Japan’s super-long government bonds staged a tentative rebound this week following intense volatility that pushed yields to historic extremes, unsettling currency and equity markets in the process. While prices recovered modestly, underlying tension remains elevated as investors question whether policymakers will take stronger action to restore confidence across the yield curve.

Finance experts from Altiryus note that the rebound reflects short-term stabilization rather than a decisive shift in sentiment. The recent surge in yields has exposed deep sensitivity to fiscal uncertainty, election risk, and structural supply pressures in Japan’s long-dated debt market.

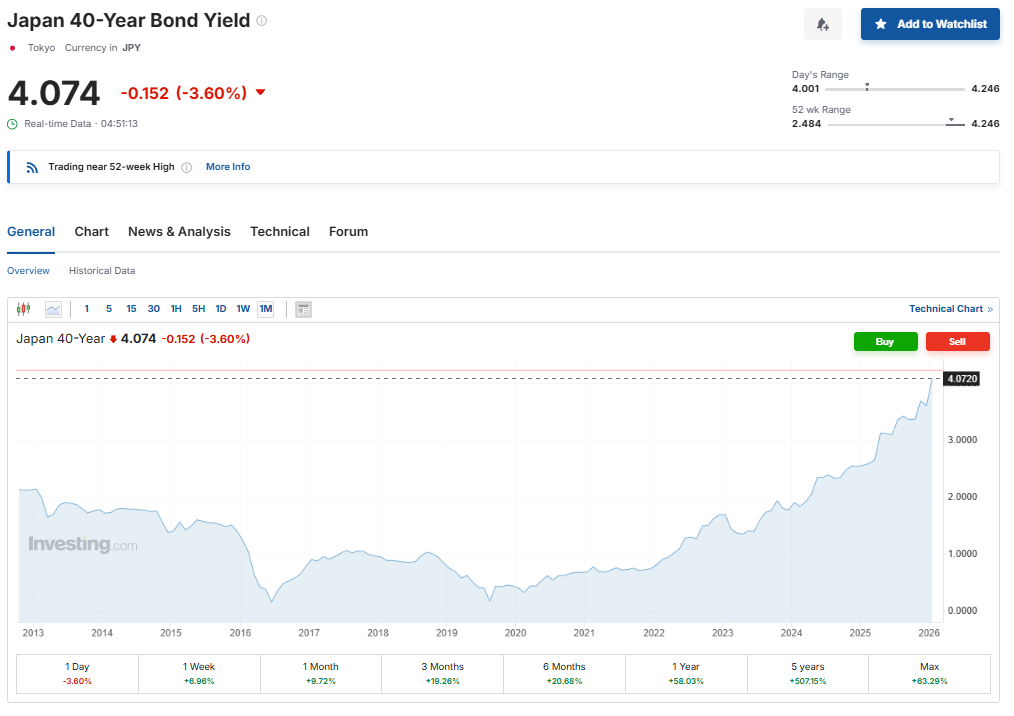

The 40-year Japanese government bond yield remained above 4%, even after retreating by 17 basis points during Wednesday’s session. Although the move eased immediate pressure, yields continue to hover near record levels, signaling persistent caution among institutional investors.

Election Risk Keeps Volatility Elevated

Market stress has been amplified by Japan’s upcoming Feb. 8 snap election, which has heightened uncertainty around fiscal direction and debt issuance policy. Election-driven volatility has historically weighed more heavily on the long end of the yield curve, where sensitivity to supply expectations is greatest.

Investors remain wary that campaign promises involving tax relief or fiscal expansion could translate into increased bond issuance, particularly in super-long maturities. This concern has limited the depth of the rebound, keeping yields elevated despite official calls for calm.

At the same time, Japanese equities extended their pullback after reaching recent highs, while the yen hovered near 158 per dollar, underscoring broader market unease. Currency weakness has compounded bond market stress by raising fears of capital outflows and reduced foreign demand for Japanese debt.

Policy Signals Offer Limited Relief

The Bank of Japan proceeded with scheduled bond-buying operations, providing some liquidity support to the market. However, participants largely viewed these actions as insufficient to counter the scale of recent yield movements.

Calls from policymakers for market calm helped slow selling, but sentiment remains fragile. Investors appear unconvinced that verbal reassurance alone can offset structural pressures tied to supply dynamics.

Market participants are increasingly focused on whether authorities may consider reducing issuance of super-long bonds or conducting targeted buybacks to ease pressure on the long end. Without concrete policy adjustments, expectations for sustained stabilization remain limited.

Yield Levels Highlight Structural Strain

The 30-year government bond yield declined to 3.71%, while the 40-year yield settled near 4.04%, after briefly touching an unprecedented 4.215% earlier in the week. These levels mark a dramatic shift from Japan’s historically low-yield environment and reflect changing risk perceptions among investors.

Such moves are particularly significant for domestic institutions, including pension funds and insurers, which rely heavily on long-duration assets. Sharp yield swings increase balance-sheet volatility and complicate asset-liability matching, adding to the urgency for clearer policy guidance.

Despite the rebound, trading conditions suggest limited conviction. Volume patterns point to cautious positioning rather than aggressive buying, reinforcing the view that markets remain in a wait-and-see mode.

Currency Weakness Adds Another Layer of Risk

Japan’s bond volatility has not occurred in isolation. The yen’s persistent weakness has amplified concerns that aggressive bond support could further pressure the currency, creating a difficult policy trade-off.

Foreign investors remain sensitive to exchange-rate risk, particularly when yields rise. This dynamic has reduced demand for Japanese bonds during periods of stress.

Finance experts observing the situation highlight that stabilizing the bond market without triggering additional currency weakness will be a delicate balancing act in the weeks ahead.

Equity Markets Feel the Impact

The bond selloff pressured Japan’s equity market, with financial stocks leading declines. Banks and insurers reversed course as volatility raised concerns about capital strain and balance-sheet exposure.

The move underscores how quickly sentiment can shift when yield movements become disorderly rather than gradual, prompting investors to reassess risk across asset classes.

Technical Perspective Suggests Fragile Stabilization

From a technical standpoint, long-dated yields remain in a stretched zone, supporting the case for short-term consolidation. However, yields remain above key trend levels, signaling that downside pressure on bond prices has not fully dissipated.

Until yields move decisively back below recent breakout levels, technical signals point to ongoing vulnerability rather than a confirmed reversal.

Looking Ahead to Key Tests

Attention now turns to the Bank of Japan’s upcoming policy decision and a 40-year bond auction scheduled next week, which will serve as a critical test of investor appetite. Weak demand could reignite volatility, while a stable auction may offer temporary reassurance.

Looking forward, finance experts tracking the market emphasize that lasting stability will require clearer coordination between fiscal policy, debt issuance strategy, and currency management. Without alignment across these areas, Japan’s long-bond market is likely to remain susceptible to sharp swings.

While the recent rebound has eased immediate stress, confidence remains fragile. The coming days will determine whether calm can be sustained or whether renewed volatility emerges as political and policy uncertainties persist.