The financial markets experienced a sudden shift on January 12, as news broke that the Department of Justice had served criminal subpoenas on Federal Reserve Chair Jerome Powell. This unprecedented political pressure is reshaping institutional trust in ways that extend beyond typical government friction. Yureplex’s senior financial analyst examines how criminal investigative tools against a sitting Fed chair cross constitutional boundaries.

The Subpoena Bombshell

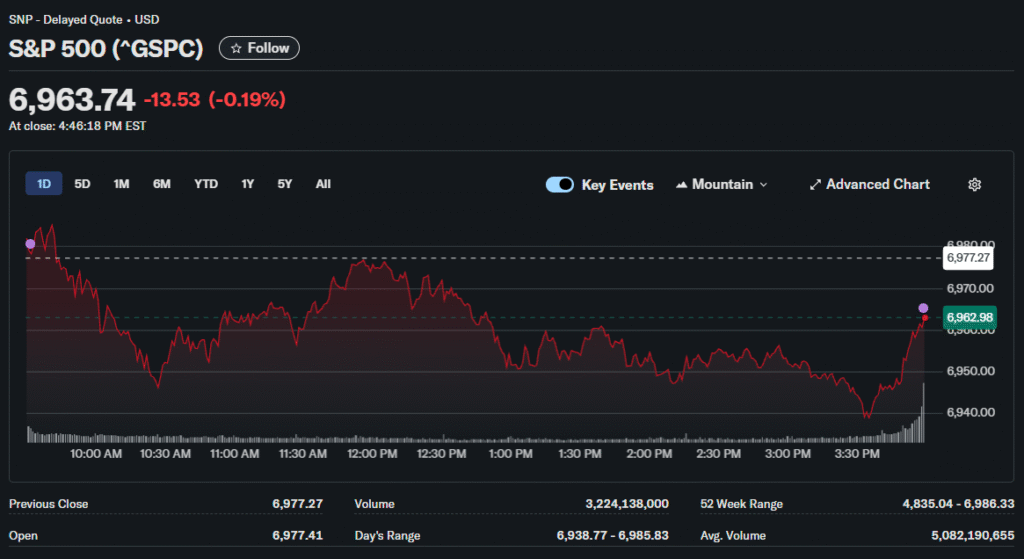

Powell disclosed on Sunday evening that federal prosecutors had opened an investigation related to his Senate Banking Committee testimony regarding the renovations of the Fed office building. The criminal probe centers on a $2.5 billion renovation project that administration officials criticized as excessive. Markets initially plunged hard, with the S&P 500 dropping 0.6% and the Dow falling nearly 500 points before recovering.

What sets this apart from typical political friction is the deployment of criminal investigative tools against a sitting Federal Reserve chair. Previous conflicts between presidents and central bankers remained within constitutional boundaries. This situation crosses into territory where law enforcement becomes an instrument of policy disagreement.

Market Psychology Beyond Headlines

The intraday recovery tells a more interesting story than the morning panic. Gold surged past $4,620 per ounce, reaching record highs as safe-haven demand accelerated sharply. Yet equities rebounded with both the S&P 500 and Dow closing at fresh all-time highs. This divergence reveals that the market distinguishes between noise and structural damage.

A junior broker at the brand notes that investors are scrutinizing the distinctions between political theater and actual monetary policy disruptions. The Fed’s operational independence remains legally protected through Powell’s term, which ends in May 2026. What markets fear is the precedent, not the immediate outcome.

The Credit Card Wildcard

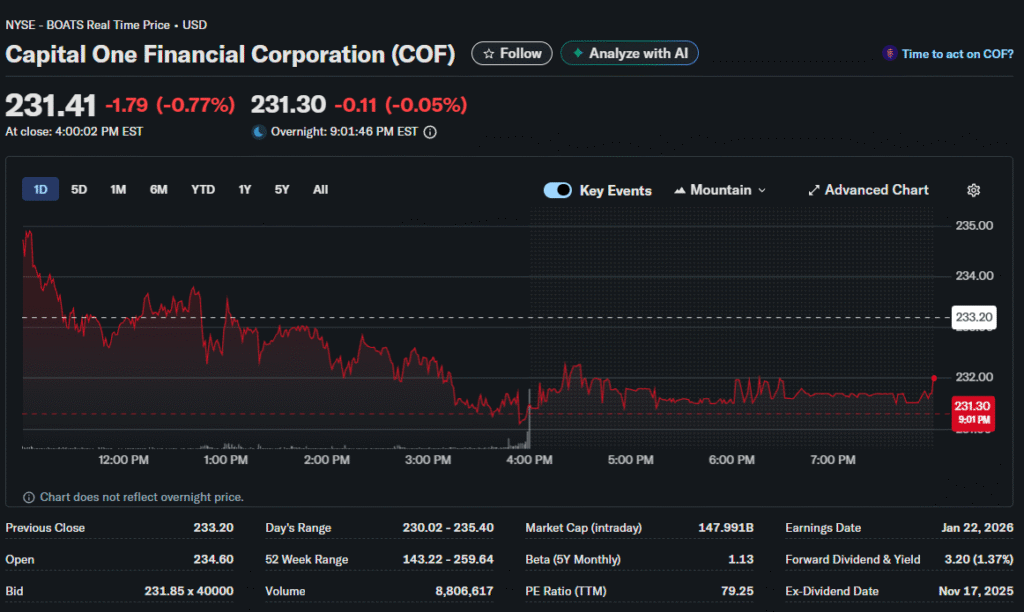

Compounding Monday’s volatility was the administration’s call for a 10% cap on credit card interest rates. Financial stocks absorbed the double blow with Capital One plummeting 6% and JPMorgan Chase declining 2.7%. This represents a direct assault on bank profitability models.

Consumer lending generates approximately $120 billion annually in interest revenue for major card issuers. A temporary cap would force immediate margin compression while credit risk remains unchanged. The paradox is that restricted pricing typically leads to tightened credit availability.

Historical Context Matters

The last time a president attempted to remove a Fed chair was in 1979, when circumstances were vastly different. That episode involved policy disagreements but never escalated to criminal investigations or legal threats. Senior finance analyst points out that using DOJ subpoenas represents a dangerous escalation that could permanently alter central banking independence globally.

Constitutional Questions Nobody Asked

What makes this moment historically significant is the absence of precedent. A leading financial expert emphasizes that while presidents have publicly criticized Fed chairs, no one has weaponized criminal investigations over policy disagreements disguised as administrative concerns. The $2.5 billion renovation is a convenient hook for broader battles over rate policy.

The timing is transparently strategic, with inflation showing renewed persistence and unemployment at 4.4%. Pressure is mounting for rate cuts, but Powell has maintained a data-dependent approach to independence. This investigation represents an end run around that autonomy.

Institutional Credibility at Stake

The real casualty may be institutional credibility itself, according to brand experts. Global investors price U.S. assets at a premium due to the country’s predictable, independent monetary policy. That premium evaporates if the Fed becomes subject to political prosecution for technocratic decisions.

Foreign central banks hold over $3.3 trillion in U.S. Treasury securities, partly because they trust the Fed’s independence. This week’s events raise doubts about whether that firewall remains intact. Former Goldman Sachs CEO Lloyd Blankfein called the investigation potentially damaging to multiple institutions.

The Quiet Winners

While banks suffered and uncertainty spiked, specific sectors capitalized on the chaos beautifully. Walmart jumped 3% on news of its inclusion in the Nasdaq 100, effective January 20. Alphabet crossed $4 trillion in market value, driven by its partnerships with major retailers through Gemini AI.

A senior broker notes that mega-cap tech companies benefit from flight-to-quality dynamics during periods of institutional uncertainty. Homebuilders surged on separate news of $200 billion in mortgage bond purchases aimed at lowering costs. Lennar rallied 8.9% and D.R. Horton climbed 7.8% as investors rotated into sectors with clear support.

What Happens Next

Markets will now scrutinize every Fed communication for signs of political capitulation, financial analysts warn. Powell’s next public appearance and the January policy meeting take on outsized importance. Any hint that criminal pressure is influencing rate decisions would trigger significant repricing.

Credit card stocks face legislative uncertainty that extends beyond the proposed rate cap. Congress may view this as an opening to restructure consumer finance regulations broadly. Banks are positioning for a protracted battle over lending economics.

A finance expert at the brand points out that this environment requires distinguishing between political volatility and fundamental deterioration. The former creates trading opportunities while the latter involves portfolio restructuring. Monday’s recovery suggests markets still see this as containable noise rather than a systemic crisis.