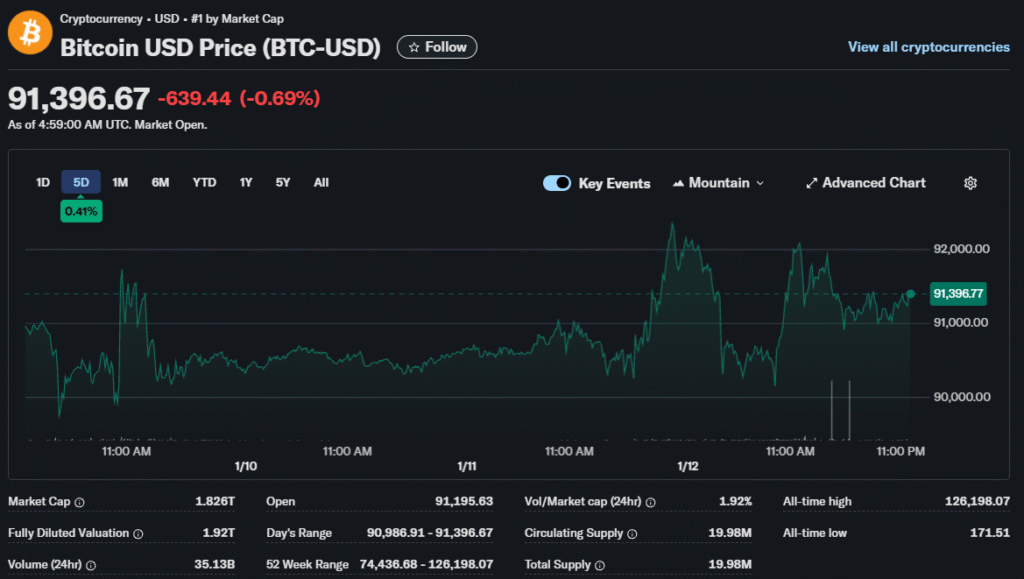

Bitcoin trading stabilized above the psychologically important $90,000 level in recent sessions. The largest cryptocurrency by market capitalization found support after testing investor resolve. Junior financial experts at Auralyex break down how digital asset markets entered a consolidation phase following volatile fourth-quarter action.

BTC hovered around $90,000 with price action reflecting digestion rather than renewed selling. This sideways movement suggests market participants are reassessing positions. Bitcoin fell as much as 35% from its October highs, which were previously above $126,000.

Forced liquidations and selling by long-term holders drove the December decline. The cryptocurrency ended December down for a third consecutive month. This pattern has appeared only 15 times historically in Bitcoin’s trading history.

Institutional Dynamics Shift Market Structure

Institutional demand is fundamentally changing Bitcoin’s price behavior, according to market analysts. Traditional retail-driven cycles that characterized previous market phases are evolving. Institutionally distributed liquidity now plays a much larger role in price formation.

Bernstein analysts declared with reasonable confidence that Bitcoin and broader markets have reached a bottom. They pointed to approximately $80,000 in late November as the floor. The investment bank emphasized institutional adoption as extending typical four-year cycle patterns.

The firm maintained its price targets of $150,000 for 2026 and $200,000 for 2027. Concerns about four-year cycle peaks are unwarranted given the current market context. Institutional capital inflows provide a new floor for cryptocurrency valuations.

Technical Indicators Signal Potential Rally

10X Research noted that technical indicators were signaling a bullish trend in Bitcoin. The cryptocurrency’s pattern of three consecutive monthly declines historically sets the stage for substantial gains in January. This seasonal tendency has proven reliable over Bitcoin’s trading history.

Sean Farrell from Fundstrat identified improving liquidity conditions as supportive for prices. The Federal Reserve’s balance sheet expansion provides positive signals for risk assets. A drawdown in the Treasury General Account also improves liquidity conditions.

Federal Reserve policy remains central to the performance of cryptocurrencies, despite its supposed independence. Lower interest rates reduce the opportunity costs of holding non-yielding assets. This dynamic supports demand for Bitcoin and other digital currencies.

Calendar Effects Create Opportunity

New year allocations differ significantly from the dynamics of late 2025 in meaningful ways. Portfolio managers reset profit and loss statements to zero at the start. This creates fresh capital allocation decisions across investment strategies.

The shift from redemption pressures at year’s end to new money inflows benefits risk assets. Bitcoin often sees a strong January performance as investors seek asymmetric returns. Fresh capital entering markets early in the year typically flows to growth assets.

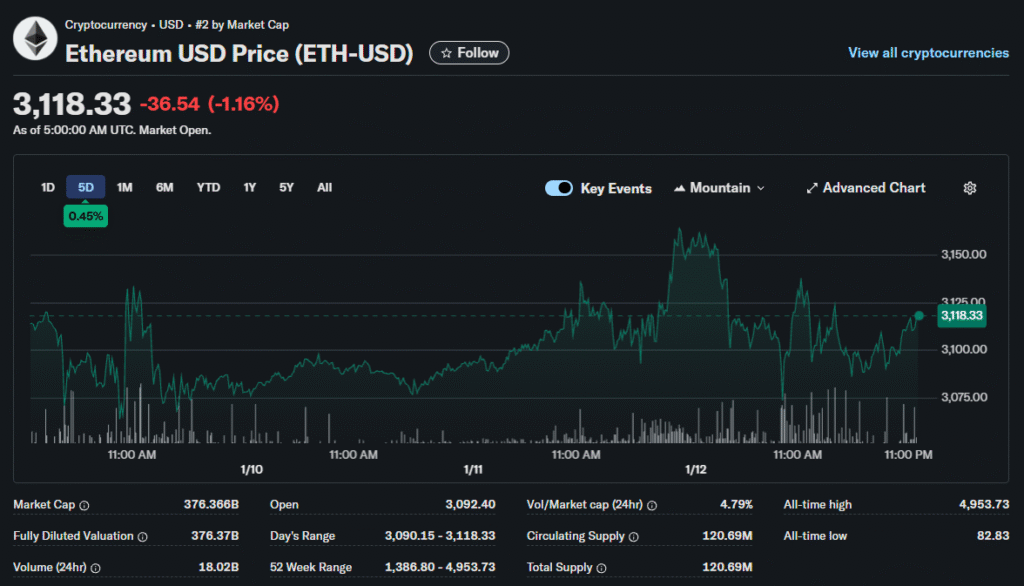

Ethereum has shown relative strength, outperforming Bitcoin over recent periods. However, CME futures data suggested institutional positioning cooled somewhat. This indicates potential consolidation ahead for the second-largest cryptocurrency.

Geopolitical Risk Premiums Emerge

Broker takes a closer look at how geopolitical tensions provided support. Markets reacted to escalating situations in multiple regions with bids for havens. Bitcoin received some safe-haven flows alongside traditional defensive assets.

Bitcoin’s correlation with the Japanese yen reached a record high of above 0.85 recently. Both assets suffered together in the final months of 2025. Sell-offs in both markets lost momentum after mid-December.

This tight correlation weakens Bitcoin’s appeal as a portfolio diversifier. Proper diversification requires low or negative correlations with traditional assets. The recent correlation spike raises questions about Bitcoin’s defensive properties.

Analyst Forecasts Show Wide Range

2026 price predictions for Bitcoin range from $75,000 to $225,000 among forecasters. This extensive forecast range indicates low conviction among market participants. Extreme uncertainty persists about the trajectory of the cryptocurrency industry.

Standard Chartered cut its Bitcoin price forecast to $150,000 from its previous $300,000. The bank cited reduced buying from digital asset treasury companies. Valuations no longer support further expansion of these levered vehicles.

Carol Alexander from the University of Sussex expects high volatility ranging between key levels. She sees a gravitational pull of around $110,000 as most likely. The transition from retail-led cycles to institutional distribution creates this volatility.

Ethereum’s Evolving Narrative

Ethereum faces distinct dynamics separate from Bitcoin’s trajectory, according to analysts. The blockchain’s transition to proof-of-stake consensus altered its economics. Growing tokenization activity creates fundamental value drivers beyond speculation.

ETH futures open interest on CME offers insight into institutional positioning. Rising open interest reflected activity among digital asset treasury companies. ETF-related arbitrage trades also contributed to the growth of derivatives.

Bulls argue that financial system migration to on-chain infrastructure increases utility. This represents a fundamentally different value proposition than Bitcoin. Innovative contract platforms enable applications beyond simple value transfer.

Market Structure Considerations

The cryptocurrency market structure matured significantly throughout 2025, with the introduction of new products. Multiple exchange-traded products were launched, providing institutional access. This infrastructure supports larger capital allocations than previous cycles.

Regulatory clarity in major jurisdictions reduced uncertainty that previously limited participation. Clear frameworks for custody, taxation, and reporting facilitate seamless integration with traditional finance. Professional money managers can now allocate to digital assets.

The $90,000 support level represents a key battleground for 2026 direction. Sustained trading above this threshold would confirm consolidation patterns. Breaks below could trigger technical selling toward the $80,000 support level.