U.S. equity markets reached new record highs despite escalating political tensions surrounding central bank independence. The S&P 500 overcame early session declines to close 0.16% higher at 6,977.27 points. Senior financial analyst at Auralyex examines how investors remain focused on corporate fundamentals rather than Washington drama.

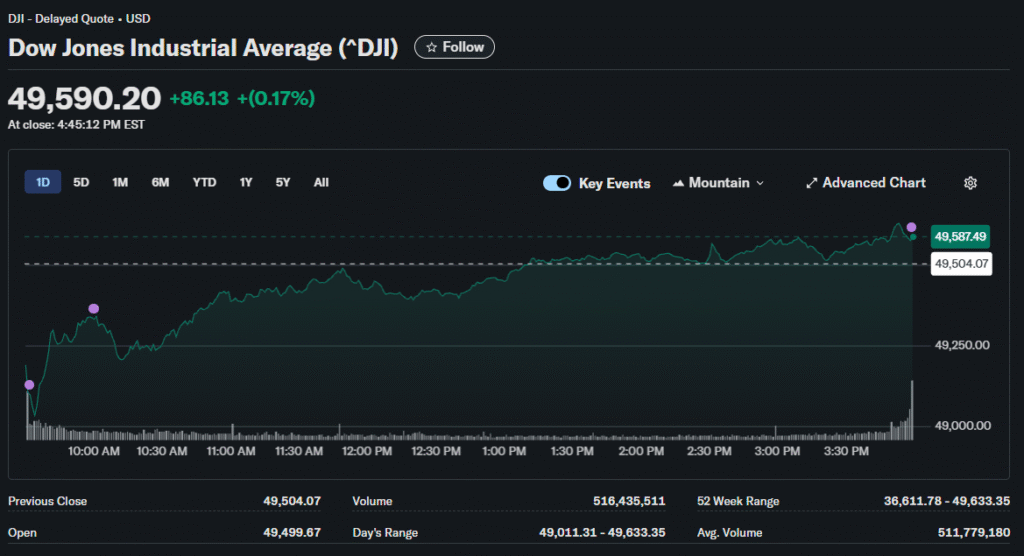

The resilience demonstrated by major indices suggests that market participants can see through political noise. Both benchmarks reached new intraday highs before settling at closing peaks. The Dow Jones Industrial Average rose 86.13 points or 0.17% to end at 49,590.20.

The Nasdaq Composite climbed 0.26% to finish at 23,733.90 points. Technology stocks provided critical support during afternoon trading as buyers stepped in. Large-cap tech names helped offset weakness in other sectors.

Political Pressure Creates Unusual Backdrop

Markets rallied despite news that the Department of Justice opened an investigation into Federal Reserve officials. This unprecedented development represents an extraordinary escalation in tensions between branches. The situation adds complexity to future monetary policy considerations.

The stock market largely ignored attempts to influence Fed policy throughout 2025. The central bank proceeded with three rate cuts while inflation stabilized. However, the current political environment adds new wrinkles to this dynamic.

Jim Lebenthal from Cerity Partners explained that the investigation’s impacts will likely be long-term. Interest rates are unlikely to change in the near term due to political pressure. Inflation metrics also will not shift quickly due to these developments.

Corporate Earnings Drive Positive Sentiment

Investors anticipate strong earnings from companies reporting this week, according to market strategists. The fourth-quarter earnings season began with major financial institutions posting their results. This set a constructive tone for equity markets overall.

Expectations for consumer price index data coming in well below 3% provide additional comfort. Lower inflation readings would vindicate the Fed’s decision to cut rates three times. They could potentially support further easing moves later in the year.

The economy continues growing rapidly, according to recent data releases. Lebenthal described too many good things happening simultaneously to derail the bull market. This Goldilocks scenario of solid growth without overheating supports higher stock valuations.

Asian Markets Signal Global Strength

Asian equity futures are primed for gains following the U.S. trading session. Australian and Hong Kong index futures rose in overnight trading. Japanese benchmarks surged nearly 4% after the market reopened from a public holiday.

The Japanese yen continued to weaken against major currencies in the forex market. This benefits exporters and lifts equity sentiment in the region. Currency movements often precede broader market trends in global trading.

Historically, a weakening yen has correlated with risk-on behavior in global markets. Investor sentiment remained buoyant across regions despite the unusual political backdrop. This global coordination suggests the equity rally has broad-based support.

Sector Performance Shows Breadth

A finance expert explores how market gains reflected widespread participation beyond tech mega-caps. Walmart stocks provided key support to the consumer discretionary sector. Some technology names also advanced despite recent rotation pressures away from mega caps.

The Technology sector continues to dominate index performance. It represents 35.9% of total S&P 500 earnings expected over the coming quarters. The sector’s market capitalization weighting stands at 43.1% of the index.

Defense stocks jumped on reports of increased military spending plans from Washington. Investors found opportunities across multiple themes despite narrow leadership concerns. Small-cap stocks also surged to record levels as money rotated.

Market Indicators Flash Mixed Signals

Only two stocks in the S&P 500 traded at new 52-week lows recently. CoStar Group and GoDaddy represented the weakest performers in the index. This extremely narrow group indicates broad underlying strength across equities.

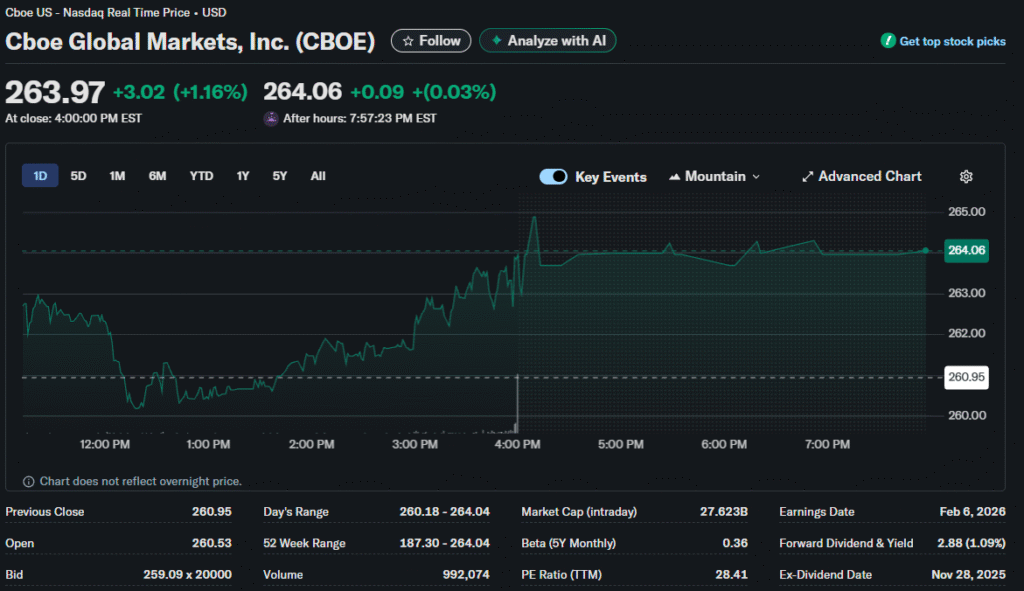

Dollar Tree reached levels not seen since April 2014 in its recovery. CBOE Global Markets traded at all-time highs dating back to its June 2010 IPO. These disparate performance stories reflect sector-specific dynamics rather than systematic weakness.

The Santa Claus rally failed to materialize this year for the first time since 2022. The S&P 500 fell nearly 1% during the traditional late December, early January period. This marks the third consecutive down Santa period for markets.

Investment Strategy Implications

The forward P/E multiple for the S&P 500 currently stands at 22 times earnings. This appears elevated compared to five-year and ten-year historical averages. High valuations compress future return potential even if earnings grow steadily.

Stocks trading at premium multiples need to deliver exceptional earnings growth. Otherwise, they risk multiple compression that sends share prices lower. Diversification across sectors becomes increasingly essential when market concentration reaches extreme levels.

The Magnificent Seven technology stocks account for a significant portion of the index weighting in portfolios. This creates vulnerability if narrow leadership falters in the future. Investors should carefully consider position sizing, given the risks of valuation and concentration.

Market participants balance optimism about earnings against concerns about political interference. The Fed’s independence remains crucial for maintaining economic stability. Any erosion of this independence could trigger reassessment of risk premiums.