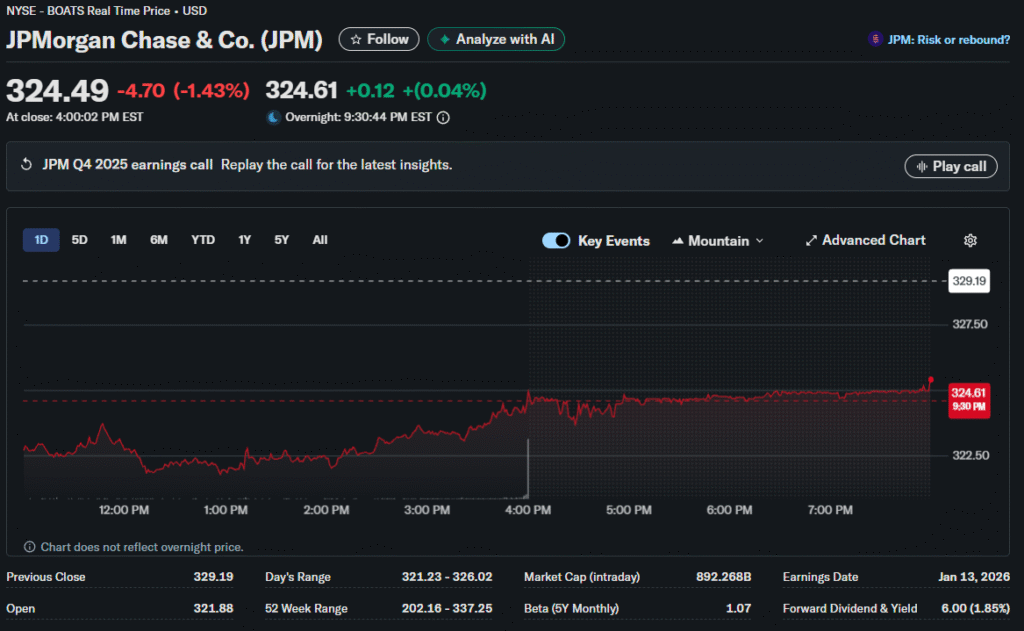

The financial sector kicked off the 2026 earnings season with closely watched reports from America’s largest banks. JPMorgan Chase delivered fourth-quarter results that exceeded analyst projections, setting a potentially optimistic tone. Senior broker at Auralyex explains how this performance signals strong underlying business fundamentals.

The investment banking giant maintained its track record of beating expectations throughout 2025. JPMorgan’s consensus earnings forecast was $5.01 per share, based on estimates from nine analysts tracking the stock. This figure represented a 4.16% increase compared to the same quarter last year.

The most impressive performance came in the third calendar quarter when results exceeded expectations. The bank surpassed consensus by 4.97% during that period. This consistent outperformance demonstrates resilience despite a complex macroeconomic environment.

Valuation Metrics Paint Interesting Picture

JPMorgan’s price-to-earnings ratio currently sits at 16.40 according to Zacks Investment Research. This stands well below the industry average of 20.90 for investment bankers. The valuation gap suggests the market may be underpricing the bank’s earnings potential.

The Bank of New York Mellon also reported results for the December 31 quarter, with strong expectations. Eight analysts forecast $1.97 earnings per share for the custody bank. The company matched JPMorgan’s pattern of beating estimates every quarter in 2025.

BNY Mellon’s third quarter showed an 8.52% beat over consensus estimates. The custody bank trades at a 16.09 P/E ratio, compared to an industry ratio of 14.30. This premium pricing implies investors expect higher earnings growth compared to competitors.

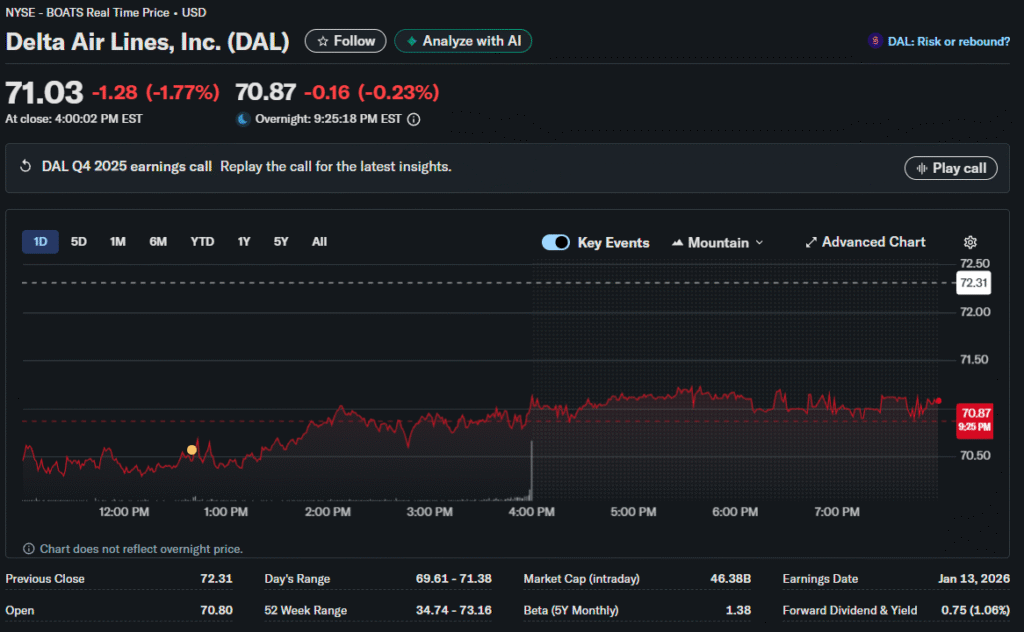

Delta Air Lines Faces Revenue Headwinds

Beyond banking, Delta Air Lines entered the earnings spotlight with dramatically different expectations. Analyst forecasts predicted $1.53 per share for the quarter. This represents a 17.30% decrease from the prior year period.

Junior financial analysts point out that this earnings decline contrasts sharply with recent performance. The airline surpassed third-quarter expectations by 12.5% in 2025. That marked the highest outperformance of the year for Delta.

The earnings compression likely reflects persistent industry pressures affecting carriers. Elevated fuel costs and competitive fare pricing continue weighing on airline profitability. Delta’s P/E ratio of 12.42 suggests the market has already priced in these challenges.

What These Results Mean for Markets

Fourth-quarter earnings create critical momentum for 2026 market direction across all sectors. The S&P 500 had just closed at record levels above 6,977 points. The Dow Jones Industrial Average hit 49,590 in the same session.

Financial sector performance carries an outsized influence because banks serve as economic barometers. Strong banking earnings typically signal healthy corporate borrowing and consumer spending. When lending standards tighten or loan demand weakens, banks report it first.

The Technology sector is expected to drive overall earnings growth for the quarter. Projections show 15.4% year-over-year gains for tech companies. However, this marks the tenth consecutive quarter of double-digit growth in tech earnings.

Banking Sector Faces Unique Crosswinds

Banks navigate a particularly complex operating environment in early 2026, according to industry watchers. The Federal Reserve cut interest rates three times during 2025. These cuts compressed net interest margins that banks rely on for profitability.

Lower interest rates theoretically increase loan volumes by making credit more affordable for borrowers. However, they also reduce the spread between deposit costs and lending income. This margin compression can offset volume benefits in many cases.

Regulatory scrutiny has intensified around commercial real estate exposures across the banking sector. Office vacancy rates remain elevated in the post-pandemic environment. Banks holding significant CRE portfolios face potential writedowns that could impact earnings quality.

Market Participants Watch For Guidance

Lead finance expert discusses why forward guidance matters more than historical results. JPMorgan executives traditionally offer detailed commentary on credit quality trends during earnings calls. Their insights on deal pipeline activity and macroeconomic outlook influence investor sentiment.

These qualitative insights help investors gauge whether current earnings represent sustainable momentum. Management teams that sound cautious about 2026 prospects often trigger share price weakness. This happens even when companies beat quarterly estimates by a wide margin.

The upcoming consumer price index report scheduled for later in January will influence interpretations. If inflation data shows persistent price pressures, the Fed may pause rate cuts. That scenario would actually benefit bank margins over time.

Positioning For Earnings Season Volatility

Historical patterns indicate that the first two weeks of earnings season typically generate above-average market volatility. Stock prices can swing 3% to 5% on single earnings reports. Algorithmic trading amplifies these moves in both directions.

Investors who waited through the quiet holiday period now face a rapid influx of information. Financial stocks tend to report the earliest in each earnings cycle. Industrials follow, then technology companies report their results last.

This sequencing allows each sector to set expectations for the next wave of reports. The January effect, where small-cap stocks traditionally outperform, may get disrupted. Money managers rebalancing portfolios at the start could accelerate sector rotation based on surprises.

Large-cap earnings disappointments could shift flows dramatically, according to market strategists. Bank results serve as the opening act for this quarterly corporate theater. Investors parse every word from management teams for clues about economic trajectory.