The AUD/USD currency pair has attracted attention this week as traders navigate a combination of risk sentiment shifts, macroeconomic data, and central bank expectations. Despite a recent pullback, a closer analysis suggests a bullish outlook for the pair, driven largely by rising Australian inflation expectations and potential monetary policy divergence between the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed).

In this comprehensive article, Aurudium brokers thoroughly examine the key aspects of the topic with exceptional clarity and insight, providing readers with a deeper understanding and valuable perspectives.

AUD/USD Pullback Amid Risk-Off Sentiment

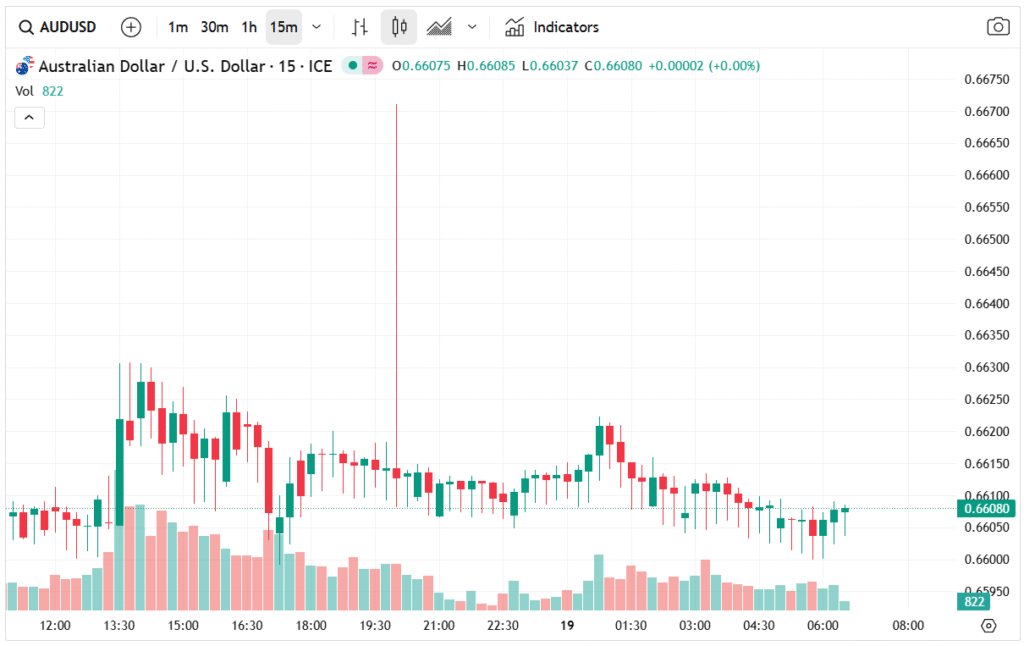

The AUD/USD pair continued its downward trend, retreating to the psychological level of 0.6600, after reaching a year-to-date high of 0.6705. This movement coincides with renewed risk-off sentiment in global markets, primarily triggered by concerns surrounding the artificial intelligence (AI) sector.

On Wednesday, the Nasdaq 100 Index, heavily weighted toward technology stocks, fell by over 1%, continuing a decline that began last week following quarterly results from Broadcom and Oracle. The index closed at $24,647, down 1.93%, while the Dow Jones Industrial Average and S&P 500 experienced similar losses.

Market observers note that profit-taking is occurring after strong year-to-date gains in US equities. In such scenarios, the US dollar (USD) often strengthens as it is perceived as a safe-haven currency, leading to temporary pressure on the AUD/USD pair.

US Macro Data and Inflation Expectations

Looking ahead, traders are closely monitoring US macroeconomic releases, which could influence the next Federal Reserve actions. Among the most anticipated reports is the upcoming US inflation report, expected to show that both headline and core inflation remain above 3% in November.

However, market participants remain optimistic that tariff impacts on inflation may gradually ease, while falling energy prices could provide a near-term relief to overall inflationary pressures. These factors are critical, as they determine the Fed’s monetary stance, which directly impacts currency pairs like AUD/USD.

Australian Inflation Expectations Drive Bullish Sentiment

Despite the recent AUD/USD pullback, sentiment toward the Australian dollar (AUD) remains largely bullish. A key catalyst is the latest consumer inflation expectations report, which revealed that Australians anticipate inflation to reach 4.7% this month, significantly above the RBA’s target range of 2–3%.

This sharp rise in inflation expectations increases the probability of an interest rate hike by the RBA, which historically supports the AUD against the USD. In essence, the market may soon price in a more aggressive RBA stance, especially if US inflation moderates, creating a divergence between the RBA and Fed policies that favors AUD strength.

AUD/USD Technical Analysis

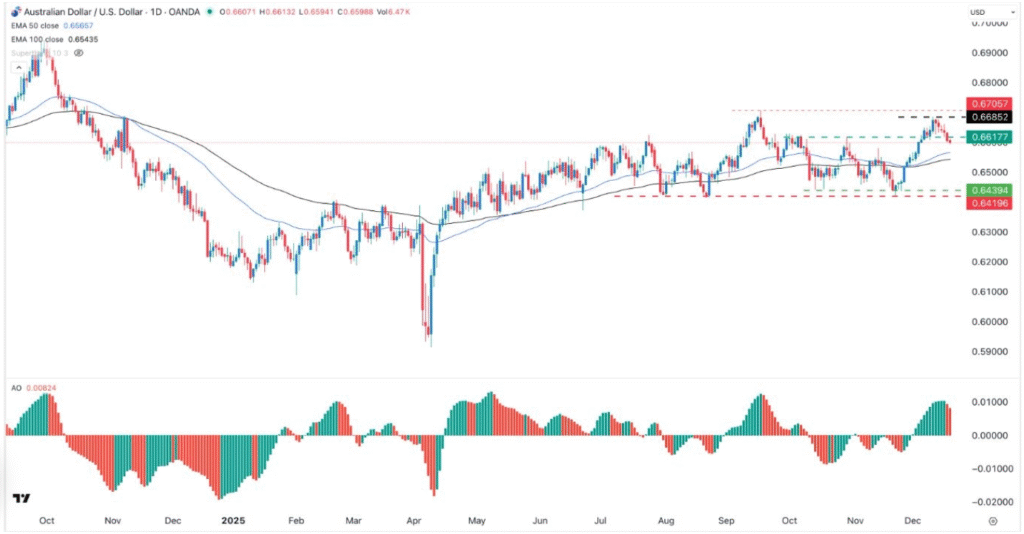

From a technical perspective, the AUD/USD daily chart shows a retracement from a monthly high of 0.6685 to the current 0.6600. The pair has breached the support level at 0.6617, its highest point recorded on October 29, signaling a short-term pullback within an overall uptrend.

Key technical indicators provide a mixed yet positive outlook. The 50-day and 100-day moving averages remain nearby, offering dynamic support, while the Awesome Oscillator is holding above the zero line, suggesting that bullish momentum is intact.

These signals indicate that despite recent market volatility, the AUD/USD pair could resume its uptrend, particularly if RBA rate hike expectations continue to rise while US inflation data remains within forecast.

Potential Resistance and Target Levels

Technical levels suggest that the AUD/USD pair has the potential to test the resistance zone at 0.6700, near the year-to-date high. This scenario assumes a continuation of the risk-on sentiment in global markets, a moderating US dollar, and sustained bullish fundamentals from Australia.

Investors should also consider short-term volatility risks driven by AI sector jitters and profit-taking in US equities, which can temporarily suppress AUD gains. However, the combination of strong inflation expectations in Australia and a potential policy divergence with the Fed makes a compelling case for medium-term bullish positioning.

Conclusion: Bullish AUD/USD Outlook

In summary, while the AUD/USD pair has experienced a recent decline to 0.6600, the underlying fundamentals remain supportive of a bullish view. Rising Australian inflation expectations, combined with potential RBA rate hikes, create favorable conditions for AUD strength.

Traders should monitor US inflation reports, global risk sentiment, and technical support/resistance levels. A move toward 0.6700 resistance appears likely if the RBA-Fed divergence persists and risk-on sentiment returns to the markets.

For technical traders, maintaining positions above the 50-day and 100-day moving averages and monitoring the Awesome Oscillator can help confirm the continuation of the uptrend. Ultimately, the AUD/USD pair offers a promising bullish setup in the context of rising Australian inflation and central bank divergence.