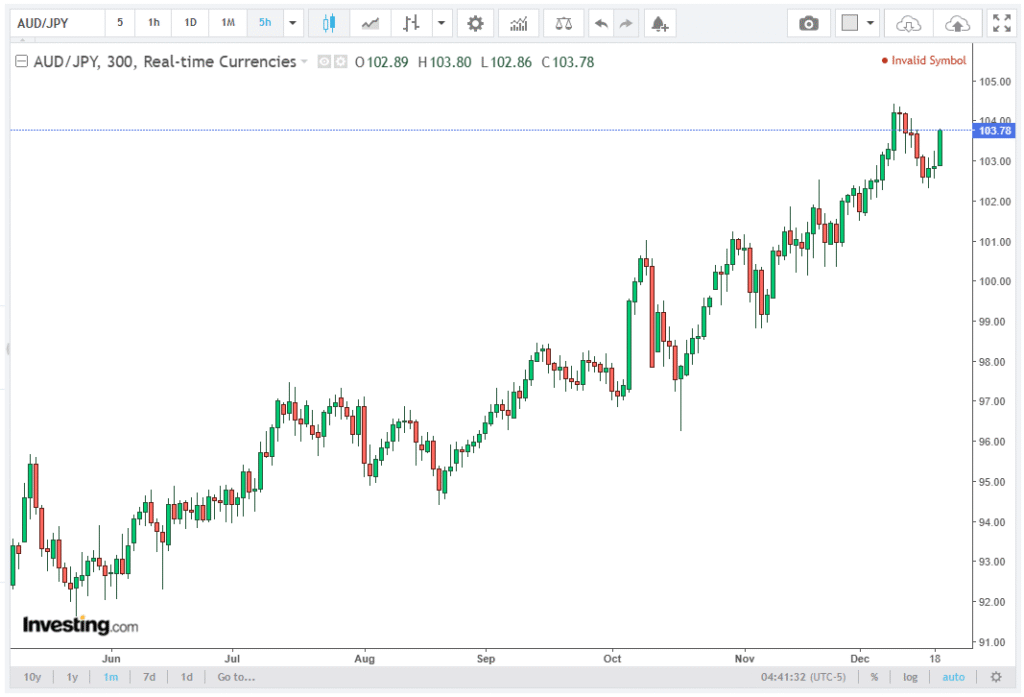

The AUD/JPY currency pair extended its winning streak for the third consecutive session, trading around 103.00 during Asian market hours on Friday. This article by Unirock Gestion offers expert commentary and a complete breakdown of the subject.

The Australian Dollar (AUD) advanced against the Japanese Yen (JPY) as the Bank of Japan (BoJ) took a decisive step in monetary policy, raising its short-term interest rate by 25 basis points (bps) to 0.75%, up from 0.50%, in line with market expectations. This rate hike marks the highest level in three decades for the Japanese central bank, signaling a shift toward policy normalization.

BoJ Decision: Unanimous Rate Hike Signals Policy Confidence

The Bank of Japan’s policy statement revealed that the rate decision was unanimous, reflecting a cohesive stance among board members. Despite the increase, the BoJ emphasized that real interest rates are expected to remain significantly low, maintaining a supportive environment for economic activity.

The statement also highlighted that the central bank will continue adjusting the policy rate if economic indicators such as GDP growth and price inflation evolve in line with forecasts. This approach aligns with the BoJ’s broader objective of achieving a stable 2% inflation target, a benchmark for sustainable economic growth and monetary stability.

The BoJ’s communication strategy underscores its forward guidance, indicating that further rate hikes are likely if inflation pressures persist. For traders, this provides a clear framework for JPY positioning, especially against higher-yielding currencies such as the AUD.

AUD Strength Supported by Inflation Data

The Australian Dollar has found additional upside momentum as investors digest the latest consumer inflation expectations. Data released for December showed that expectations rose to 4.7%, up from November’s three-month low of 4.5%, reinforcing the Reserve Bank of Australia’s (RBA) hawkish bias.

Higher inflation expectations support the RBA’s potential for further monetary tightening, making the AUD an attractive carry-trade option against the low-yielding JPY. This dynamic has contributed to the AUD/JPY cross’s resilience, helping it sustain gains around the 103.00 level.

Private Sector Credit Growth Boosts AUD Outlook

Adding to the positive sentiment, Australia’s Private Sector Credit data showed a 0.6% month-over-month (MoM) increase in November, surpassing expectations of 0.2%, although slightly slower than October’s 0.7% growth.

On an annual basis, credit expansion accelerated to 7.4% year-over-year (YoY) from 7.3%, marking the fastest pace since January 2023. The data indicates robust lending activity in Australia, supporting household and business spending, a key factor for sustainable economic growth and inflationary pressures.

For foreign exchange traders, the combination of strong domestic credit growth and inflationary trends strengthens the AUD’s appeal, particularly when contrasted with Japan’s historically low-interest-rate environment.

Market Implications

The AUD/JPY pair is benefiting from a classic risk-on setup, where the higher-yielding AUD gains against the low-yielding JPY, a currency traditionally viewed as a safe-haven. Traders should note several key technical and fundamental drivers:

The BoJ policy path, with continued rate hikes and forward guidance, may keep the JPY under pressure, favoring AUD/JPY upside. Meanwhile, RBA hawkishness, supported by rising inflation expectations and solid credit growth, may prompt further monetary tightening, enhancing AUD strength.

Lastly, risk sentiment remains crucial, as the JPY tends to weaken in risk-on environments, while the AUD benefits from investor optimism.

AUD/JPY Outlook: BoJ Rate Hike and RBA Hawkishness Drive Momentum

The AUD/JPY outlook remains bullish as the Bank of Japan’s 25-basis-point rate hike fuels yen weakness, while the Australian Dollar benefits from robust inflation expectations and private sector credit growth.

Investors are closely monitoring the RBA’s hawkish stance, which suggests the possibility of further monetary tightening, supporting continued upside potential for AUD/JPY. With the pair trading around 103.00, market participants are positioning for short-term gains, driven by the divergence in monetary policy between Japan and Australia and persistent risk-on sentiment in global markets.

Looking Ahead

Investors will continue to monitor BoJ commentary closely, paying attention to any nuances in language that may indicate the pace and magnitude of future rate adjustments. Meanwhile, the RBA’s next policy meeting and domestic inflation data will remain crucial for AUD positioning.

Given the current market setup, AUD/JPY is likely to remain sensitive to macroeconomic releases, central bank statements, and global risk trends. The interplay between a tightening RBA and a gradually normalizing BoJ creates a structural advantage for the AUD against the JPY, at least in the near-term horizon.

Conclusion

The AUD/JPY currency pair has consolidated gains around 103.00 following the BoJ’s expected 25-bps rate hike, reflecting both Japanese monetary policy shifts and Australian domestic economic strength.

Key drivers include BoJ policy guidance, RBA hawkishness, rising consumer inflation expectations, and private sector credit growth. Traders should continue to watch central bank communications, inflation metrics, and risk sentiment as the pair navigates the current trading environment.