The Pound Sterling (GBP) came under selling pressure in early European trading on Friday after data revealed that UK Retail Sales unexpectedly fell in November. This article from Unirock Gestion offers readers a clear and thorough explanation of the subject.

The decline underscores growing concerns about consumer spending in the United Kingdom (UK), while investors also monitor Bank of England (BoE) policy moves and the upcoming appointment of the next Federal Reserve (Fed) chairman.

UK Retail Sales Show Unexpected Decline

The Office for National Statistics (ONS) reported that UK Retail Sales, a critical gauge of consumer demand, unexpectedly declined by 0.1% month-on-month in November. Analysts had forecast a 0.4% expansion, making the drop a notable deviation from expectations.

However, the contraction was less severe than October’s 0.9% decline, which was downwardly revised from 1.1%. On a year-on-year (YoY) basis, consumer spending grew by 0.6%, slower than the anticipated 0.9%.

The data highlights mixed sector performance. Weakness was driven by lower sales in automotive fuel and non-retailing stores, while household goods, textile clothing, and footwear stores saw strong demand. Persistent declines in Retail Sales raise concerns about UK economic growth, especially given soft hiring trends and external economic risks.

Bank of England Cuts Interest Rates

The BoE moved forward with a 25 basis point (bps) rate cut, reducing the Bank Rate to 3.75% on Thursday. The vote was tight at 5-4, reflecting divergent opinions among policymakers.

Initially, the Pound Sterling reacted positively, appreciating in hopes of continued monetary support. However, the gains were short-lived as the BoE reaffirmed a “gradually downward” policy path. Officials signaled confidence that inflation will move closer to 2% by Q2 2026, keeping a cautious stance on aggressive easing.

Pound Sterling Drops Against US Dollar

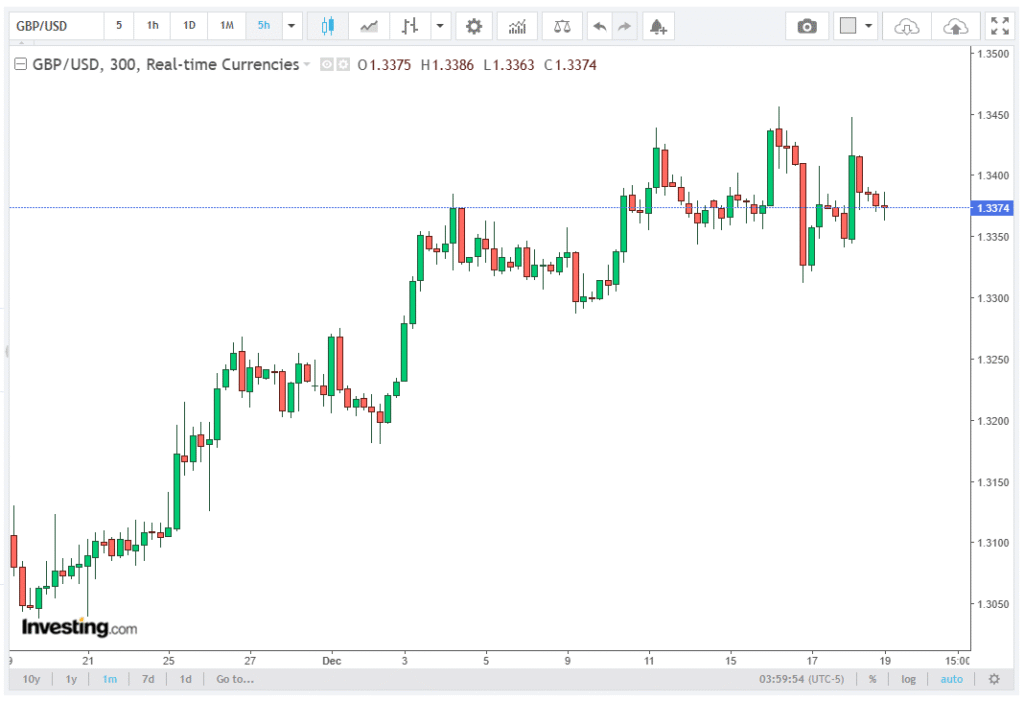

The GBP/USD pair slipped to around 1.3370 during the European session. Weak UK Retail Sales, coupled with a strong US Dollar (USD), pressured the British currency.

The US Dollar Index (DXY), which tracks the Greenback against six major currencies, rose 0.17% to 98.60, regaining strength after a brief dip following soft US Consumer Price Index (CPI) data. The November CPI report showed headline inflation decelerating to 2.7% YoY and core inflation to 2.6% YoY, slightly below expectations.

Despite the softer inflation figures, the USD recovered, as analysts cited distortions caused by the US government shutdown. According to the CME FedWatch tool, the probability of a 25 bps Fed rate cut in January rose slightly to 25.5%, from 24.4% earlier in the week.

Fed Chair Succession Could Impact Market Sentiment

Investors remain cautious ahead of the Fed chair appointment, expected by early 2026. Leading contenders include White House Economic Adviser Kevin Hassett, former Fed Chairman Kevin Warsh, and current Fed Governors Christopher Waller and Michelle Bowman.

Market expectations regarding the next Fed policy stance could significantly influence USD strength and, indirectly, GBP/USD volatility.

Market Implications of Weak UK Retail Sales on GBP Outlook

The unexpected decline in UK Retail Sales could have significant market implications for the Pound Sterling. Persistent weakness in consumer spending may heighten concerns about slower UK economic growth, potentially influencing BoE monetary policy decisions in upcoming meetings.

Traders are likely to reassess GBP positioning against the US Dollar and Euro, considering the combination of soft domestic demand, global interest rate expectations, and upcoming Fed policy announcements. Weak Retail Sales data may also amplify volatility in forex markets, making GBP/USD a key pair for short-term trading strategies.

Technical Analysis: GBP/USD Holds Key Support

From a technical perspective, the GBP/USD pair trades near 1.3377, holding above the 20-day Exponential Moving Average (EMA). The EMA slope remains upward, suggesting that buyers maintain control, despite short-term corrections.

The 14-day Relative Strength Index (RSI) stands at 59, indicating neutral to bullish momentum. The pair’s recent dips have been contained, validating the pattern of higher lows. Key technical levels to watch include support at the 20-day EMA near 1.3320, with stronger support at the December 3 low of 1.3203, while resistance lies at the recent two-month high of 1.3455, where a breakout could signal fresh cycle highs.

Conclusion

The Pound Sterling faces a challenging environment, pressured by weaker-than-expected UK Retail Sales, cautious BoE guidance, and an uncertain US monetary outlook. While technical support at the 20-day EMA provides a buffer, market participants remain attentive to global central bank signals, inflation data, and macro developments.

With the next Fed chair announcement looming and the BoE maintaining a gradual policy stance, volatility in GBP/USD is likely to persist in the near term. Investors will closely watch how UK consumer demand, inflation trends, and central bank policies intersect to shape the British Pound’s trajectory.