A long-discussed silver shortage has officially moved from theory to reality, and the price action is now reflecting it. At Arbitics, analysts are closely tracking how structural imbalances in the silver market are reshaping investment opportunities, especially after a prediction made years ago has fully played out.

Back in 2023, a simple but powerful observation highlighted the issue: global silver consumption was exceeding production by roughly 150 million ounces per year. Large above-ground inventories had temporarily masked that gap, but the imbalance itself never disappeared. Instead, it quietly widened.

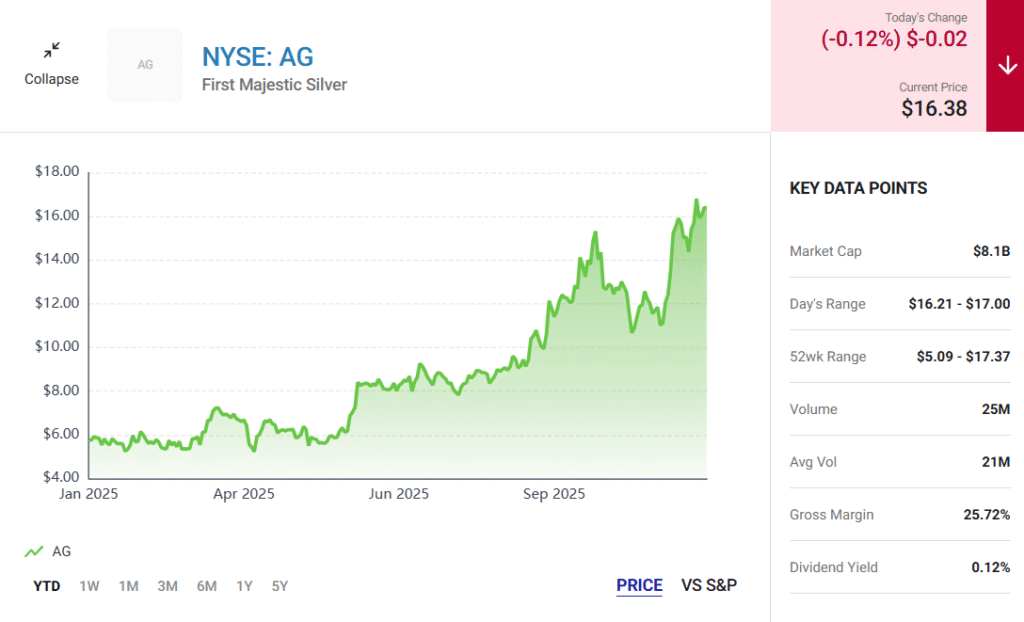

Fast forward to today, and the outcome is clear. Silver prices have climbed by roughly 150% over the past three years, confirming that the market has reached a new equilibrium. Supply failed to respond meaningfully, while demand remained structurally strong.

Why Silver’s Bull Market Was Inevitable

Unlike many commodities, silver production is notoriously inelastic. Most silver is mined as a byproduct of other metals like gold, copper, lead, or zinc. That means miners cannot easily increase silver output in response to higher prices.

Recent data underscores this reality:

- Mine production rose by less than 1% in 2024

- Global demand exceeded supply by approximately 149 million ounces

- 2025 marks the fifth consecutive year of a silver deficit exceeding 100 million ounces

Meanwhile, industrial demand continues to surge. Silver is essential for:

- Solar panels

- Electric vehicles

- Semiconductors

- Electronics and AI hardware

These are not cyclical fads. They represent long-term structural demand drivers tied to electrification, automation, and digital infrastructure.

Two Ways Investors Gain Silver Exposure

There are two primary ways investors gain exposure to silver, each offering different risk and return profiles. The first is through silver-backed exchange-traded funds, such as the iShares Silver Trust, which holds physical silver stored in secure vaults.

This approach allows investors to track the spot price of silver without dealing with storage, insurance, or transportation issues. It offers simplicity, liquidity, and transparency, making it a popular choice for those seeking straightforward exposure to silver’s price movements.

However, while ETFs closely mirror silver prices, they do not amplify returns. Gains are generally limited to the metal’s price appreciation, with no operational upside. This is where silver mining companies come into play.

Miners offer leveraged exposure to silver prices, meaning their earnings can grow faster than the metal itself when prices rise. Through increased production, cost efficiencies, and operational scaling, miners can potentially deliver outsized returns during a sustained silver bull market.

Why First Majestic Stands Out

Among silver-focused companies, First Majestic has emerged as one of the most compelling ways to gain leveraged exposure to rising silver prices.

What sets it apart is its revenue mix:

- 57% of revenue comes directly from silver, making it one of the closest examples of a pure-play silver miner

- Q3 production reached a record 3.9 million ounces, representing 96% year-over-year growth

- All-in sustaining costs range between $14.80 and $15.80 per ounce, leaving wide profit margins at current silver prices

The company’s most recent quarter tells an important story:

- $139 million increase in revenue

- $73 million from higher silver production

- $66 million from higher silver prices

This dual driver means earnings growth is not dependent solely on price spikes. Increased production strengthens resilience and long-term scalability.

Valuation vs. Growth Reality

At first glance, First Majestic’s price-to-earnings ratio of 113 may appear elevated. But context matters.

This is a company that:

- Nearly doubled revenue year over year

- Operates in a market with structural supply constraints

- Benefits from multi-decade demand tailwinds

High-growth commodity producers often look expensive before earnings fully scale. In this case, the valuation reflects expectations of sustained demand rather than speculative hype.

What Happens If Silver Pulls Back?

Silver prices will eventually experience corrections. That’s inevitable in any commodity cycle. However, near-term risks appear limited.

The forces driving demand remain intact:

- Clean energy expansion

- EV adoption

- AI-driven semiconductor growth

- Persistent global supply deficits

With silver demand exceeding supply for five consecutive years, the market structure continues to favor producers with scalable output and cost discipline.

Final Takeaway

The silver bull market is no longer speculative. It’s structural. As supply struggles to keep pace with industrial demand, companies positioned to expand silver production stand to benefit disproportionately. First Majestic represents one of the most direct ways to gain exposure to this imbalance, offering both price leverage and operational growth.

For investors looking beyond ETFs and toward companies that can compound returns in a supply-constrained environment, silver-focused miners deserve close attention as this cycle continues to unfold.