Boeing’s share price has returned to levels last seen before the January 2024 midair manufacturing incident, marking a symbolic milestone in the aerospace company’s long recovery. The rebound suggests that investor confidence has gradually been restored as operational stability improves and financial performance begins to normalize after years of disruption.

Equity experts from Altiryus observe that the recovery reflects more than short-term optimism. Instead, markets appear to be pricing in tangible progress across production discipline, regulatory alignment, and cash flow visibility following one of the most challenging periods in the company’s history.

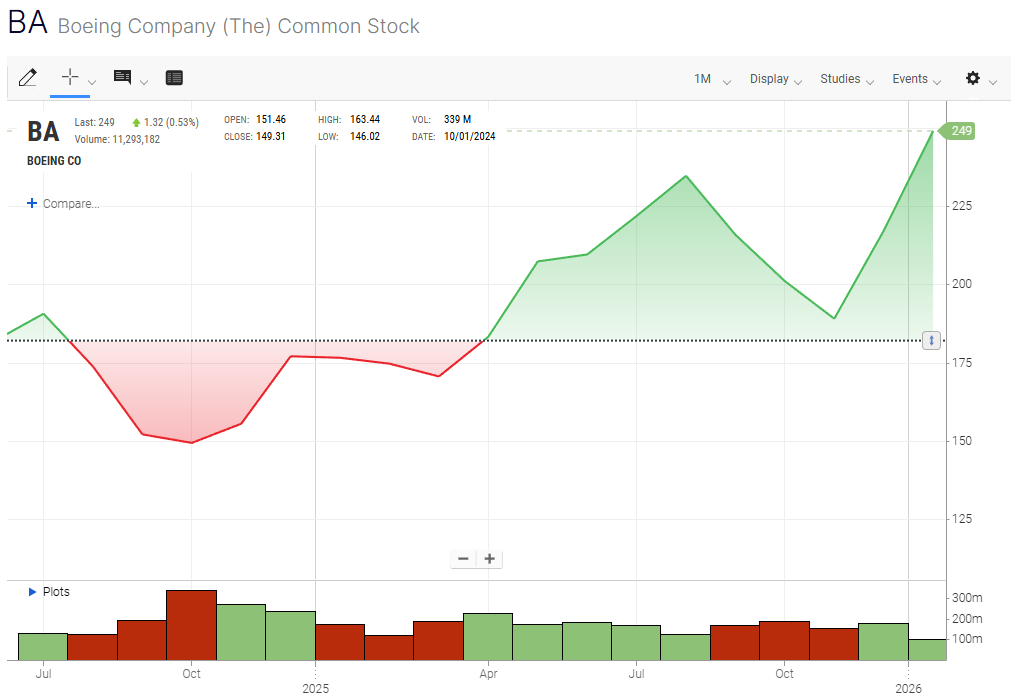

Boeing shares recently closed near $249, matching prices recorded just before the 2024 incident that triggered widespread safety reviews and heightened regulatory scrutiny. In the months that followed, the stock declined by as much as 45%, reflecting investor concerns over delivery delays, regulatory risk, and reputational damage.

A Long Road Back From Crisis

The company’s share price volatility did not begin in 2024. Boeing has faced repeated shocks since 2019, including fatal aircraft accidents, a prolonged grounding of key models, and the near-collapse of global air travel during the pandemic. While the stock experienced intermittent rallies, confidence remained fragile as setbacks continued to emerge.

The 2024 manufacturing failure reignited concerns just as the company was showing early signs of stabilization. Regulatory investigations intensified, production limits were imposed, and leadership changes followed. For investors, the episode reinforced doubts about whether Boeing could execute a sustained turnaround.

Recent price action suggests those doubts are easing. The stock’s recovery from lows near $137 during early 2025 reflects renewed confidence that the worst disruptions may now be behind the company.

Production Discipline And Regulatory Progress

One of the most important signals supporting the recovery has been progress on production oversight. Regulators previously imposed limits on monthly output of Boeing’s most widely used aircraft, constraining deliveries and revenue generation.

Approval to raise production capacity has been interpreted by markets as a vote of confidence in improved quality controls. The ability to increase output incrementally provides Boeing with a clearer path to restoring scale while avoiding the operational strain that contributed to earlier failures.

A technical price chart tracking Boeing shares over the past two years highlights a steady recovery trend following the removal of key production constraints, reinforcing the perception that operational risk is gradually declining.

Deliveries, Orders, And Backlog Strength

Improving production has translated into stronger delivery performance. Boeing has reported one of its highest delivery rates in several years, supported by resilient demand from airlines seeking to modernize fleets amid long-term growth in global air travel.

Order momentum has also strengthened. The company’s backlog remains substantial, providing multi-year revenue visibility and supporting the case for a return to consistent cash generation. In recent periods, Boeing has outperformed its primary competitor in net aircraft orders, a development not seen since before the pandemic.

For investors, backlog growth is particularly important, signaling confidence from customers and reducing exposure to short-term demand volatility.

Cash Flow Turning Point Approaches

Another major factor behind the stock’s recovery is the improving outlook for cash flow. After years of negative free cash flow driven by production stoppages, compensation costs, and restructuring expenses, Boeing has guided toward a return to positive annual cash generation.

Market participants interpret this shift as a critical inflection point. Sustained positive cash flow would strengthen the balance sheet, reduce reliance on external financing, and allow greater flexibility in future capital allocation decisions.

A second technical chart showing volume trends alongside price appreciation illustrates rising participation during periods of positive cash flow guidance, suggesting growing institutions.

Operational Execution Becomes the Central Focus

As Boeing moves beyond crisis stabilization, investor attention is increasingly shifting toward execution consistency rather than recovery headlines. Markets are closely monitoring whether the company can maintain production quality while gradually increasing output, a balance that has historically proven difficult in large-scale aerospace manufacturing.

Equity analysts note that credibility is now being rebuilt through predictability, not promises. Meeting delivery targets, avoiding new quality lapses, and maintaining transparent communication with regulators are becoming more influential drivers of valuation than aggressive growth projections. Each successful production milestone reduces perceived downside risk, while any setback would likely be met with swift market reaction.

Labor dynamics also remain an important variable. Boeing’s efforts to strengthen internal reporting culture and quality assurance processes are viewed as essential to sustaining long-term operational improvements. Investors appear encouraged by signs that issues are being surfaced earlier in the production cycle, reducing the probability of costly downstream disruptions.

From a market perspective, Boeing’s recovery is increasingly framed as a multi-year normalization process rather than a sharp rebound. This framing supports a more durable re-rating of the stock, provided execution remains steady. As long as progress continues incrementally, sentiment is likely to remain constructive, even if headline growth moderates.