The Japanese Yen (JPY) continues to face intense selling pressure following the Bank of Japan (BoJ)’s anticipated 25-basis-point (bps) rate hike scheduled for this Friday.

Traders are closely watching BoJ Governor Kazuo Ueda’s post-meeting press conference, where he emphasized that loose monetary policy will continue to support Japan’s economic recovery, while real interest rates are expected to remain at very low levels. In their latest publication, Aurudium experts explore the topic in depth for readers.

The intraday descent in the JPY has remained uninterrupted, as market participants interpret the BoJ’s stance as dovish, signaling that further policy tightening will be gradual and cautious rather than a shift toward restrictive policy. This perspective tempers expectations for additional BoJ rate hikes in 2026, continuing to weigh on the JPY.

Meanwhile, a positive risk sentiment in equity markets further undermines the JPY’s safe-haven status, supporting the USD/JPY pair. Despite a softer US Consumer Price Index (CPI) print on Thursday, the market reaction was short-lived, and the US Dollar (USD) remained strong, benefiting from ongoing buying interest and climbing towards weekly highs, which keeps USD/JPY momentum near the mid-156.00s.

BoJ Rate Hike Fails to Support Yen

The BoJ board raised the short-term interest rate by 25 bps, bringing it to 0.75%, marking the highest level in 30 years. However, the move was largely priced in, leaving the JPY bears in control.

In the policy statement, the BoJ emphasized its commitment to gradually adjust rates in line with economic and price developments. While the probability of meeting the baseline economic scenario has risen, the BoJ did not provide explicit forward guidance, which left traders reluctant to push the JPY higher.

During the press conference, Governor Ueda highlighted that Japan’s economy is recovering moderately, albeit with some underlying weakness. He noted that the pace of monetary adjustment will depend on the economic, price, and financial outlook, reinforcing that the BoJ remains accommodative.

Inflation Data Adds Little Relief to Yen Bulls

Recent data from Japan’s Statistics Bureau showed the National CPI rose 2.9% YoY in November, slightly down from 3.0% in October. The core CPI, excluding fresh food prices, remained steady at 3%, while the core-core CPI, excluding both fresh food and energy prices, eased from 3.1% to 3%.

Despite sticky inflation remaining above the BoJ’s 2% target, JPY bulls are cautious, waiting for clear signals on future monetary tightening. Additionally, the sharp rise in Japanese government bond yields, fueled by public debt exceeding 250% of GDP, continues to raise fiscal concerns, further pressuring the JPY.

Divergence Between BoJ and Fed Supports USD/JPY

In the US, the Bureau of Labor Statistics reported the CPI rose 2.7% YoY in November, below expectations of 3.1%, while core CPI climbed 2.6%, missing estimates. These figures indicate cooling inflationary pressures, creating expectations that the Federal Reserve (Fed) may ease monetary policy in 2026, with 63 bps of rate cuts priced in by traders.

This divergence between a hawkish BoJ and a potentially dovish Fed provides support for the lower-yielding JPY, yet the initial market reaction was short-lived, keeping the USD close to weekly highs and USD/JPY trading near mid-156.00s.

Investors are now eyeing US economic data, including Existing Home Sales and the University of Michigan Consumer Sentiment Index, for further trading cues. However, given current dynamics, the USD/JPY pair appears set to end the week nearly unchanged, prompting caution among aggressive traders.

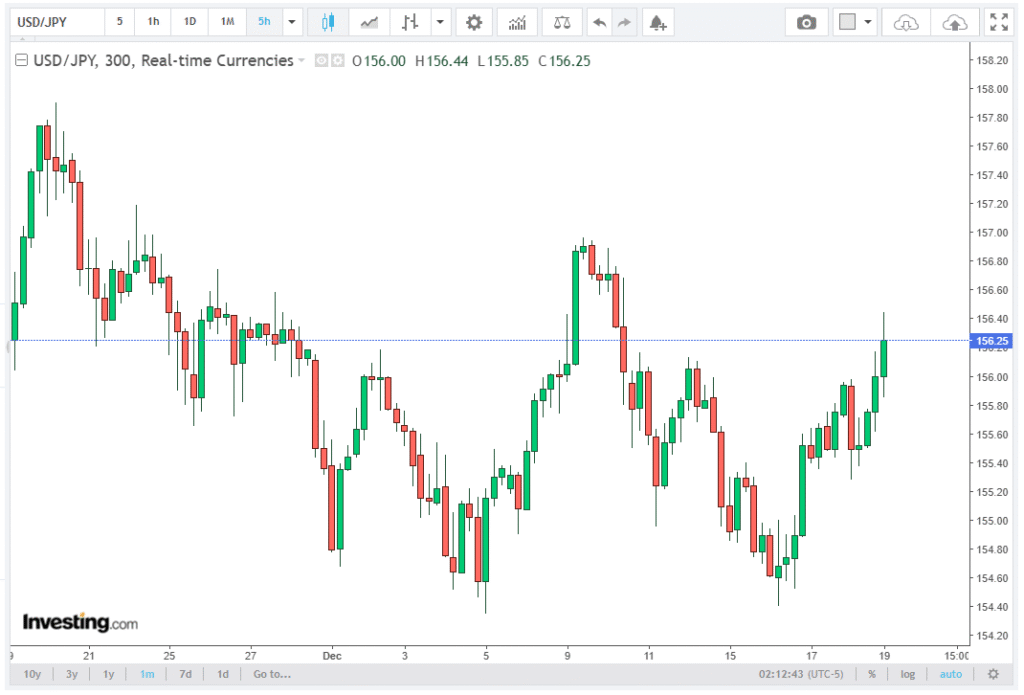

Technical Outlook: USD/JPY Eyes Monthly Peak

From a technical perspective, USD/JPY remains on track to climb further towards the monthly high around 157.00. The pair has broken through the 100-hour Simple Moving Average (SMA), and sustained strength above 156.00 is likely to trigger bullish momentum.

Hourly and daily oscillators are in positive territory, suggesting spot prices could challenge the 157.00 region, with intermediate resistance near 156.55-156.60.

On the downside, the 100-hour SMA, now acting as support around 155.30, may cushion losses ahead of the psychological 155.00 level. A decisive break below this mark could open the path to 154.35-154.30, with the monthly low at 154.00 representing a critical technical barrier that might shift the bias toward bearish traders.

Conclusion

Overall, the Japanese Yen remains under persistent selling pressure following BoJ Governor Ueda’s dovish remarks and the 25 bps rate hike. The lack of hawkish guidance, combined with positive risk sentiment and a firm USD, keeps USD/JPY momentum strong. While technical indicators point toward further gains near 157.00, caution is warranted as key support levels could influence short-term price dynamics.

Traders are advised to closely monitor BoJ communications, Japanese inflation data, and US economic releases, as these factors will continue to shape JPY valuation and the direction of USD/JPY in the near term.