The Federal Reserve delivered another quarter-point rate cut on Wednesday, lowering the benchmark range to 3.5-3.75%. The move fulfilled market expectations but carried warning flags about future policy direction. Three committee members dissented, marking the first three-way split since September 2019.

A financial expert at Logirium examines the central bank’s third consecutive rate reduction and what the unprecedented three-way dissent reveals about divisions over monetary policy direction. Chairman Jerome Powell’s post-meeting press conference emphasized the committee’s comfortable position after reducing rates by 75 basis points across three consecutive meetings dating to September.

Unusual Dissent Pattern

The 9-3 vote featured disagreements from both policy camps. Governor Stephen Miran preferred a steeper half-point reduction, citing labor market concerns. Regional presidents Jeffrey Schmid of Kansas City and Austan Goolsbee of Chicago favored holding steady.

This bidirectional dissent pattern reveals deep uncertainty about the appropriate policy stance. Hawks worry about inflation persistence, while doves fear labor market deterioration. Powell must navigate between these competing concerns while maintaining committee cohesion.

Four additional non-voting participants registered “soft dissents” through their individual rate projections. They declined to support the policy decision despite lacking formal votes. This broader disagreement suggests more turbulence ahead as the committee debates the 2026 strategy.

Dot Plot Reveals Divisions

The quarterly Summary of Economic Projections showed committee members expect just one rate cut in 2026. This matches September’s projection but represents a significant hawkish shift from market pricing weeks earlier. The dot plot’s widening spread across future years highlights internal disagreement.

Individual projections for the longer-run neutral rate ranged widely. Some members see rates settling near 3% while others project closer to 3.5%. This fundamental disagreement about equilibrium policy complicates near-term decision-making.

Markets had priced in roughly two quarter-point cuts for 2026 before Wednesday’s meeting. The Fed’s guidance suggests a higher-for-longer trajectory than investors anticipated. This disconnect could drive volatility in rate-sensitive assets.

Economic Assessment Evolution

The policy statement acknowledged that job gains have slowed and unemployment has edged up through September. More recent indicators remain consistent with these trends. However, the committee removed previous language about “downside risks to employment” intensifying.

Inflation has moved higher since earlier in the year and remains somewhat elevated above the 2% target. The central bank’s preferred measure registered 2.8% annually in September. Core readings that exclude volatile food and energy prices showed similar persistence.

The statement’s language echoed phrasing from December 2024’s meeting. That similar wording preceded a four-month pause in rate cuts. The repetition signals potential for an extended period without further reductions.

Balance Sheet Operations Begin

The Fed announced it will resume Treasury security purchases after halting balance sheet runoff on December 1. The central bank reduced its holdings by approximately $2.4 trillion since June 2022 through quantitative tightening.

Initial purchases total $40 billion in Treasury bills, starting Friday. Buying is expected to remain elevated for several months before declining significantly. The New York Fed will manage operations to maintain ample reserve levels.

Officials carefully distinguished these technical operations from traditional quantitative easing. The purchases aim to ensure smooth repo market functioning rather than providing monetary stimulus. However, any balance sheet expansion typically supports easier financial conditions.

Market Reaction Dynamics

Stocks rallied following Powell’s press conference, with major indexes recovering earlier losses. The S&P 500 and Nasdaq both closed sharply higher. Investors focused on Powell’s statement that rate hikes aren’t in the committee’s base case for 2026.

Treasury yields showed a muted response to the rate cut. The 10-year note edged modestly lower but remained within recent trading ranges. Bond markets appear skeptical about aggressive further easing given persistent inflation readings.

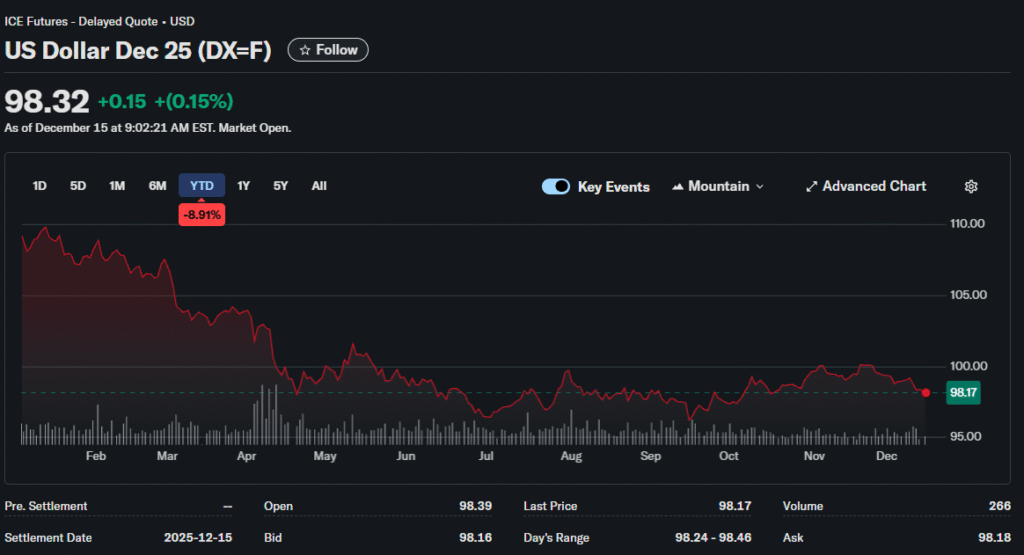

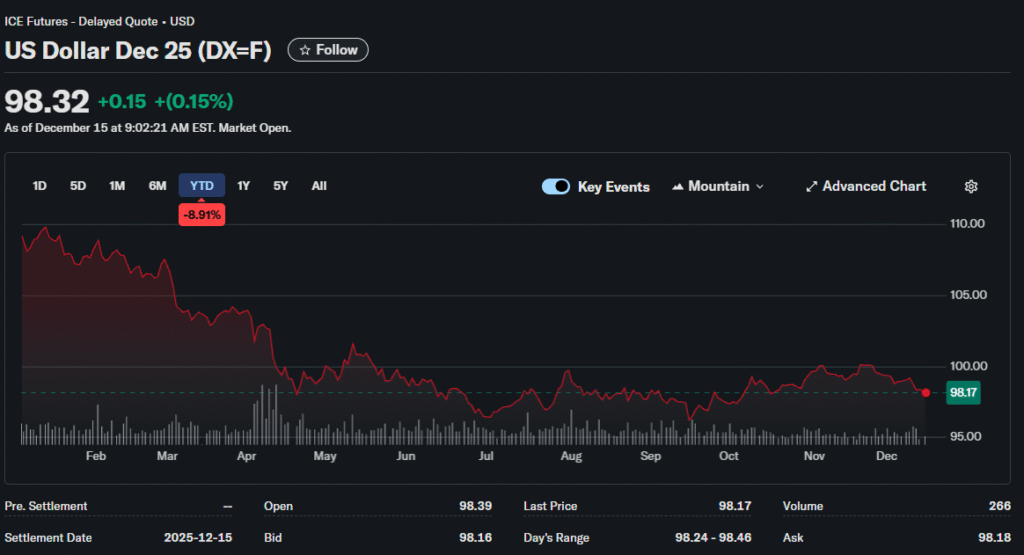

Currency markets reflected cautious risk sentiment. The dollar index strengthened slightly against major pairs. Gold held near recent highs despite the rate cut, maintaining its safe-haven bid amid broader uncertainty.

Data Interpretation Challenges

Powell acknowledged that upcoming economic data may prove unreliable due to the government shutdown’s impact. October and November figures will be viewed skeptically. The committee expects more complete December data before the January meeting.

This data uncertainty complicates policy calibration at a critical juncture. The Fed must decide on further rate cuts without confidence in recent economic indicators. Chairman Powell suggested the committee will scrutinize reports carefully to identify shutdown-related distortions.

The clustering of employment and inflation releases in mid-December created additional volatility. Markets received delayed payroll data on Monday, showing mixed signals. Wednesday’s CPI report arrived just hours before the Fed decision.

Investment Positioning

The Fed’s cautious tone benefits savers through higher deposit rates but disappoints borrowers hoping for relief. Mortgage rates have remained elevated despite recent Fed cuts. The 30-year fixed average stood at 6.19% last week.

Corporate treasurers must adjust financing plans around a higher-for-longer rate environment. The assumption of steady reductions throughout 2026 now appears questionable. Strategic planning requires scenarios for rates staying near current levels.

Asset allocators face difficult decisions about duration exposure and sector positioning. Defensive areas that benefit from slower growth may outperform if the Fed holds rates steady while economic momentum fades.