The Indian Rupee (INR) started strong against the US Dollar (USD) on Friday, boosted by soft US inflation data and measured interventions from the Reserve Bank of India (RBI).

The USD/INR pair declines to near 90.30, reflecting the Indian currency’s resilience amid global currency fluctuations. Aurudium brokers outline the essential details of the topic with precision and insight.

US CPI Growth Moderates, Weakening the US Dollar

On Thursday, the US Consumer Price Index (CPI) for November revealed a moderation in inflation, with headline figures falling to 2.7% year-on-year (YoY) from 3% in October, below economists’ expectations of 3.1%. The core CPI, which excludes volatile food and energy components, dropped to 2.6% from 3%, signaling a softer inflationary environment.

The initial reaction in the US Dollar was negative, reflecting market sensitivity to inflation data. However, losses were partially recovered as the soft CPI prints did not significantly alter dovish expectations for the Federal Reserve’s (Fed) January policy meeting.

The CME FedWatch tool indicates a strong likelihood that the Federal Reserve will keep rates steady at 3.25%-3.50%, though a 25-basis-point reduction is still on the table.

Indian Rupee Strengthens on RBI Support

Despite the US Dollar holding ground, the Indian Rupee has rebounded from its record lows of 91.55 against the USD earlier this week, boosted by RBI interventions in the spot and non-deliverable forward (NDF) markets.

So far in 2025, the INR has depreciated more than 6% against the USD, driven by strong Greenback demand from Indian importers and foreign fund outflows from the Indian stock market amid uncertainty over a US-India trade deal. Washington currently imposes 50% tariffs on imports from India, including 25% punitive duties on oil imports from Russia, one of the highest tariffs among US trading partners.

FII Activity Supports INR, But Risks Remain

Foreign Institutional Investors (FIIs) have been net sellers this month, offloading a total of Rs. 21,688.26 crore in the Indian equity market. However, nominal buying interest emerged on Wednesday and Thursday, with FIIs turning net buyers of Rs. 1,767.49 crore worth of shares.

While these flows provide short-term support to the INR, the broader risk sentiment remains cautious amid the ongoing US-India trade stalemate. Without a clear resolution on trade or a sustained inflow of foreign funds, the INR’s recovery may struggle to maintain momentum.

Fed Chair Speculation Adds to Market Uncertainty

The next major USD/INR trigger could come from the US President’s announcement regarding the Fed Chair succession. On Thursday, he interviewed Fed Governor Christopher Waller and praised him as great. Governor Michelle Bowman was also complimented as “fantastic” during comments to reporters.

Earlier, the US President had narrowed down potential candidates for the Fed Chairman post to Kevin Hassett, White House Economic Adviser, and Kevin Warsh, former Fed Chairman. Any decision on the Fed leadership could influence monetary policy expectations and impact the USD/INR trajectory in the near term.

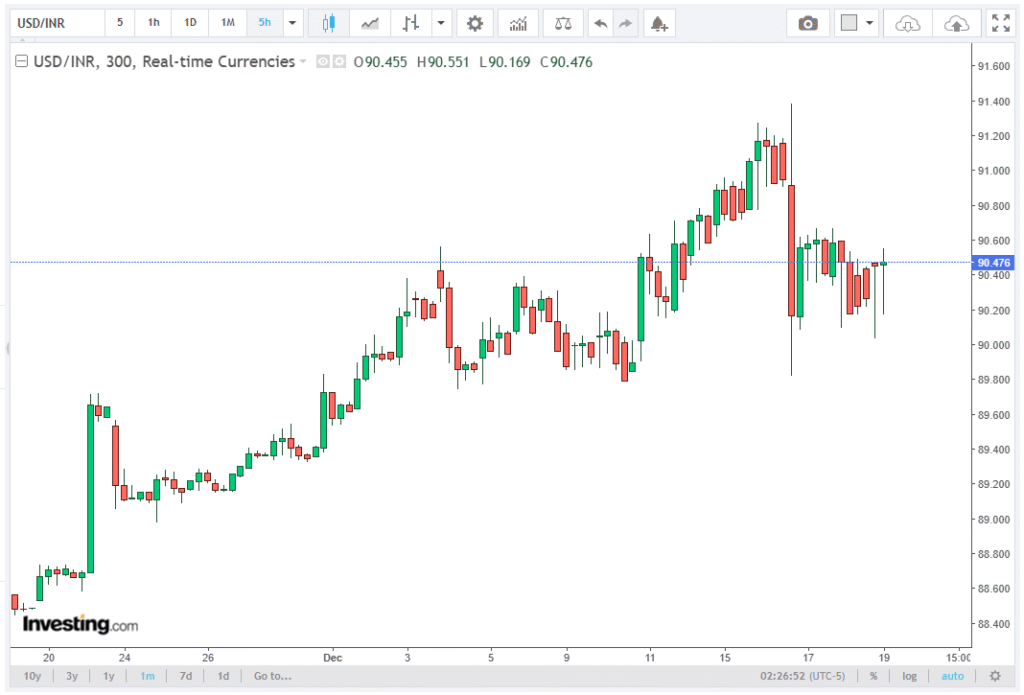

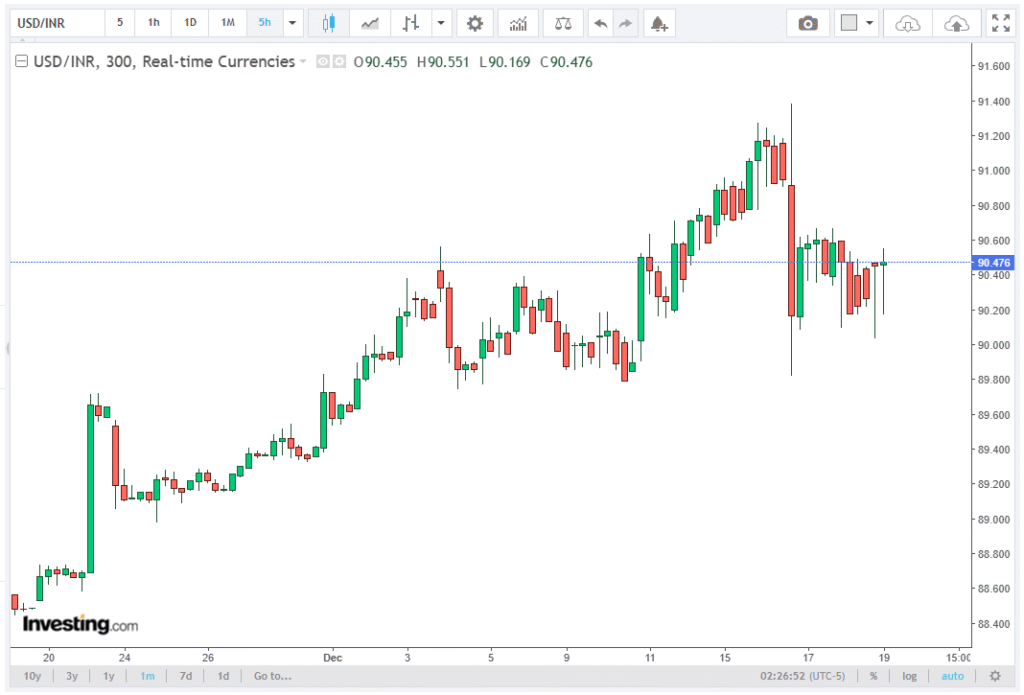

Technical Analysis: USD/INR Shows Downside Potential

From a technical perspective, USD/INR trades at 90.3935, holding above the rising 20-day Exponential Moving Average (EMA) at 90.2125, which preserves an upward bias. The EMA’s positive slope continues to guide prices higher and absorb recent pullbacks.

The 14-day Relative Strength Index (RSI) at 56 (neutral) has eased from prior overbought levels, indicating moderated momentum. Immediate support lies at the 20-day EMA at 90.2125, and a decisive close below this level could trigger a deeper corrective phase.

Bulls remain in control as long as the pair trades above the 20-day EMA, which continues to trend higher and supports intraday dips. A rebound in the RSI would bolster renewed upside pressure, whereas a break below the EMA could hand initiative to sellers, tilting risks toward a broader pullback.

Outlook for USD/INR

The Indian Rupee remains supported by RBI interventions and soft US inflation data, but its sustainability depends on multiple factors: US CPI trends and future Fed policy decisions, FIIs inflows/outflows and risk sentiment in Indian markets, US-India trade negotiations and tariff policies, as well as technical levels, including 20-day EMA support and RSI dynamics.

In the near term, USD/INR is likely to test the 90.00 level, with downside risk tempered by RBI support. Traders should monitor global macroeconomic cues, Fed leadership announcements, and FIIs’ activity to gauge the directional bias for the pair.

Conclusion:

The Indian Rupee maintains a tentative boost as USD/INR stays on the backfoot, supported by moderate US inflation, RBI interventions, and recent FII buying interest. While technical indicators suggest a potential downside breakout below 90.00, sustained gains will require stronger fundamentals, including positive capital inflows, trade clarity, and stable global risk appetite.