Gold prices continued their powerful advance this week, extending an already historic rally as geopolitical tension tied to Arctic developments and renewed instability in Japan’s sovereign bond market intensified demand for safe-haven assets.

According to forex strategists from Altiryus, the latest surge reflects a convergence of geopolitical risk, fiscal credibility concerns, and weakening confidence across major economies. Rather than reacting to a single headline, investors appear to be responding to a broader erosion of trust that has been building steadily across global financial systems.

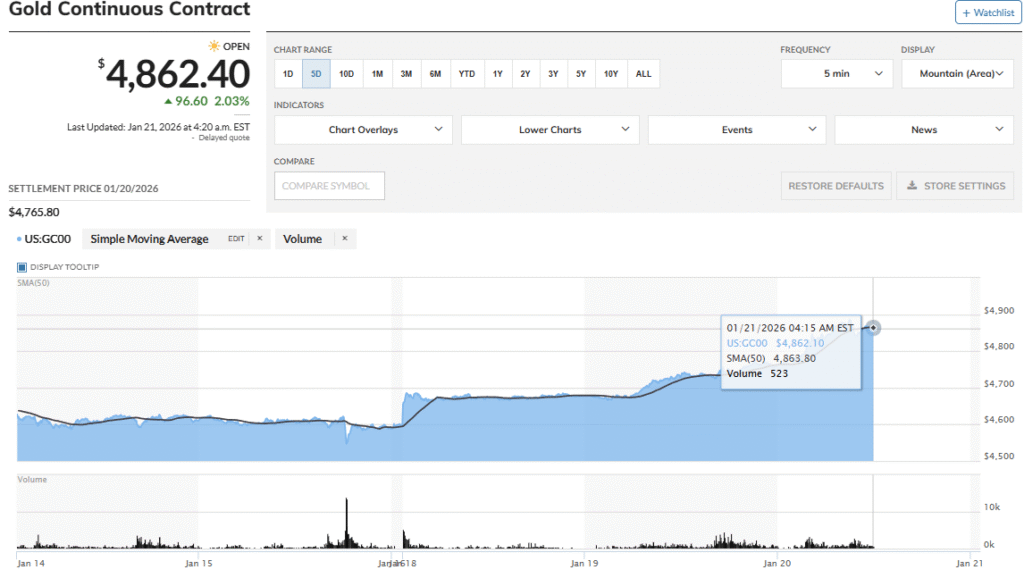

Gold climbed to a fresh all-time high of $4,878.22 per ounce, marking one of the strongest momentum phases in decades. The rally unfolded as diplomatic friction surrounding Greenland escalated and volatility resurfaced in global debt markets, particularly in Japan, where government bonds came under renewed pressure.

Geopolitical Friction Drives Haven Flows

Heightened uncertainty surrounding Greenland has emerged as a major catalyst for the latest leg higher in gold. Recent policy signals from the United States triggered firm responses from several European governments, reviving concerns about trade retaliation, economic fragmentation, and policy coordination breakdowns.

Multiple European economies now face the prospect of new tariff actions, raising fears of supply chain disruption and reduced cross-border cooperation. Currency markets reacted swiftly, with the U.S. dollar weakening across consecutive sessions. Historically, periods of diplomatic stress combined with currency softness tend to support gold prices, a pattern that has reasserted itself clearly.

Market participants note that the pace of gold inflows suggests defensive positioning rather than short-term speculation. Capital has rotated into precious metals as investors reassess geopolitical risk premiums across equities, currencies, and fixed income.

Japan’s Debt Turmoil Adds a Second Layer of Risk

Alongside geopolitical stress, renewed instability in Japan’s sovereign bond market has amplified investor unease. A sharp repricing of long-dated government debt has reignited debate around fiscal sustainability in advanced economies, particularly those carrying elevated debt burdens and long-standing reliance on accommodative policy frameworks.

The bond market volatility has fueled what many analysts describe as the debasement trade, where investors rotate away from fiat currencies and government bonds toward tangible assets. Gold has been a primary beneficiary of this shift, supported by concerns that traditional policy tools may be losing effectiveness.

Spot prices reflected this demand, with gold advancing more than 2.4% during Asian trading hours. Silver traded near $95 per ounce, holding close to record levels, while platinum briefly touched $2,511.10 before consolidating.

Technical Momentum Reinforces the Trend

From a technical perspective, gold’s rally remains firmly supported. Prices continue to trade well above key moving averages, with both the 50-day and 200-day trends sloping higher. Momentum indicators such as the Relative Strength Index remain elevated, yet show no confirmed bearish divergence.

Volume patterns further support the bullish case, indicating sustained institutional participation rather than exhaustion-driven buying. Breakouts above prior resistance levels have been followed by consistent continuation, a characteristic commonly associated with structurally driven trends.

Central Bank Buying Strengthens Structural Support

Central bank demand continues to provide a strong foundation for gold prices. The National Bank of Poland recently approved plans to acquire an additional 150 metric tons, reinforcing its position as one of the most active official buyers globally. Meanwhile, Bolivia’s central bank resumed gold purchases following updated reserve regulations introduced in December 2025.

These official-sector flows reduce available market supply and create demand that is largely insensitive to short-term price volatility. Many analysts believe central bank accumulation has reshaped gold’s long-term profile from a cyclical hedge into a strategic reserve asset.

Precious Metals Broadly Follow Higher

Gold’s strength has spilled over into the wider metals complex. Copper prices advanced toward $13,000 per ton, supported by ongoing infrastructure investment and energy transition demand. Silver and platinum also benefited, reflecting a combination of investment inflows and supply-side constraints.

The synchronized rise across industrial and precious metals suggests a broader real-asset rotation rather than isolated speculation. Historically, such alignment reflects deeper macro positioning tied to inflation hedging, currency diversification, and declining confidence in traditional financial instruments.

Outlook Centers on Trust Rather Than Inflation Alone

Looking ahead, forex strategists observing the move argue that gold’s rally is increasingly driven by confidence dynamics rather than inflation metrics alone. With geopolitical alliances under strain, sovereign debt sustainability under scrutiny, and policy credibility questioned, investors are prioritizing assets that sit outside the conventional financial system.

Short-term consolidation may occur following the recent surge, but the broader trend remains constructive, supported by persistent macro uncertainty, defensive asset allocation shifts, and continued institutional demand globally. As long as uncertainty across geopolitics, fiscal policy, and monetary governance persists, gold is likely to retain its strategic appeal. In the current environment, the metal continues to stand out as one of the few assets investors still trust.