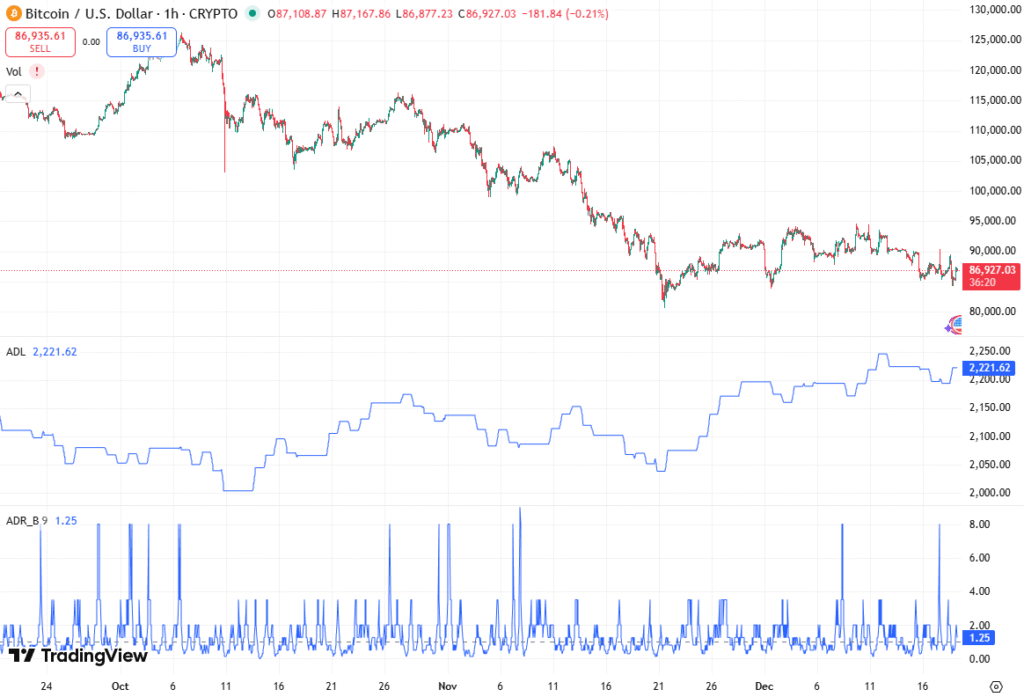

The BTC/USD pair continues to attract significant attention as Bitcoin price action enters a critical phase of consolidation. After several weeks of volatile movement, the market now appears to be paused within a clearly defined range, suggesting that both bulls and bears are reassessing direction. The current environment favors range-based trading strategies rather than aggressive trend-following approaches.

Aurudium experts deliver a detailed and insightful analysis of the subject in their latest piece. Recent price behavior indicates that Bitcoin is neither decisively bullish nor convincingly bearish, reinforcing the importance of key technical levels at this stage.

BTC/USD Technical Analysis

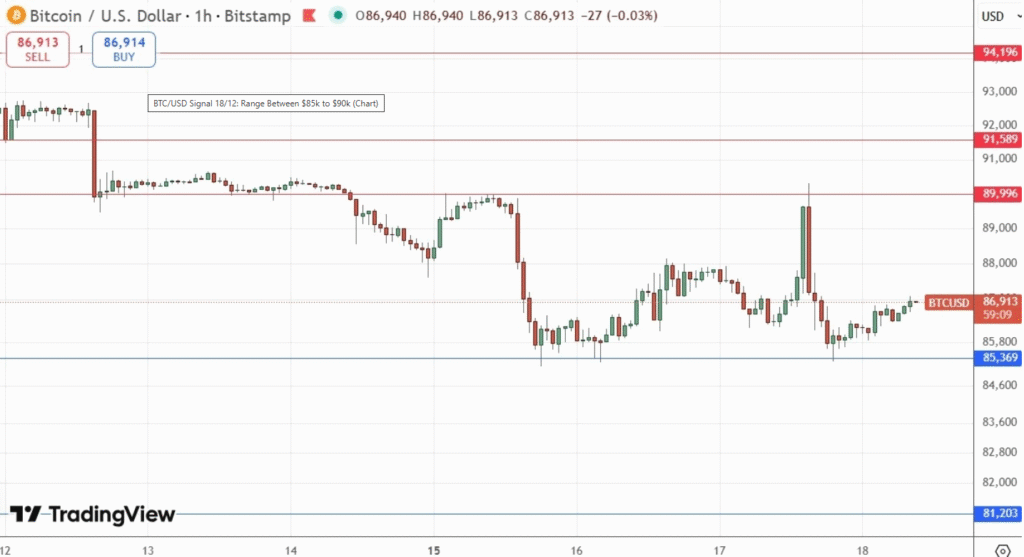

In the previous BTC/USD forecast on Monday, the outlook focused on a potentially decisive moment for Bitcoin. At that time, the price structure could be interpreted in two different ways: a bearish wedge formation, which typically precedes a downside breakout, or a bullish “square root” pattern, characterized by a higher low followed by two equal higher lows. This dual interpretation clearly highlighted the uncertainty present in the market.

A downside trigger was identified below $87,884, which was expected to open the door to further selling pressure. That level was breached, validating part of the bearish scenario. However, follow-through momentum was limited, suggesting that sellers lacked strong conviction.

Key Levels: $85,000 and $90,000

The most important development since the last forecast is the shift in market structure. Instead of a wedge or continuation pattern, the BTC/USD pair is now trading within a flat, square consolidation zone.

The current trading range shows upper resistance at $90,000 and lower support at $85,000, reflecting a near-perfect balance between buying and selling pressure and signaling a neutral market bias. A confirmed breakout beyond either boundary is likely to produce a meaningful continuation move, potentially defining Bitcoin’s next medium-term trend.

Bullish Scenario: Break Above $90,000

A decisive bullish breakout above $90,000 would represent a clear victory for buyers. Such a move would invalidate the current consolidation and suggest renewed upward momentum.

The key implications of a bullish breakout include a clear shift in market sentiment toward optimism, an increased probability of trend continuation, and the attraction of momentum traders and breakout buyers. If this level is breached with strong volume and follow-through, Bitcoin could quickly move into price discovery mode, with higher resistance zones coming into focus.

Bearish Scenario: Breakdown Below $85,000

On the downside, a bearish breakdown below $85,000 would be technically significant. This level represents the lower boundary of consolidation, and a failure here would indicate that selling pressure has regained control.

However, downside risk may be temporarily limited by a very important support level near $81,000. Why $81,000 matters is that it acts as a major historical support zone, is likely to attract dip buyers and long-term participants, and represents a potential inflection point for market direction.

If price action reaches this level, it is expected to become a highly contested area, with the potential for either a strong rebound or a deeper correction if support fails.

Market Structure and Sentiment

One of the most notable changes in the current setup is the symmetry of the consolidation pattern. Unlike trending environments where momentum clearly favors one side, the present structure is flat, compressed, and indecisive.

This suggests equal commitment from buyers and sellers, a reduced effectiveness of trend-based strategies, and an increased relevance of support and resistance trading. Until a breakout occurs, short-term traders may find opportunities within the range, while longer-term traders may prefer to remain patient and wait for confirmation.

Fundamental Outlook: Bitcoin and the US Dollar

There is no high-impact Bitcoin-specific news scheduled for today, meaning that technical factors are likely to remain the dominant driver of price action.

However, attention should be paid to the US Dollar, as several important economic releases are due. Key Economic Events include US CPI (Inflation Data) and US Unemployment Claims. These releases can influence USD volatility, which often has an indirect impact on BTC/USD pricing, especially during periods of consolidation.

Higher-than-expected inflation or labor market surprises could temporarily increase market volatility, potentially acting as a catalyst for a breakout.

Final Outlook

The BTC/USD Forex signal remains range-bound between $85,000 and $90,000, with no clear directional bias at present. The market is in a waiting phase, and patience is required.

Key takeaways include that $90,000 is the critical bullish breakout level, $85,000 is the key bearish breakdown point, and $81,000 remains a pivotal long-term support zone.

Consolidation favors range trading over trend chasing, and until a confirmed breakout occurs, Bitcoin is likely to continue oscillating within this defined range, keeping traders focused on risk management, confirmation, and discipline rather than prediction.