment banking activity surged from multi-year lows. Initial public offerings accelerated as companies that had been shelved during high-rate periods returned. The IPO pipeline is filled substantially with technology and healthcare companies seeking liquidity.

Mergers and acquisitions rebounded robustly. Deal volumes climbed as strategic buyers and private equity deployed capital. Antitrust scrutiny eased marginally, though regulatory approval timelines remained extended compared to historical norms.

Goldman Sachs is positioned particularly well for capital markets recovery. The firm’s heavy weighting toward investment banking operations meant operating leverage to M&A and underwriting activity. Trading revenues also benefited from increased volatility across asset classes.

Credit Quality Holds

Loan loss provisions remained manageable despite economic uncertainty. Charge-off rates stayed below long-term averages across consumer and commercial portfolios. Borrowers generally maintained healthy balance sheets and servicing capacity.

However, senior broker warns that forward-looking indicators suggest caution is warranted. Commercial real estate exposure, particularly office properties, required monitoring. Some regional banks carried concentrated positions in struggling submarkets.

Consumer credit metrics showed mixed signals. Credit card delinquencies ticked higher among subprime borrowers. Auto loan performance deteriorated marginally. However, mortgage portfolios demonstrated remarkable resilience given homeowner equity cushions and conservative underwriting standards.

Valuation Gaps Narrow

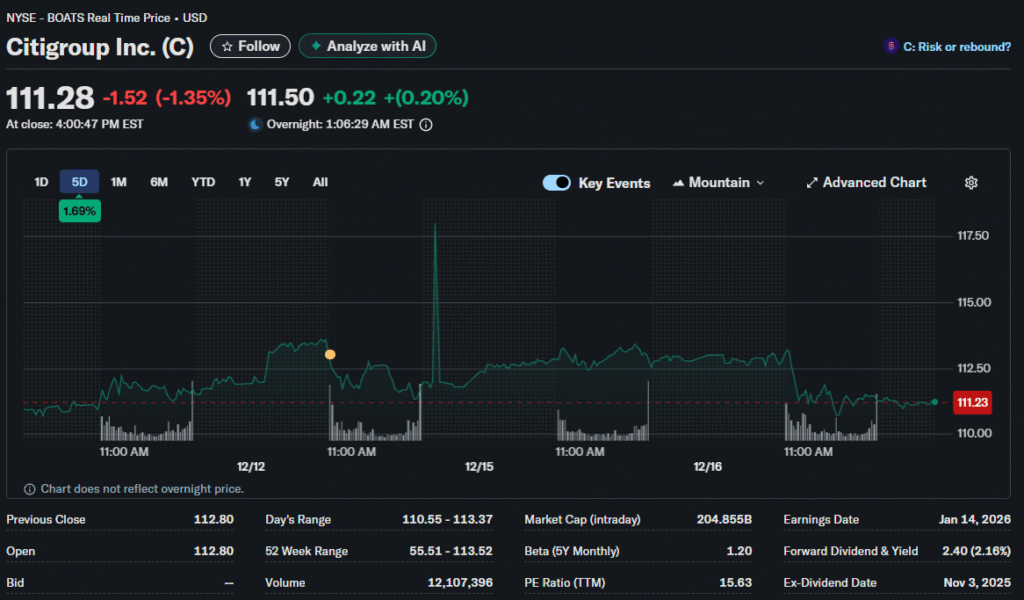

Citigroup traded at 1.14 times tangible book value, significantly cheaper than JPMorgan’s 3.03 multiple and Goldman Sachs’ 2.56. This discount reflected ongoing transformation challenges and execution risks. However, progress on strategic initiatives attracted value-oriented investors.

The valuation dispersion within the sector created stock-selection opportunities. Market leaders commanded premium multiples justified by superior returns on equity. Turnaround stories traded at discounts pending proof of improved profitability.

Bank of America occupied the middle ground, trading at reasonable multiples relative to franchise quality. The bank’s balance sheet sensitivity to rate changes positioned it well for curve steepening. However, regulatory capital requirements limited flexibility somewhat.

Regulatory Environment Shifts

Bank supervision moderated from peak levels following the 2023 failures. Basel III implementation timelines extended as the industry pushed back. Stress testing results showed sector resilience with all major institutions passing Federal Reserve examinations comfortably.

Technology Investment Payoff

Digital banking capabilities have matured significantly, with mobile adoption climbing. Branch rationalization accelerated without material customer losses. However, cybersecurity investments consumed substantial resources as threat landscapes evolved while fintech competition intensified in payments and wealth management niches.

Deposit battles subsided as customers showed less rate sensitivity. Non-interest-bearing deposits stabilized after years of decline. However, money market funds still compete effectively with a $6 trillion industry providing attractive alternatives.

Dividend Appeal Strengthens

Bank dividends provided attractive yields relative to the broader equity market. Wells Fargo, Bank of America, and JPMorgan offered 2.5-3.5% yields while maintaining reasonable payout ratios. These income streams attracted retirees and conservative investors.

Share repurchase programs accelerated as capital ratios exceeded targets. Citigroup particularly emphasized buybacks given the valuation discount. The company repurchased billions quarterly, reducing share count meaningfully.

However, dividend sustainability depended on earnings trajectories. Economic recession would pressure profitability and potentially force dividend cuts. Investors monitored credit trends carefully for early warning signals.

Geographic Performance Divergence

Southern and Western regional banks outperformed Northern peers. Population migration patterns benefited Sun Belt institutions. Texas banks navigated energy exposure successfully while diversifying into technology sectors in Austin and Dallas.

Foreign Exchange Volatility

Currency movements impacted international operations, with dollar strength reducing translated earnings. Emerging market exposures generated attractive margins but carried elevated risks, while cross-border payment volumes remained robust despite geopolitical tensions.

Outlook Brightens Cautiously

Bank stocks are entering 2026 with favorable technical and fundamental setups. Multiple tailwinds aligned, including curve steepness, capital markets activity, and stable credit. However, recession risks and regulatory uncertainty tempered unbridled optimism.

Sector rotation into financials from technology reflected changing market leadership. Value investing principles favored banks after years of growth stock dominance. Portfolio rebalancing drove substantial inflows into financial sector funds.

The banking industry’s performance ultimately depended on the economic trajectory and interest rate path. Soft landing scenarios favored continued outperformance, while hard landings would reverse gains quickly.