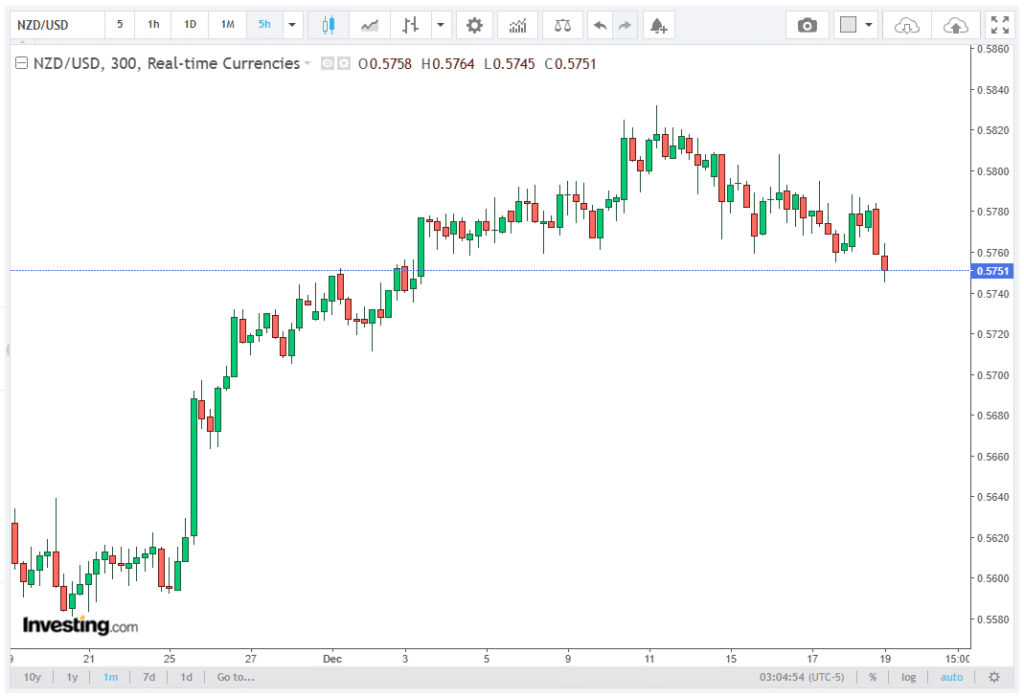

The NZD/USD pair weakened to around 0.5760 in early European trading on Friday, despite an upbeat New Zealand Gross Domestic Product (GDP) report.

Market participants cited renewed US Dollar (USD) demand as the primary driver behind the Kiwi’s struggle to gain traction, leaving traders focused on upcoming US economic data and interest rate expectations. Unirock Gestion experts deliver a detailed and insightful analysis of the subject in their latest piece.

Kiwi Fails to Respond to Strong GDP

New Zealand GDP data for the third quarter (Q3) showed a 1.1% expansion, a notable rebound from the revised 1.0% contraction in Q2. Activity across key sectors, including retail, construction, and services, remained robust, reflecting a solid economic performance.

Despite this positive macro signal, the NZD/USD pair remained under pressure. According to BBH FX analysts, the Reserve Bank of New Zealand (RBNZ) is expected to maintain the official cash rate (OCR) at 2.25% through 2026, which keeps the Kiwi dollar in a range-bound environment.

Analysts noted that interest rate stability amid a strong GDP underscores that currency movements are increasingly influenced by global risk sentiment and US Dollar dynamics rather than domestic economic data alone.

US Dollar Strength Keeps Kiwi Under Pressure

The US Dollar (USD) regained traction on Friday, exerting downward pressure on NZD/USD. Market sentiment was shaped by cooler-than-expected US inflation data, which intensified speculation regarding the Federal Reserve’s (Fed) interest rate path in early 2026.

Traders now anticipate a potential series of rate cuts by the Fed, following a quarter-point reduction at each of its last three meetings. Despite these expectations, caution prevails as Fed officials have highlighted the need for more “clean” data, especially after disruptions caused by the recent government shutdown.

The Greenback’s resilience reflects the interplay of US monetary policy expectations, safe-haven demand, and risk-on sentiment across foreign exchange markets. For the NZD/USD pair, this translates into a limited ability for the Kiwi to rally, even when supported by strong domestic GDP figures.

Market Pricing and Interest Rate Expectations

Financial markets are currently pricing in approximately 26.6% odds of a US interest rate cut at the Fed’s next policy meeting in January, as indicated by the CME FedWatch Tool. These probabilities reflect traders’ ongoing reassessment of monetary policy trajectories, driven by inflation trends, labor market data, and geopolitical developments.

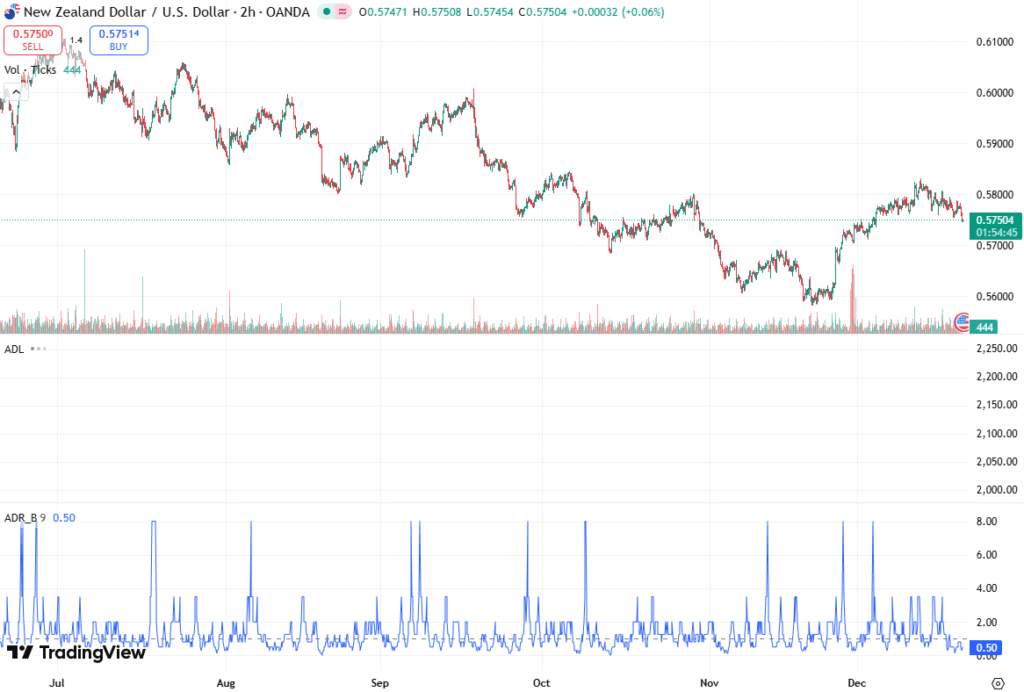

For the NZD/USD pair, this environment suggests a cap on downside losses, as potential USD weakness from future Fed easing could provide technical support around the 0.5750–0.5760 level. However, in the short term, strong USD demand continues to dominate, limiting the Kiwi’s upside momentum.

Upcoming Data to Watch

Traders remain focused on the University of Michigan (UoM) Consumer Sentiment Index and UoM Consumer Inflation Expectations, both scheduled for release later on Friday. These indicators are expected to influence short-term USD flows, which could, in turn, affect NZD/USD price action.

The Consumer Sentiment Index offers insights into household confidence, spending tendencies, and the broader economic outlook, while Inflation Expectations provide a gauge for future Fed policy decisions, directly impacting USD strength and, by extension, NZD/USD trends.

NZD/USD Volatility and Risk Sentiment Impact

The NZD/USD pair is also influenced by broader market volatility and risk sentiment, which can amplify short-term price swings. Positive risk-on sentiment, driven by global equity gains or commodity price rallies, could support the Kiwi, given New Zealand’s exposure to commodity exports like dairy and timber.

Conversely, heightened geopolitical tensions or market uncertainty may boost USD safe-haven demand, keeping NZD/USD under pressure. Traders should monitor cross-asset correlations and market sentiment indices to gauge the pair’s near-term direction.

Technical Trading Strategies for NZD/USD

For traders focused on NZD/USD, a range-bound strategy appears most suitable given current conditions. Monitoring key support at 0.5750 and resistance around 0.5780–0.5800 can help identify entry and exit points for both short-term and medium-term trades.

Additionally, the release of US economic indicators, including consumer sentiment and inflation expectations, may trigger breakouts or pullbacks, offering scalping and swing trading opportunities.

Summary

Despite New Zealand’s strong Q3 GDP growth of 1.1%, the NZD/USD pair has failed to gain traction, hovering near 0.5760 amid renewed USD demand. The RBNZ’s stable monetary policy stance and expectations of further US rate cuts create a mixed outlook, limiting significant gains for the Kiwi dollar.

Market participants will closely monitor the University of Michigan Consumer Sentiment Index and Inflation Expectations later today, as these US indicators could trigger short-term volatility.

Overall, while the Kiwi remains under pressure, potential USD weakness from future Fed easing may cap further losses, keeping NZD/USD within a range-bound trading corridor in the near term.