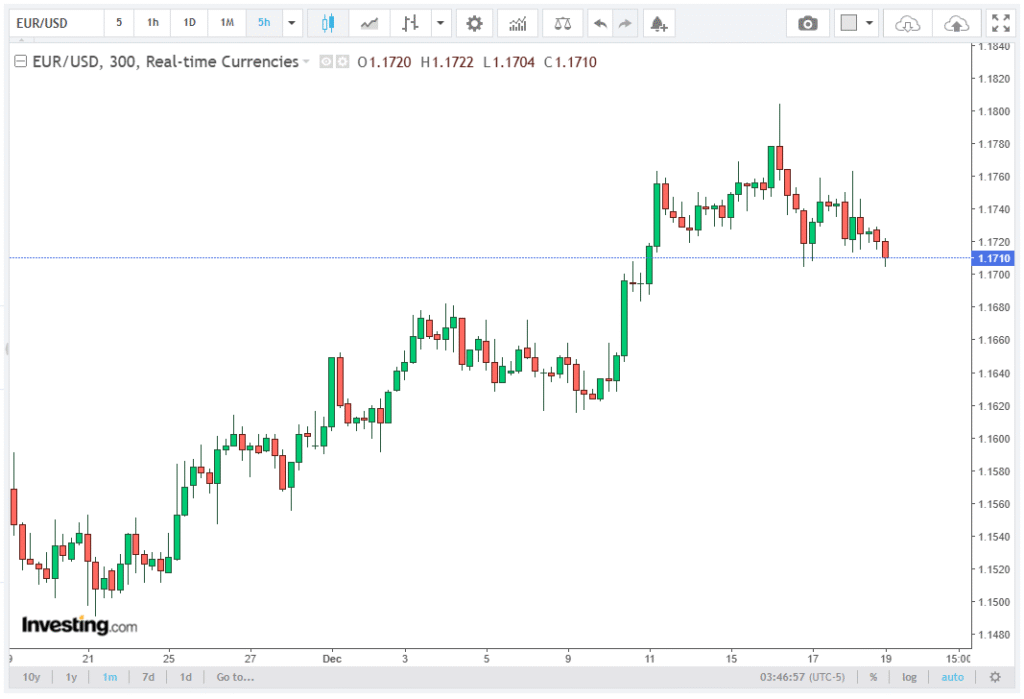

EUR/USD Price Forecast: Approaches Nine-Day Support Around 1.1700

The EUR/USD pair remains under close observation as it trades near 1.1720 during the Asian hours on Friday, marking the fourth consecutive session of weakness. Despite this short-term retracement, technical analysis on the daily chart continues to signal a bullish bias, with the pair moving within an ascending channel pattern. The Unirock Gestion team presents a structured and informative breakdown of this matter.

The 14-day Relative Strength Index (RSI) currently stands at 62.11, suggesting strong bullish momentum while staying clear of overbought conditions. This implies that the EUR/USD retains room for further upside before the market may encounter profit-taking pressure.

Key Support and Resistance Levels

The immediate support for EUR/USD is observed at the nine-day Exponential Moving Average (EMA), currently around 1.1713. A test of this level could provide a buying opportunity for traders anticipating a rebound toward resistance zones.

Further support lies near the lower boundary of the ascending channel, close to 1.1700. A break below this level would likely weaken the short-term price momentum and expose the pair to the 50-day EMA around 1.1644. Should selling pressure intensify, the three-week low of 1.1589, recorded on December 1, may act as a key downside target.

On the upside, the EUR/USD may attempt to test the two-month high of 1.1804, reached on December 16. A daily close above this level could push the pair further toward the upper boundary of the ascending channel, near 1.1850. A break above the channel would open the path for the EUR/USD to explore 1.1918, the highest level since June 2021, representing a strong bullish continuation scenario.

Technical Indicators Suggest Bullish Momentum

Exponential Moving Averages (EMAs) remain critical in tracking the trend strength of the EUR/USD pair. The pair is trading above both the 9-day and 50-day EMAs, reinforcing a bullish bias. The short-term EMA remaining above the medium-term EMA confirms upward momentum, while providing dynamic support during intraday pullbacks.

The 14-day RSI at 62.11 is notable as it indicates strong positive momentum without triggering overbought signals. This suggests that the EUR/USD may continue its recovery toward resistance zones, providing opportunities for traders to align with the prevailing trend.

Ascending Channel Analysis

The ascending channel pattern remains a key framework for forecasting EUR/USD movement. The upper boundary of the channel around 1.1850 acts as a critical resistance zone, while the lower boundary near 1.1700 provides support for short-term pullbacks.

As long as the pair remains within this channel, the bullish bias is expected to persist. Technical traders often monitor price action around channel boundaries to identify potential reversal or breakout opportunities. A sustained break above the channel could accelerate the move toward multi-month highs, while a break below support may shift the bias toward consolidation or deeper correction.

Potential Price Scenarios

Bullish Scenario: An immediate rebound from the nine-day EMA (1.1713) could target the two-month high of 1.1804, with further extension toward 1.1850 at the upper channel boundary. An aggressive bullish breakout could explore 1.1918, the highest level since June 2021.

Bearish Scenario: A break below the nine-day EMA (1.1713) may push the pair toward the lower ascending channel boundary (1.1700), with further weakness targeting the 50-day EMA at 1.1644. Continued decline could test the three-week low of 1.1589.

Market Sentiment and Economic Drivers

The EUR/USD outlook is heavily influenced by macroeconomic data and central bank policies. Recent European economic indicators, including manufacturing PMI and retail sales, suggest a moderate recovery, supporting the bullish sentiment in the euro.

Meanwhile, U.S. economic reports such as non-farm payrolls and inflation data could impact the greenback, affecting short-term EUR/USD fluctuations. Traders should monitor market sentiment, as shifts in risk appetite or geopolitical events may accelerate volatility around key support and resistance levels.

Summary of Technical Outlook

Overall, the EUR/USD pair exhibits a bullish bias despite short-term consolidation. Support levels at the nine-day EMA (1.1713) and the lower channel boundary (1.1700) provide traders with potential entry points. Resistance levels at 1.1804, 1.1850, and 1.1918 offer targets for potential trend continuation.

The 14-day RSI confirms healthy bullish momentum without overbought conditions, while the short- and medium-term EMAs reinforce upward trend dynamics. Technical traders should monitor price action around key EMAs and ascending channel boundaries, as these levels will likely define the next directional move for the EUR/USD pair.

In conclusion, the EUR/USD remains technically positioned for further gains, provided it sustains above key support levels. Traders should watch the nine-day EMA at 1.1713 closely, as it may dictate whether the pair rebounds toward multi-month highs or experiences a short-term pullback toward the 50-day EMA.