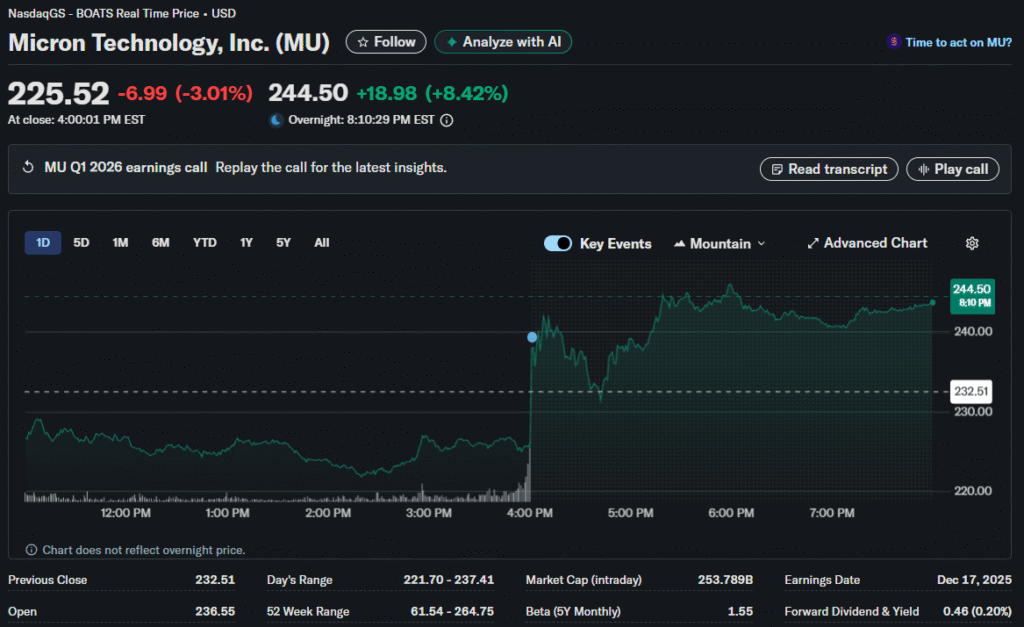

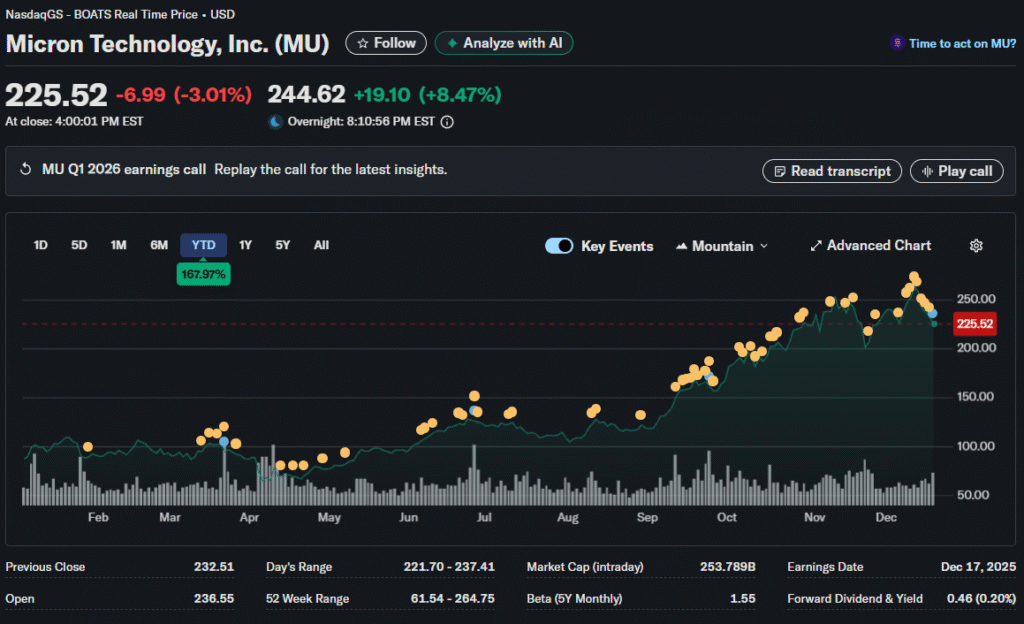

Micron Technology delivered quarterly results on Wednesday evening that defied the pessimism gripping technology markets. The memory chip manufacturer forecast second-quarter adjusted profit of $8.42 per share, nearly double consensus expectations. Shares surged 14% in after-hours trading as investors digested the surprise.

A financial analyst at Logirium takes a closer look at Micron’s blockbuster forecast that challenges the bearish narrative engulfing semiconductor stocks. Revenue guidance came in at $18.70 billion, well above analyst estimates clustering near $16 billion, with management attributing the strength to tight memory supply and booming AI data center demand.

Supply-Demand Dynamics

Memory chip pricing has stabilized after years of volatility. DRAM and NAND flash markets show balanced supply-demand conditions. Previous cycles featured wild swings between shortage and glut. Current equilibrium supports more predictable margins.

Industry capacity additions have moderated significantly. Major manufacturers learned painful lessons from aggressive expansion that crashed prices. Disciplined capital spending prevents oversupply that historically destroyed profitability.

Micron’s competitors face similar market dynamics. Samsung and SK Hynix have also benefited from rational industry behavior. The oligopolistic structure enables better pricing discipline than fragmented markets allow.

AI Demand Driver

High-bandwidth memory represents Micron’s fastest-growing segment. These specialized chips power AI accelerators and graphics processors. Each advanced AI server requires substantially more memory than traditional configurations.

Nvidia’s latest generation processors use HBM3E memory exclusively. Micron supplies a significant portion of this market. The transition to more advanced AI architectures creates upgrade cycles that boost memory content per system.

Hyperscale data centers continue aggressive AI infrastructure build outs. Amazon, Microsoft, and Google collectively spend billions quarterly on computing capacity. Memory represents a critical component of these massive capital expenditure programs.

Margin Expansion Path

Gross margins improved dramatically from cyclical lows. The company now operates profitably across product lines. Further margin expansion appears likely as mix shifts to higher-value memory types.

Manufacturing efficiency gains compound pricing improvements. Smaller process nodes deliver more memory per wafer. Unit cost reductions support margins even if pricing moderates slightly.

Operating leverage kicks in as revenue scales. Fixed costs spread across a larger revenue base improve profitability metrics. Management expects the margin trajectory to continue improving through 2026.

Market Share Gains

Micron has won design wins at major cloud service providers. These victories typically translate to multi-year revenue streams. Customer diversification reduces concentration risk while expanding the addressable market.

The company invests heavily in next-generation memory technologies. Leadership in emerging categories like HBM positions Micron advantageously. Competitors must catch up technologically while Micron monetizes its current advantages.

U.S. government support for domestic semiconductor manufacturing provides additional tailwinds. CHIPS Act funding enables capacity expansion with reduced capital intensity. Geographic diversification also mitigates geopolitical supply chain risks.

Guidance Implications

Management’s bullish outlook contrasts sharply with broader semiconductor pessimism. If Micron’s view proves accurate, current sector valuations appear too depressed. The disconnect creates a potential opportunity for selective investors.

AI infrastructure demand shows no signs of slowing, according to Micron’s customer conversations. Order books remain robust across multiple quarters. This visibility provides confidence in the near-term revenue trajectory.

Memory content per server continues increasing regardless of total server unit volumes. Even if infrastructure spending moderates, content growth supports semiconductor demand. This dynamic insulates memory producers from broader economic weakness.

Inventory Normalization

Customer inventories have returned to healthy levels after the earlier build. This normalization removes the overhang that pressured previous quarters. Fresh orders now reflect true end demand rather than inventory adjustments.

Micron’s own inventory management has improved substantially. The company maintains optimal stock levels that balance working capital with customer service. Improved forecasting reduces excess inventory write-downs.

Channel inventories throughout distribution networks appear lean. Distributors typically hold minimal stock during uncertain periods. Any demand uptick would require rapid restocking that accelerates orders.

Capital Allocation Strategy

The company balances growth investment with shareholder returns. Capital expenditure focuses on high-return advanced technologies. Mature product lines receive maintenance spending only.

Share repurchases demonstrate management confidence in valuation. The buyback program accelerates when stock trades below intrinsic value estimates. This capital allocation approach benefits long-term shareholders.

Balance sheet strength provides strategic flexibility. Low debt levels and strong cash flow support both investment and returns. Financial stability differentiates Micron from more leveraged competitors.

Cyclical Versus Structural

Memory markets historically exhibited extreme cyclicality. Boom-bust patterns created massive volatility in earnings and stock prices. The current environment shows reduced amplitude in cycles.

Structural demand drivers, including AI, provide a more stable baseline consumption. Cyclical fluctuations still occur, but around a higher trend growth. This evolution supports higher valuation multiples than historical averages.

Supply discipline from rational competitors reduces downside risk. Previous cycles featured suicidal pricing competition. The current industry structure enables healthier competitive dynamics.

Competitive Landscape

Samsung maintains the largest market share but faces margin pressure. The Korean giant’s diversified business model sometimes prioritizes volume over profitability. Micron’s focused strategy allows better optimization.

SK Hynix excels in high-bandwidth memory but lacks Micron’s geographic diversification. Chinese manufacturers face technological gaps that prevent competition in advanced categories. These dynamics support Micron’s competitive position.

Strategic Takeaway

Micron’s results demonstrate that underlying technology demand remains healthy despite equity market pessimism. The disconnect between operational performance and stock prices creates opportunities. Investors must decide whether to trust management guidance or market skepticism.