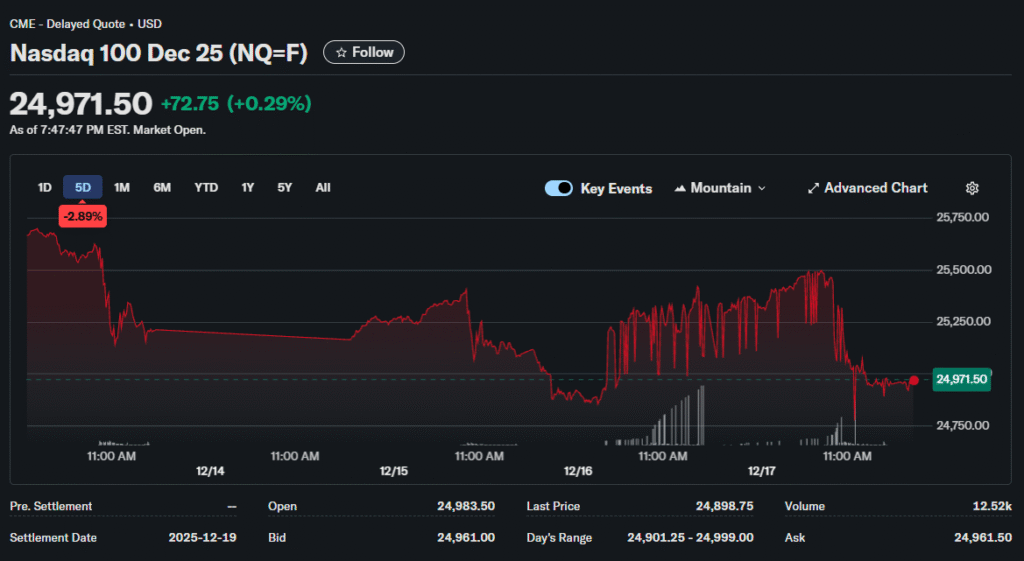

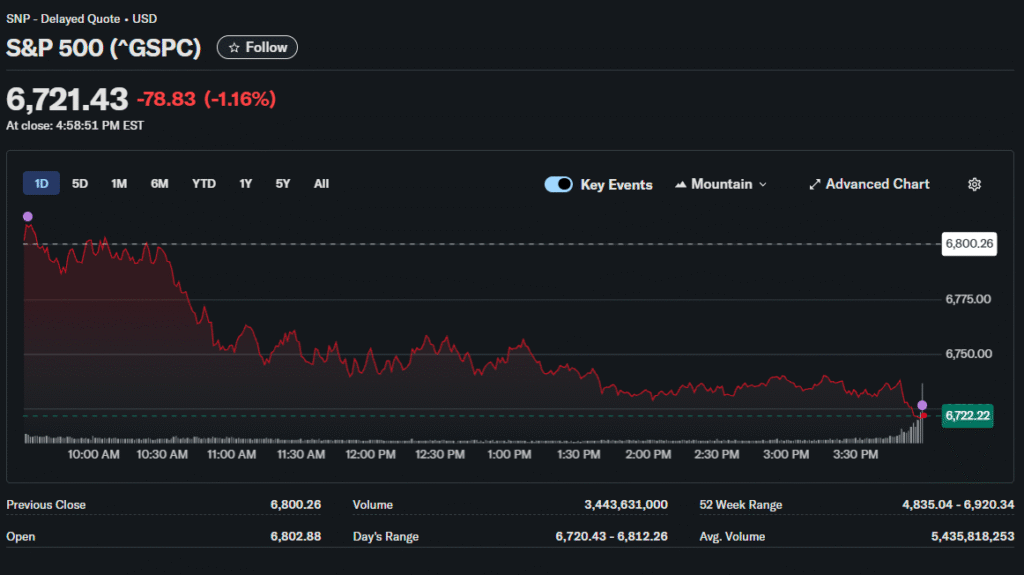

Technology shares suffered their worst session in months on Wednesday as investors reassessed the massive capital requirements behind artificial intelligence infrastructure buildouts. The Nasdaq 100 plunged 1.9% while the S&P 500 dropped 1.2%, with both indexes breaching technical support levels that had held for weeks.

Logirium‘s lead financial analyst examines the sharp technology sector retreat that erased billions in market value as infrastructure financing concerns spread across Wall Street trading desks. Oracle’s stock fell 5.4% after reports emerged that its primary infrastructure partner withdrew from a $10 billion data center project. The news sent shockwaves through related sectors.

The Financing Question

Major investment banks had structured the Oracle deal as a test case for private credit’s role in technology infrastructure. The collapse suggests that lenders are growing more selective about AI-related exposure. Credit markets have tightened considerably as interest rates remain elevated and default risks climb.

Nvidia dropped 3.8% to its lowest level since September. The chip giant’s recent weakness reflects broader concerns beyond Oracle. Investors now question whether hyperscalers can maintain their aggressive spending pace without triggering margin compression.

Broadcom lost more than 4% in sympathy selling. The company had positioned itself as a critical AI infrastructure provider. Its stock has now declined for eight consecutive sessions as rotation away from expensive growth names accelerates.

Advanced Micro Devices shed more than 5% despite no company-specific news. Alphabet declined over 3% as the sell-off spread to internet giants with significant AI investments. The correlation between these names has intensified dramatically over the past month.

Market Structure Breakdown

The S&P 500’s breach of its 50-day moving average carries technical significance beyond simple chart patterns. This level had provided consistent support since early autumn. Its failure suggests institutional algorithms may trigger additional programmatic selling.

Trading volume exceeded recent averages across major exchanges. The elevated activity indicates genuine conviction behind the selling rather than illiquid markets amplifying price swings. Market breadth statistics showed declining stocks outnumbered advancers by roughly 1.5-to-1 on the NYSE and 2.1-to-1 on the Nasdaq.

Professional options traders noticed unusual put buying activity in semiconductor names. Open interest in out-of-the-money puts has climbed to levels not seen since earlier market corrections. This positioning could create additional downside pressure if spot prices continue declining.

The Private Credit Angle

Blue Owl Capital’s decision to walk away from Oracle’s Michigan facility financing carries implications beyond one deal. The firm cited concerns about Oracle’s debt levels and spending trajectory. These same factors apply across numerous AI infrastructure projects currently seeking financing.

Major insurers and pension funds had allocated billions to technology infrastructure debt in recent quarters. The asset class promised stable returns backed by long-term contracts with creditworthy counterparties. Oracle’s financing troubles may force a reassessment of these assumptions.

Private credit markets have grown explosively, now exceeding $1.5 trillion in assets. Much of this capital targeted technology and AI-related lending. A broader pullback in this financing channel could constrain infrastructure development regardless of equity market sentiment.

Earnings Provide Contrast

After the closing bell, Micron Technology delivered quarterly results that starkly contradicted the day’s negative narrative. The memory chip manufacturer forecast second-quarter adjusted profit of $8.42 per share, nearly double consensus expectations.

Revenue guidance came in at $18.70 billion, well above analyst estimates. Management attributed the strength to tight memory supply and booming AI data center demand. The stock surged 14% in after-hours trading as investors digested the divergence.

Micron’s outlook suggests underlying AI infrastructure demand remains robust despite financing concerns. High-bandwidth memory and server buildouts continue at a pace even as equity markets price in slower growth. This disconnect highlights the complexity of current market dynamics.

Investment Implications

The rotation out of AI infrastructure names has accelerated beyond normal profit-taking patterns. Seven consecutive sessions of technology underperformance point to fundamental reassessment rather than temporary positioning adjustments. Value-oriented sectors, including financials and healthcare, have absorbed flows.

Fixed-income markets showed limited reaction to equity weakness. Treasury yields edged modestly lower but remained near recent ranges. The muted bond response suggests investors view the technology selloff as sector-specific rather than indicating broader economic deterioration.

Currency markets reflected the risk-off tone. The dollar index strengthened against most major pairs as traders reduced exposure to growth-sensitive assets. Gold prices held firm near recent highs, maintaining their haven bid.

Looking Forward

The coming weeks will test whether Oracle’s financing troubles represent an isolated incident or signal broader infrastructure funding constraints. Several major AI-related projects are currently in financing discussions. Their success or failure will heavily influence sector sentiment.

Fourth-quarter earnings season begins in January with major technology companies reporting. Guidance on capital expenditure plans will receive intense scrutiny. Any indication that spending growth is moderating could trigger additional sector weakness.

The Fed’s next policy meeting in late January looms as another catalyst. Rate expectations have shifted considerably in recent weeks. Technology valuations remain sensitive to discount rate changes given their long-duration cash flow profiles.