The GBP/USD currency pair has been showing mixed movements recently, reflecting market reactions to the latest UK economic data and anticipation ahead of major central bank decisions.

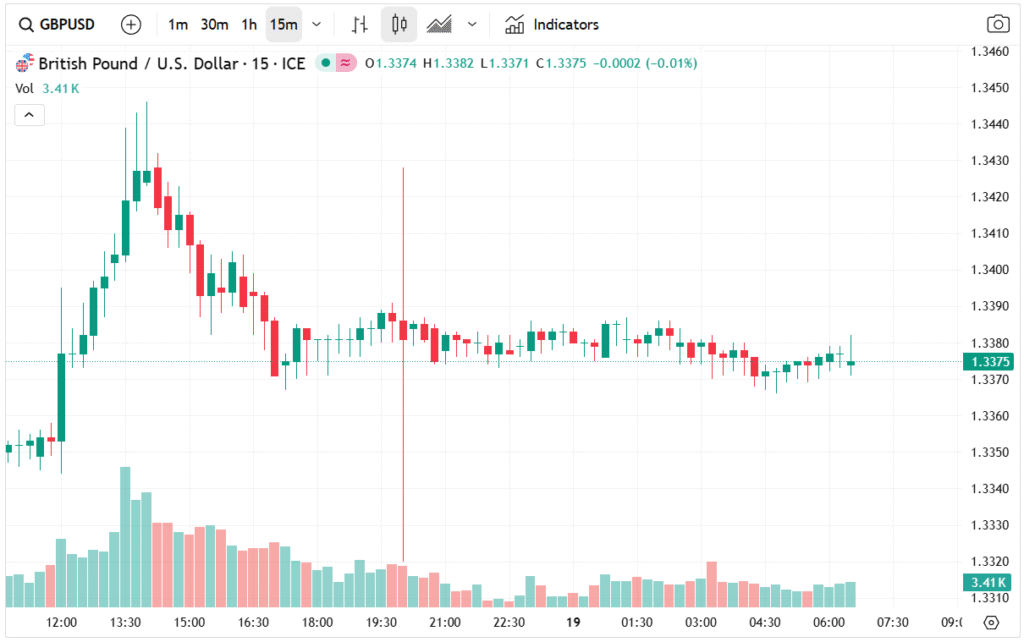

As of this writing, the pair is trading around 1.3370, slightly lower than this week’s highs, as traders prepare for the Bank of England (BoE) interest rate decision and upcoming US inflation data. The Aurudium team presents a structured and informative breakdown of this matter.

UK Economic Data Weighs on GBP

The Office of National Statistics (ONS) recently published the latest UK inflation and jobs data, sending initial ripples through the forex market. On Tuesday, the report indicated a slight increase in unemployment alongside a drop in average wages for October. Additionally, the economy reportedly lost thousands of jobs, signaling potential weakness in the UK labor market.

On Wednesday, another report highlighted a sharp decline in UK inflation. Both headline and core inflation dropped to 3.2% year-on-year, while the retail price index (RPI) fell to 3.8%. The combination of slowing inflation and weaker employment figures strengthens the market expectation that the BoE may implement a rate cut during its current two-day monetary policy meeting.

BoE Decision: Rates Poised for a Cut

Economists widely anticipate that the BoE will lower interest rates from the current 4% to 0.5%. This monetary easing is intended to stimulate economic growth amid signs of slowing momentum. The recent UK autumn budget, which introduced significant tax increases under Chancellor Rachel Reeves, could exacerbate this slowdown, making the potential rate cut even more critical.

A reduction in the policy rate would typically weaken the GBP, but in the current market environment, the GBP/USD pair is showing signs of resilience. Traders are closely monitoring the BoE’s forward guidance for additional hints about the central bank’s strategy to support growth while controlling inflation pressures.

US Inflation Report: A Key Catalyst

Alongside UK data, the upcoming US inflation report is a major market catalyst. Economists polled by Reuters forecast a slight increase in headline CPI, rising from 3.0% in October to 3.1% in November, while core CPI is expected to drop to 3.0%.

Inflation dynamics are being closely watched as energy prices have started to cool, with Brent and West Texas Intermediate (WTI) crude oil dipping below $60 per barrel this week. Market sentiment around energy markets also shifted slightly due to geopolitical developments, including renewed pressure from Donald Trump on Venezuela.

The combined influence of BoE rate decisions and US inflation data is likely to generate high volatility in the GBP/USD market, offering trading opportunities for both short-term speculators and longer-term trend followers.

GBP/USD Technical Analysis: Bullish Signals

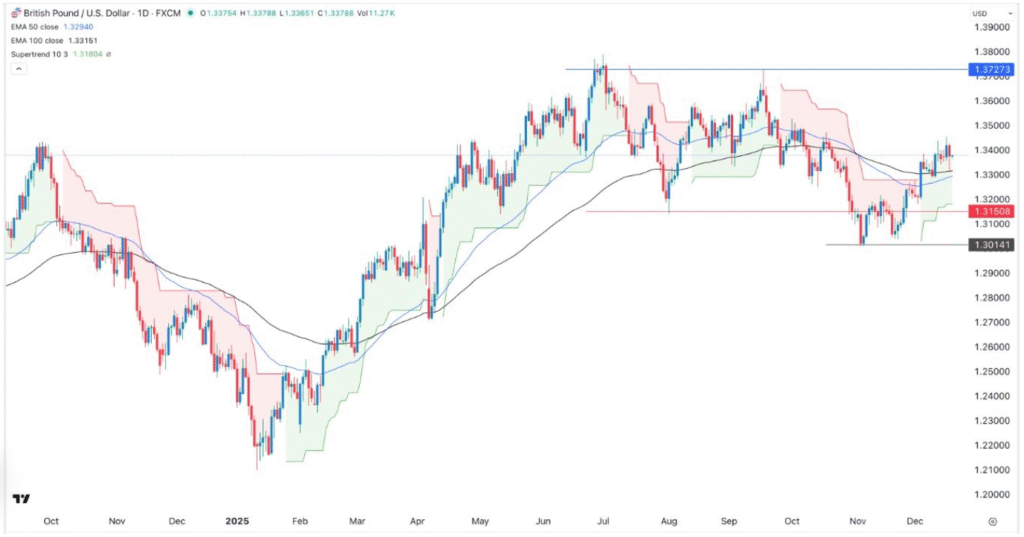

From a technical perspective, the daily chart of GBP/USD shows that the pair is trading at 1.3375, slightly below this week’s high of 1.3450–1.4450 range. This mild retracement is likely a prelude to renewed bullish momentum, as traders position themselves ahead of the BoE decision.

Several technical indicators are signaling a bullish trend, as the pair remains above the Supertrend indicator, suggesting continued upward momentum. The 50-day and 100-day Exponential Moving Averages (EMA) are on the verge of a bullish crossover, which is typically a strong signal for further price appreciation.

Immediate resistance is observed around 1.3500, marking the next key technical barrier for bulls, while on the downside, the psychological support at 1.3300 is crucial. A sustained break below this level could invalidate the bullish outlook and trigger a potential short-term correction.

GBP/USD Outlook: Key Levels and Trading Opportunities

Traders looking at the GBP/USD pair should focus on key technical levels to optimize their strategies. The immediate resistance at 1.3500 represents a potential profit-taking zone for short-term bulls, while the support level at 1.3300 could act as a strong entry point for buyers if the pair experiences a minor pullback.

Market Outlook: Bullish Bias

Overall, the GBP/USD forex signal suggests a bullish bias ahead of the BoE meeting. Despite recent UK labor market weakness and falling inflation, the technical setup supports a continuation of the upward trend. Traders are advised to monitor key resistance at 1.3500 and maintain a watch on support at 1.3300 to manage risk effectively.

The interaction between UK monetary policy and US inflation dynamics will likely remain the dominant driver for the pair. Traders and investors should also consider geopolitical factors, energy price movements, and economic forecasts, which can significantly impact GBP/USD volatility in the near term.

Conclusion

In conclusion, the GBP/USD pair appears poised for upside potential, supported by technical bullish signals and market expectations for a BoE rate cut. Keeping a close eye on US CPI data and key support and resistance levels will be critical for navigating this dynamic forex environment.