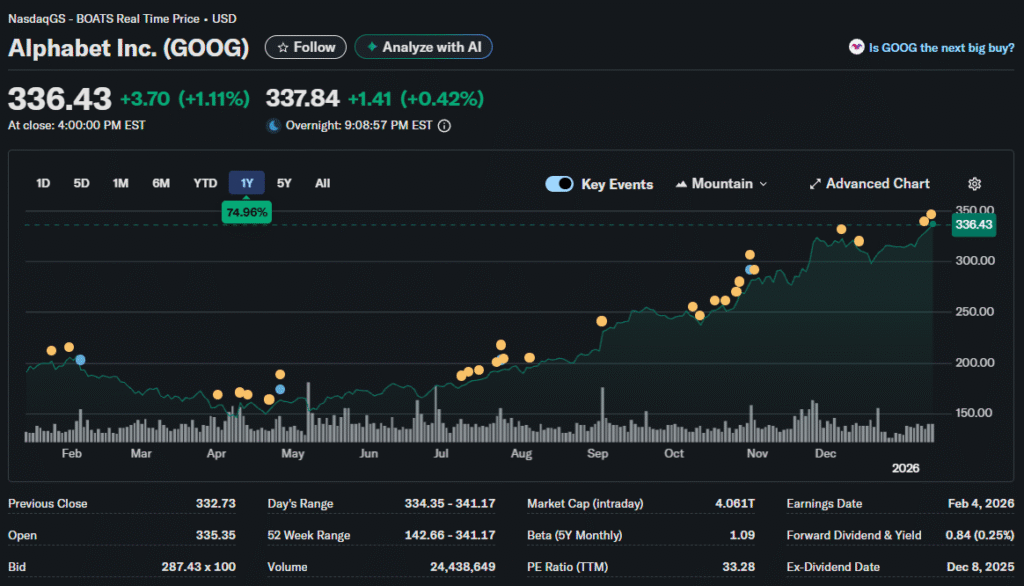

Google’s parent company shattered valuation records on January 12, becoming only the second firm to breach $4 trillion in market capitalization. Strategic AI partnerships are redefining competitive moats in technology, according to the lead broker at Yureplex, who discusses how weekend deals drove Monday gains.

Weekend Deals, Monday Gains

Alphabet surged past $4 trillion on the back of three major announcements that collectively signal a shift. The partnerships with Walmart, Wayfair, and Shopify integrate Gemini AI as a shopping assistant. This creates immediate revenue pathways from generative AI technology that competitors still struggle to commercialize.

The timing of these deals announced over the weekend and driving Monday’s 1.14% stock gain demonstrates strategic sophistication. Brand analysts note that Alphabet avoided the hype cycle trap by waiting for concrete business applications to emerge.

The Apple Acceleration

Perhaps most significant was Apple’s decision to power the next version of Siri using Gemini AI models. This represents an important concession from Apple, which has historically insisted on proprietary technology. What this reveals about Alphabet’s technical lead is substantial.

Apple evaluated multiple AI providers, including OpenAI and Anthropic, before selecting Gemini. The choice signals that Alphabet has achieved functional superiority in natural language processing. This partnership cements Gemini as the de facto standard for consumer AI interfaces.

Drone Economics Change Everything

The Wing subsidiary partnership, expanding drone deliveries with Walmart, operates on different economics than traditional logistics. A financial expert explores how this shift dramatically alters competitive dynamics in retail. Current delivery costs average $8 to $ 12 per package for conventional carriers.

Drone delivery at scale could reduce that to under $2 per package within five years. Walmart’s existing logistics infrastructure, combined with Wing’s autonomous delivery, creates a moat that competitors will struggle to replicate. The tech giant’s drone program remains in limited testing, giving Alphabet a meaningful time advantage.

The Revenue Multiplier Effect

What makes these partnerships particularly powerful is how they compound existing advantages across multiple business lines. Junior finance analyst breaks down how Gemini’s integration with shopping platforms drives both cloud computing revenue and advertising placements. This creates a virtuous cycle where each partnership simultaneously strengthens multiple revenue streams, rather than operating in isolation.

Market Structure Implications

Alphabet’s $4 trillion valuation should not be viewed in isolation, according to experts. It reflects a broader market rotation favoring companies that demonstrate AI revenue generation over those that spend on AI. While many firms tout AI investments, Alphabet is monetizing those investments through customer products.

This contrasts sharply with companies like OpenAI, which generate headlines but hemorrhage cash. Alphabet’s approach integrates AI into existing profitable businesses, creating incremental margins. A senior financial analyst points out that this difference separates winners from pretenders.

The Competitive Landscape Shifts

Microsoft faces strategic challenges despite its partnership with OpenAI and its focus on enterprise AI. A junior financial expert at the brand breaks down how Microsoft has heavily invested in enterprise AI through Azure and Copilot. This ceded consumer AI territory that Alphabet now dominates.

The shopping assistant functionality specifically targets weaknesses in competitor strategies. Bing Shopping has never achieved a significant market share compared to Google Shopping. Adding AI capabilities to an already dominant platform significantly amplifies that advantage.

Valuation Sustainability Questions

At $4 trillion, Alphabet trades at approximately 26 times forward earnings. This represents a premium to its five-year average but not extreme, given growth acceleration. Sustainability depends on converting AI features into incremental revenue.

Suppose Gemini-powered shopping increases conversion rates by even 2-3% which represents $8-10 billion in additional annual revenue. The drone delivery business could generate another $5-7 billion by 2028 if adoption matches projections. A leading finance expert emphasizes that these are achievable targets, not speculative forecasts.

Regulatory Shadows Persist

Alphabet’s expansion does not occur in a vacuum as antitrust scrutiny continues to intensify. Regulators are examining whether the integration of AI constitutes anti-competitive bundling practices. This could constrain future partnerships, as indicated by brand analysis.

European regulators, in particular, view the Apple-Alphabet AI deal skeptically, seeing it as a platform collaboration. Potential remedies could include forcing API access for rival AI models. This would substantially reduce Alphabet’s competitive advantage.

Portfolio Positioning

For investors, Alphabet serves as a test case for AI monetization models in general. Companies generating AI revenue, not just AI hype, will separate winners from losers. Alphabet’s partnerships create observable metrics for evaluating AI’s commercial viability.

The risk is execution, as drone delivery faces regulatory hurdles everywhere. AI shopping assistants must prove they increase transaction volume without cannibalizing existing revenue. Consumer adoption of AI features has been slower than technology capabilities suggest.

A finance analyst notes that the market’s willingness to award Alphabet a $4 trillion valuation indicates belief. Whether that belief proves justified will determine if this marks a sustainable leadership shift. The alternative is another tech bubble inflection point waiting to burst.