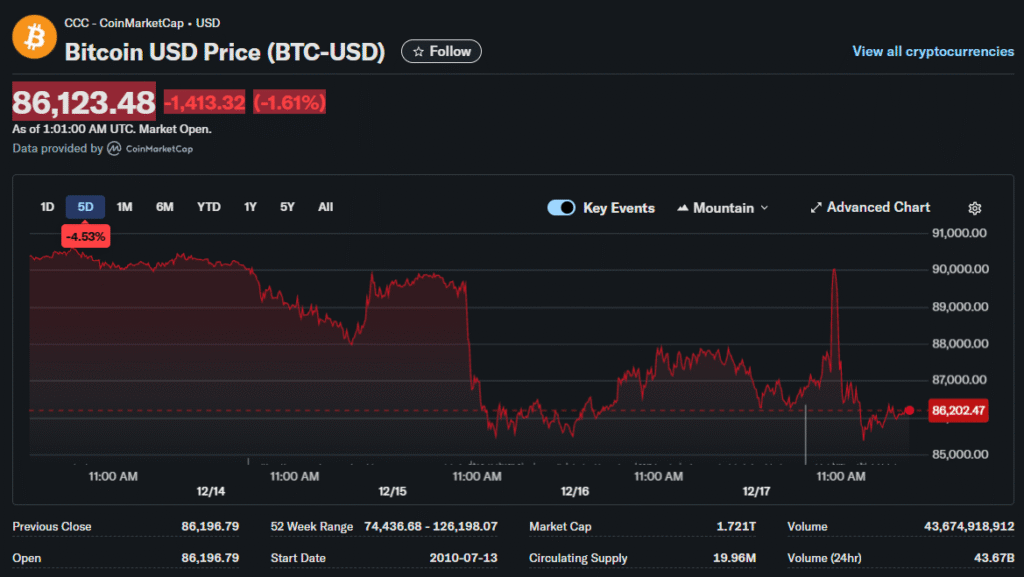

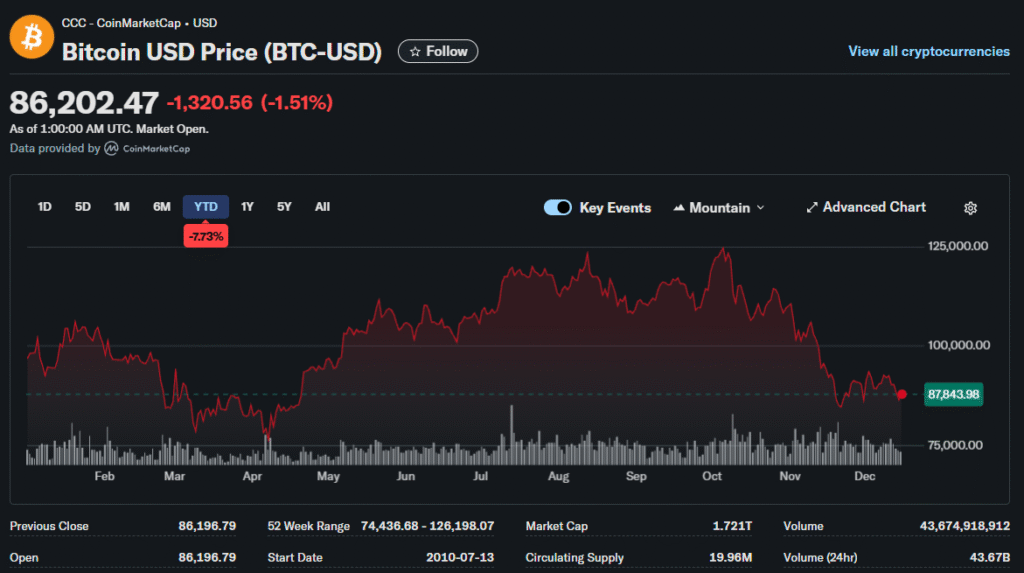

Bitcoin extended its decline Tuesday, falling to $85,266 and marking its fourth consecutive losing session. The world’s largest cryptocurrency has now dropped 30% from its October all-time high near $126,000. Market psychology has shifted dramatically as the digital asset struggles to maintain key technical levels.

A senior broker at Logirium breaks down the cryptocurrency market’s four-day losing streak as Bitcoin tests critical support levels amid shifting Federal Reserve expectations and correlation with traditional risk assets. The latest selloff reflects multiple converging pressures as Federal Reserve policy expectations have evolved considerably since the central bank’s December meeting.

Rate Reality Bites

Ten-year Treasury yields climbed to 4.2%, creating unfavorable conditions for non-yielding assets. Bitcoin offers no dividend or interest income. Rising real yields make it less attractive relative to risk-free government bonds. This dynamic has intensified as inflation remains above the Fed’s 2% target.

The correlation between Bitcoin and Nasdaq technology stocks has strengthened considerably. Both asset classes now move in tandem far more than historical patterns suggest. This relationship emerged as institutional investors began treating cryptocurrency as a growth equity proxy rather than an independent store of value.

Death cross technical patterns have appeared on Bitcoin charts since mid-November. This occurs when the 50-day moving average crosses below the 200-day average. Technical traders view this as a bearish signal that often precedes extended declines.

Leverage Liquidations

Overnight funding markets saw approximately $787 billion in outstanding leverage through perpetual crypto futures. This compares to roughly $135 billion in spot Bitcoin ETFs. The leverage ratio creates vulnerability to cascading liquidations when prices move against positioned traders.

Some exchanges offer leverage ratios exceeding 200x on cryptocurrency trades. Small price movements can trigger automatic position closures that accelerate declines. Monday’s session saw nearly $1 billion in leveraged positions liquidated as Bitcoin broke through support levels.

Retail investors dominate cryptocurrency exchanges compared to traditional equity markets. Individual traders react differently from institutional participants. Their behavior patterns create additional volatility during stress periods. Decentralized exchange structures and opaque reporting make risk assessment challenging.

Institutional Caution

The Federal Reserve delivered its third consecutive rate cut on Wednesday, bringing the target range to 3.5-3.75%. However, the central bank’s dot plot projections indicated only one additional cut planned for 2026. Markets had priced in more aggressive easing.

Bitcoin historically benefits from accommodative monetary policy. Lower rates reduce opportunity costs for holding non-yielding assets. The Fed’s hawkish pivot removes a key tailwind that supported cryptocurrency prices throughout late 2024.

Major institutional investors have grown cautious about Bitcoin exposure. Corporate treasury holdings that surged in recent years have stabilized. New entrants to the space have slowed considerably. The narrative around Bitcoin as a corporate treasury asset has lost momentum.

Safe Haven Rotation

Gold prices have rallied to near-record levels while Bitcoin declines. This divergence challenges Bitcoin’s “digital gold” narrative. Investors seeking inflation hedges or safe haven assets are clearly preferring traditional precious metals over cryptocurrency alternatives.

Capital rotation patterns show funds moving from high-beta technology assets into defensive sectors. Financials, healthcare, and consumer staples have outperformed growth stocks consistently over recent weeks. Bitcoin falls squarely in the high-beta category during this environment.

The dollar’s strength near recent highs also pressures Bitcoin. Cryptocurrency often moves inversely to the greenback. A firm dollar makes Bitcoin more expensive for international buyers using local currencies. This dynamic compounds selling pressure from other factors.

Technical Breakdown Analysis

Fibonacci extension analysis identifies $74,000 as a primary downside target. This level represents the 161.8% extension and corresponds to 2025’s yearly lows. Technical analysts expect full capitulation and potential institutional reaccumulation if prices reach this zone.

Critical support sits at $80,000 currently. A break below this psychological level would trigger a bearish market structure flip. Stop-loss orders cluster beneath round numbers. Their execution could create sharp intraday moves through these levels.

Trading volumes have remained elevated throughout the decline. High volume on down days suggests distribution rather than temporary profit-taking. Professional traders interpret this pattern as indicating genuine trend change rather than consolidation.

Macro Headwinds Persist

Weak global manufacturing activity dampens demand outlooks across asset classes. Bitcoin trades alongside risk assets rather than operating as an independent hedge. Economic softness in major markets reduces speculative appetite for volatile investments.

Bank of Japan policy decisions loom as another catalyst. Any hawkish tilt could trigger broader currency market volatility. Japanese yen weakness has supported carry trades into higher-yielding assets, including cryptocurrency. Policy normalization would reverse these flows.

Holiday season illiquidity may extend current consolidation patterns. Trading volumes typically decline in late December. Thin markets can amplify price swings in either direction. The range between $84,000-$94,000 may persist until early January.

Path Forward

The coming weeks will determine whether Bitcoin establishes a base near current levels or continues toward technical targets in the mid-$70,000 range. December jobs and inflation data will heavily influence Federal Reserve expectations and, consequently, crypto market sentiment.

Options markets show elevated implied volatility across near-term expiries. Traders are pricing significant uncertainty about direction over the next month. This environment rewards patience over aggressive directional bets.