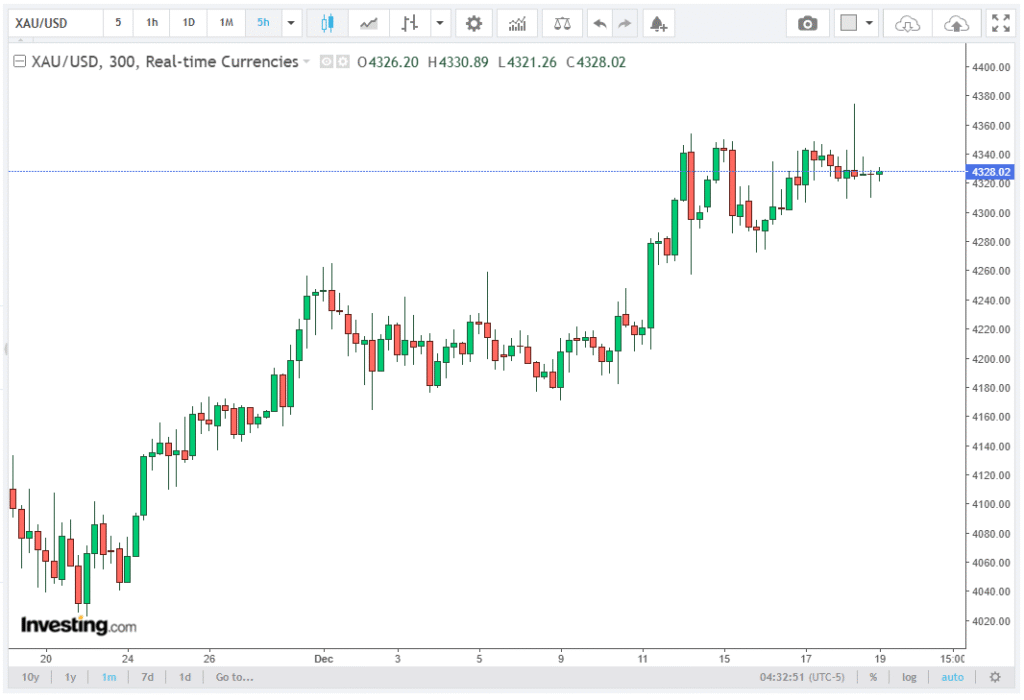

Gold (XAU/USD) edged lower in early European trading on Friday, losing momentum amid profit-taking and weak long liquidation from shorter-term futures traders.

The metal slipped below $4,350, signaling a temporary pause in bullish momentum despite ongoing Fed rate cut expectations and supportive macroeconomic factors. Unirock Gestion brokers outline the essential details of the topic with precision and insight.

Gold Price Declines Amid Profit-Taking

The early European session saw Gold prices retreat slightly, driven primarily by profit-taking after recent gains. Short-term traders liquidating positions exerted downward pressure, although the broader bullish bias remains intact. The recent price action indicates that while near-term corrections are possible, underlying support factors could limit the downside for the yellow metal.

Gold’s non-yielding nature means its attractiveness often depends on opportunity costs, which are influenced by interest rate expectations. Following unexpectedly cooling US inflation data, traders are now assessing the potential for further US Federal Reserve (Fed) rate cuts, which could reinforce the appeal of Gold as a safe-haven asset.

US Inflation Data Fuels Fed Rate Cut Speculation

On Thursday, the US Bureau of Labor Statistics (BLS) released CPI inflation data for November, showing headline inflation at 2.7%, below the market consensus of 3.1%. The core CPI, which excludes volatile food and energy prices, rose by 2.6%, also missing the analyst expectations of a 3.0% increase.

This unexpected cooling in US consumer price inflation has raised expectations for further monetary easing in 2026. According to Sal Guatieri, senior economist at BMO Capital Markets, a surprisingly sharp decline in U.S. consumer price inflation could pave the way for further Federal Reserve easing.

Despite these signals, financial markets currently price in only a 26.6% probability of a rate cut at the Fed’s next meeting in January, according to the CME FedWatch tool. The Fed had previously cut rates by a quarter-point at its last three meetings, reflecting a cautious approach toward monetary stimulus.

Geopolitical Tensions and Safe-Haven Demand

Another factor supporting Gold is geopolitical uncertainty. The New York Times reported that Venezuela’s government ordered its navy to escort ships carrying petroleum products, escalating tensions with the US. Such developments often boost safe-haven demand for Gold, as investors seek risk-off assets during periods of uncertainty.

In addition, strong industrial and investment demand remains a positive driver for Gold prices, mitigating some of the near-term selling pressure. While profit-taking is weighing on the market, these underlying support factors could stabilize XAU/USD and prevent a steep decline.

University of Michigan Consumer Sentiment Index in Focus

Traders are also monitoring domestic economic sentiment indicators. Later on Friday, the University of Michigan Consumer Sentiment Index for December will be released, offering fresh insights into US household confidence. This index is particularly important as the longest US federal government shutdown in history impacted data collection for the recent inflation report, leaving gaps in market expectations.

The Consumer Sentiment Index will provide a clearer picture of spending patterns and inflation expectations, both of which could influence the Fed’s policy outlook and, in turn, Gold price dynamics. Traders should monitor shifts in consumer confidence, as a stronger-than-expected reading may signal higher consumer spending and potential interest rate adjustments, while a weaker reading could indicate slower economic growth.

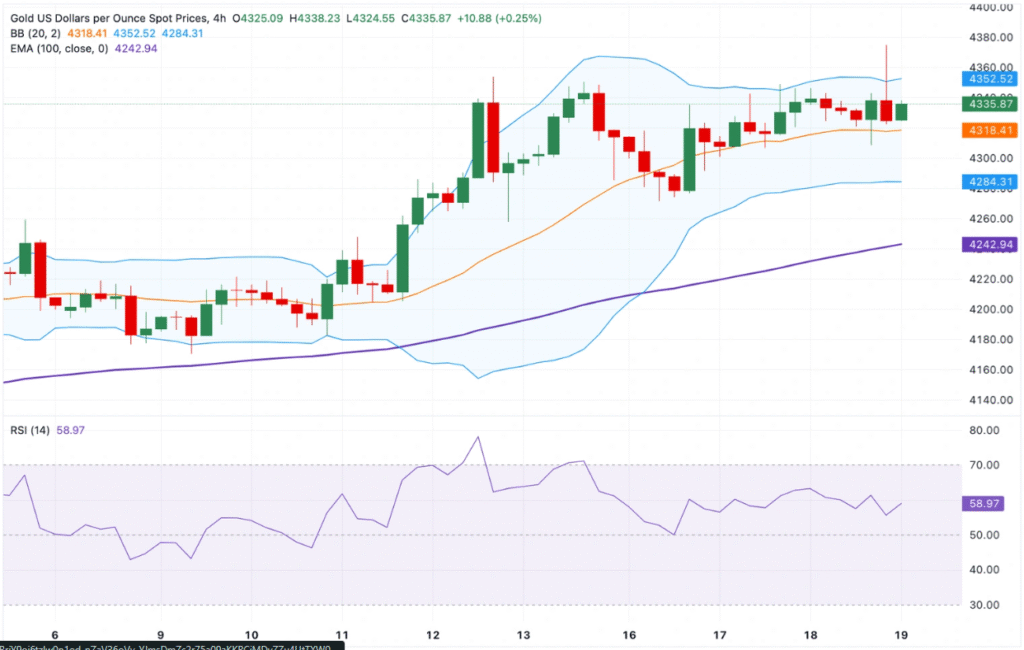

Technical Outlook: Gold Retains Bullish Bias

Despite the decline, technical indicators suggest Gold remains in a bullish trend. The four-hour chart shows higher highs and higher lows, with the price holding above the key 100-period Exponential Moving Average (EMA). The Bollinger Bands are widening, and the 14-day Relative Strength Index (RSI) is above the midline, indicating that the path of least resistance remains to the upside.

Key resistance levels for XAU/USD include the upper Bollinger Band at $4,352. A decisive break above this level could signal renewed buyer interest, potentially pushing prices toward the all-time high of $4,381 and the psychological $4,400 mark.

On the downside, if bearish candlesticks develop and prices stay below the December 17 low of $4,300, sellers could target the December 16 low of $4,271. Further support lies at the 100-day EMA near $4,242, which could act as a key contestation level for market participants.

Conclusion

Gold faces short-term profit-taking pressures amid Fed rate cut speculation and cooling US inflation data. While the early European session shows a modest decline below $4,350, technical indicators and underlying safe-haven demand suggest that the bullish outlook for the yellow metal remains intact.

Traders will remain focused on the University of Michigan Consumer Sentiment Index for December and geopolitical developments in Venezuela, which could further influence Gold price dynamics. With interest rate expectations and geopolitical tensions providing support, XAU/USD may continue its march toward record highs, barring a significant shift in market sentiment.