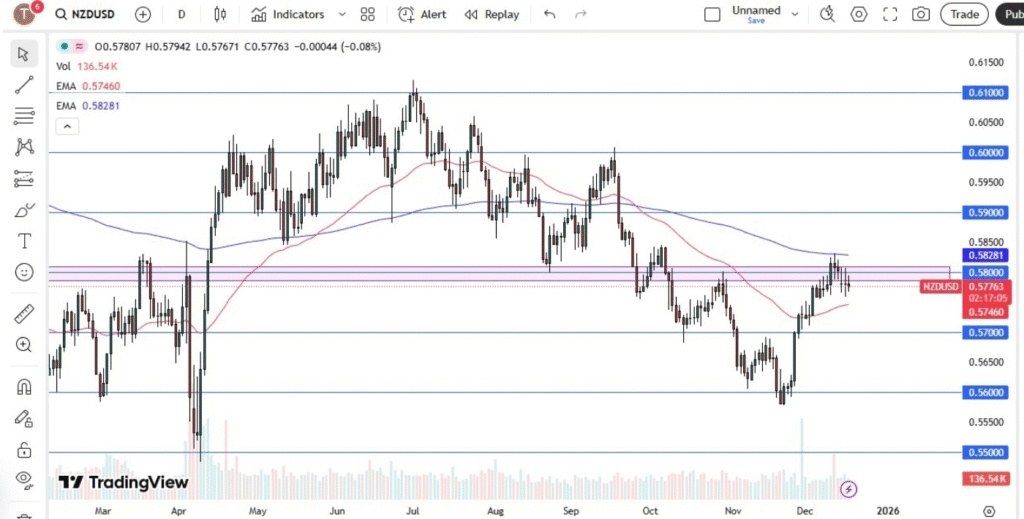

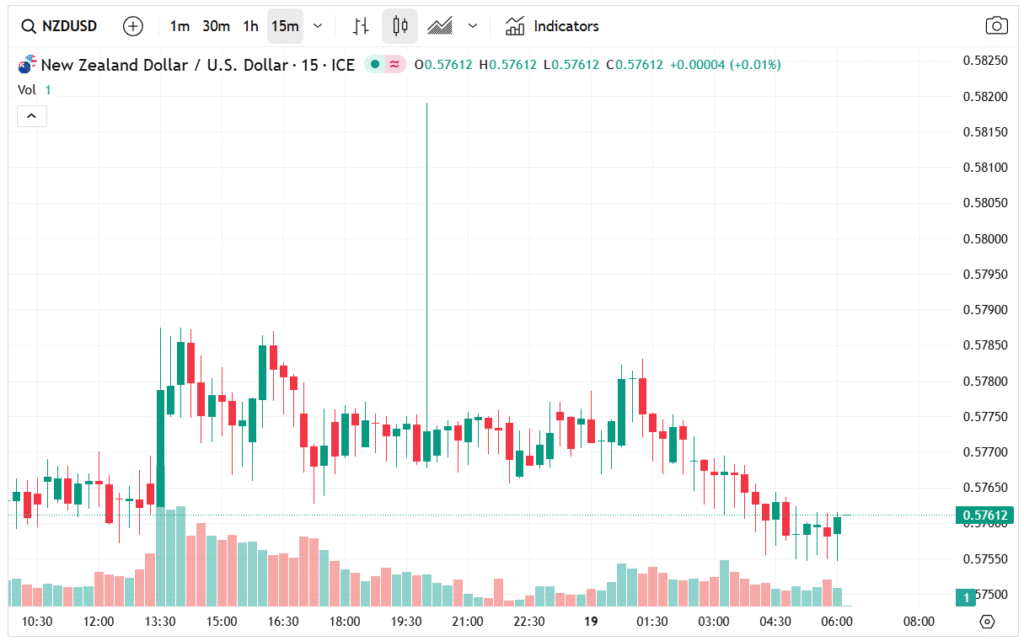

The New Zealand dollar (NZD) attempted an early rally during Wednesday’s trading session, but bullish momentum quickly faded, leaving the NZD/USD pair hesitating near the 0.58 psychological level.

The brokers at Aurudium provide a comprehensive breakdown of this topic in this article. This area has once again proven to be a significant technical barrier, reinforced by the presence of the 200-day Exponential Moving Average (EMA).

The repeated reaction around 0.58 highlights how important this zone is for long-term market participants. The 200-day EMA is widely followed by institutional traders, trend-followers, and algorithmic systems, making it a natural area for profit-taking, position adjustments, and increased volatility.

As a result, the market is currently experiencing a period of price compression, characterized by choppy, indecisive, and noisy trading behavior.

Key Technical Levels: 0.58 as a Decision Zone

From a technical analysis standpoint, the 0.58 level has acted as both support and resistance multiple times in the past. This historical relevance adds further technical weight to the area, increasing the likelihood of short-term consolidation rather than a clean directional breakout.

At present, the NZD/USD pair appears to be struggling with directional clarity. Bulls have been unable to generate sustained upside momentum, while bears have yet to force a decisive breakdown. This type of price action often precedes a larger move, but timing remains uncertain.

Key Moving Averages and Market Structure

200-Day EMA: Long-Term Trend Pressure

The 200-day EMA continues to cap price action, reinforcing the idea that the long-term trend remains under pressure. As long as the pair trades below this indicator, upside potential may remain limited, and rallies could continue to attract selling interest.

50-Day EMA and the Ongoing Death Cross

Adding further complexity is the 50-day EMA, which is currently positioned below the price but remains part of a broader bearish structure. Since late September, the market has been operating under a death cross, where the 50-day EMA remains below the 200-day EMA, a classic signal of long-term bearish momentum.

However, it is worth noting that the 50-day EMA has begun to flatten and is attempting to turn higher. While this does not negate the existing bearish signal, it does suggest that downside momentum may be slowing, potentially leading to range-bound conditions in the near term.

Macro Influence: US Dollar Strength and Risk Sentiment

From a macro perspective, the US dollar (USD) has shown renewed resilience over the last several sessions, strengthening against multiple major currencies. This broader USD recovery reflects ongoing concerns around global growth, interest rate differentials, and risk appetite.

Wednesday’s session was particularly notable, as the dollar experienced pushback across several majors, reinforcing the idea that risk-sensitive currencies, including the New Zealand dollar, remain vulnerable. The Kiwi is often considered a high-beta, risk-oriented currency, meaning it tends to underperform during periods of risk aversion.

Given the current uncertain global outlook, traders appear increasingly reluctant to increase exposure to currencies that sit further out on the risk spectrum, as broader risk-off sentiment continues to dominate market positioning.

This cautious approach is placing additional and persistent downward pressure on NZD/USD, limiting upside attempts and reinforcing near-term bearish momentum.

Bearish Scenario: Key Downside Targets

If the NZD/USD pair fails to hold above the 50-day EMA, the technical picture could deteriorate further. A decisive break below this moving average would likely expose the 0.57 support level as the next downside target.

Below 0.57, market participants may begin to focus on the 0.56 region, which represents a deeper support zone and could attract buyers looking for value. However, reaching this level would confirm that bearish momentum has regained control, reinforcing the broader downtrend narrative.

Bullish Scenario: What Would Change the Outlook?

Despite the current uncertainty, a bullish reversal cannot be completely ruled out. If price were to break above 0.5850 with strong volume and follow-through, it could signal renewed upside conviction.

In such a scenario, the market may begin to target the 0.60 level, a major psychological round number that often attracts significant market attention. However, any move toward 0.60 would likely require a combination of improving global risk sentiment and continued US dollar weakness, conditions that are not yet firmly in place.

Conclusion: A Market Stuck in Transition

At this stage, NZD/USD appears to be a conflicted and overextended market, caught between long-term bearish pressures and short-term stabilization attempts. The combination of the 200-day EMA, the death cross, and weakening risk appetite suggests that caution remains warranted.

For now, the pair looks like a technical mess, prone to false breakouts and short-lived moves. Until price decisively breaks above resistance or below key support, traders may continue to see sideways consolidation with a slight bearish bias.