Flagstar Bank National Association (NYSE: FLG) remains under close watch by analysts and institutional investors as the company navigates a challenging operating environment. According to Fintel, JP Morgan reaffirmed its Neutral rating on Flagstar Bank on December 16, 2025, signalling a wait-and-see approach rather than a clear bullish or bearish outlook. This stance reflects a balance between valuation upside and ongoing financial and operational risks facing the regional banking sector.

From the perspective of brokers at Arbitics, recent analyst forecasts, institutional fund activity, and shareholder positioning offer valuable insight into how the market is currently assessing Flagstar Bank’s risk-reward balance.

Analyst Price Targets Point to Measured Upside

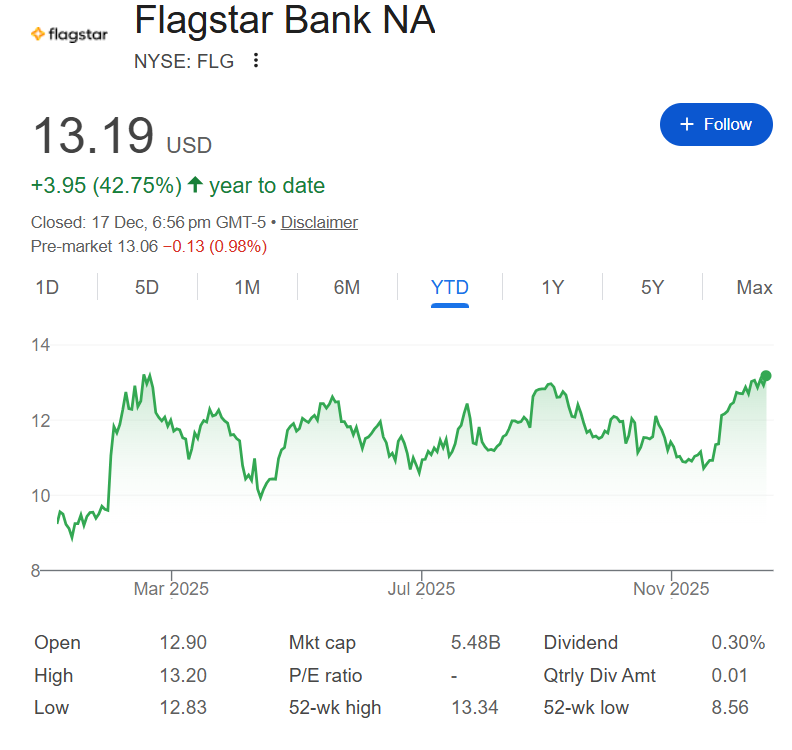

Despite the Neutral recommendation, analyst estimates suggest moderate upside potential for the stock. As of December 6, 2025, the average one-year price target for Flagstar Bank stands at $14.05 per share, with projections ranging from $11.62 on the low end to $16.80 on the high end. Compared with the stock’s most recent closing price of $12.93, the consensus target implies an 8.70% potential upside.

This forecast suggests analysts see room for recovery or stabilisation, though not enough conviction to justify aggressive buying recommendations. The relatively wide target range also highlights uncertainty around execution, earnings visibility, and broader macroeconomic conditions.

Earnings Outlook Remains a Key Challenge

One of the primary factors tempering enthusiasm is Flagstar’s earnings outlook. Current projections point to a non-GAAP earnings per share (EPS) estimate of -0.33, indicating that profitability pressures remain unresolved. For many investors, this negative EPS forecast underscores why analysts are reluctant to shift toward a more optimistic stance.

Rising funding costs, margin compression, and integration challenges within the regional banking space continue to weigh on near-term earnings expectations. Until there is clearer evidence of sustainable profitability improvement, Flagstar is likely to remain a stock that investors approach cautiously.

Institutional Sentiment Shows Mixed Signals

Institutional ownership trends provide a nuanced picture. A total of 709 funds and institutions currently report positions in Flagstar Bank, representing an increase of four owners, or 0.57%, over the past quarter. This modest rise suggests incremental interest rather than a decisive shift in sentiment.

At the same time, total institutional shares outstanding declined by 0.97% over the last three months to approximately 415.36 million shares. This indicates that while some new funds initiated or added positions, others reduced exposure.

The average portfolio allocation to FLG across all reporting funds is 0.21%, reflecting a 0.86% increase quarter over quarter. Overall, institutions appear to be maintaining exposure at relatively small weights, consistent with a Neutral outlook.

Options Market Signals Cautious Optimism

One data point leaning slightly bullish is the options market. Flagstar’s put/call ratio currently sits at 0.59, a level often interpreted as bullish sentiment, as it suggests more call options than puts are being traded. This may indicate expectations for short-term stabilisation or upside, even if long-term conviction remains limited.

However, options sentiment alone is rarely decisive, especially when earnings fundamentals remain under pressure. Still, it does suggest that some market participants are positioning for a rebound rather than a sharp decline.

Major Shareholders Hold Steady

Looking at large shareholders, stability appears to be the dominant theme:

- Liberty 77 Capital holds 75 million shares, representing 18.04% ownership, with no change over the last quarter.

- Reverence Capital Partners owns 35.98 million shares (8.65% ownership), also unchanged.

- Hudson Bay Capital Management controls 34.69 million shares, or 8.34% ownership, with no reported adjustments.

These unchanged positions suggest that major stakeholders remain committed but are not increasing exposure aggressively.

Selective Accumulation by Long-Term Funds

One notable exception is T. Rowe Price Investment Management, which increased its holdings to 13.51 million shares, representing 3.25% ownership. This marks a 20.10% increase in share count and a 32.02% rise in portfolio allocation over the last quarter. Such a move suggests selective confidence from a long-term-oriented investor.

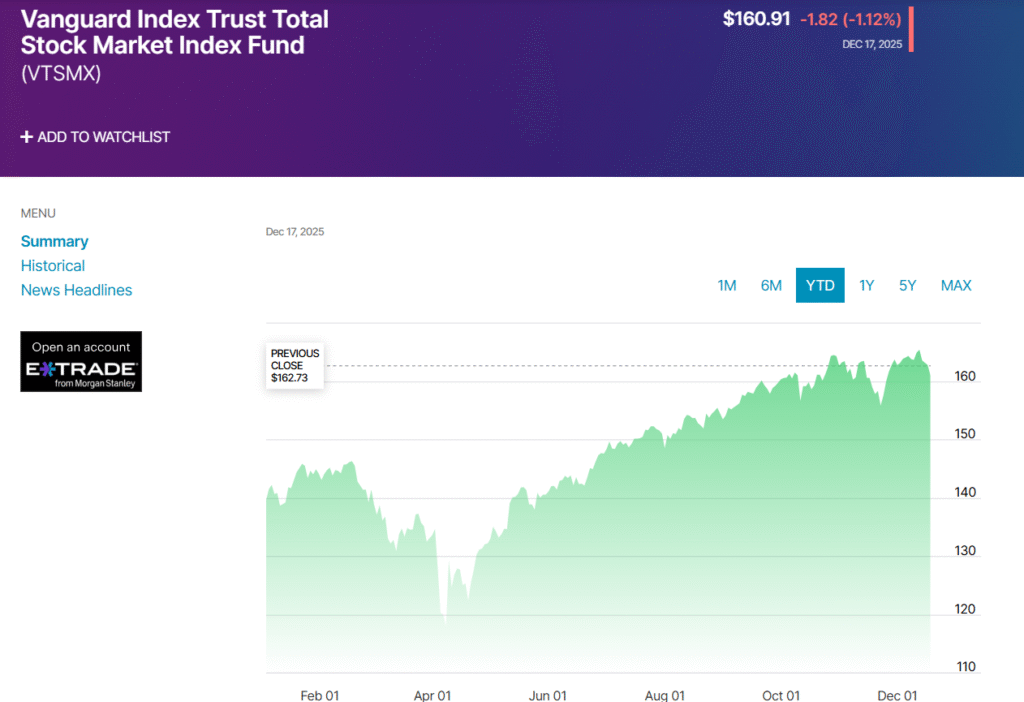

Meanwhile, the Vanguard Total Stock Market Index Fund (VTSMX) holds 10.67 million shares (2.57% ownership). While Vanguard slightly increased its share count by 0.77%, it reduced portfolio allocation by 17.98%, reflecting broader portfolio rebalancing rather than a strong view on Flagstar specifically.

The Bottom Line

JP Morgan’s Neutral rating highlights Flagstar Bank’s position between modest valuation-driven upside and ongoing earnings uncertainty. While price targets suggest limited upside, mixed institutional sentiment and negative earnings forecasts remain key concerns.

From any brokers’ perspective, Flagstar may appeal primarily to risk-tolerant investors willing to accept volatility while waiting for clearer operational progress. Until profitability improves, FLG is likely to remain more suitable for monitoring than for high-conviction investment strategies.