Market action beneath the surface tells a different story than headline numbers suggest. While the S&P 500 remained essentially unchanged on January 8, money flowed aggressively into sectors that had been underperforming for months. Unirock Gestion senior financial analysts examine how defense stocks and small caps are reshaping portfolio allocations.

Military Spending Creates Winners

Defense contractors surged after the US President announced plans to increase military spending by 50% to $1.5 trillion annually. Northrop Grumman and Lockheed Martin both surged as much as 8% before moderating their gains. This follows Wednesday’s turbulence when the same stocks fell due to dividend payment restrictions.

The whipsaw action reflects uncertainty about policy execution. One day, corporate capital allocation is threatened, and the next, it promises massive revenue growth. Institutional money is betting that the spending increase matters more than buyback limitations.

Small Caps Hit Records While Tech Stumbles

Small-cap benchmarks reached all-time highs as the Russell 2000 extended its rally from January. This contrasts sharply with the Nasdaq 100’s 0.6% decline, driven by weakness in Nvidia and Apple. The rotation suggests investors are pricing in different economic conditions than those that favor mega-cap technology.

Historically, small-cap strength has signaled confidence in domestic economic expansion. These companies generate most revenue stateside, making them direct plays on US growth. The record highs also indicate expectations that smaller firms will benefit from defense spending multipliers.

Sector Performance Splits Wide

Eight of eleven S&P 500 sectors closed lower, yet the index stayed nearly flat. Utilities dropped 2.5%, industrials fell 1.9%, and materials declined 1.6%. Healthcare added 1%, providing the day’s defensive support.

This divergence matters more than the movement of the aggregate index. Portfolio managers are repositioning their portfolios aggressively, rather than simply buying or selling equities broadly. The shift from growth to value represents strategic reallocation.

Labor Data Complicates Fed Outlook

Weaker employment reports eased inflation concerns but raised questions about economic momentum. Job openings hit a 14-month low at 7.146 million. Private payrolls added just 41,000 positions, well below expectations.

Markets interpreted this as reducing pressure on the Federal Reserve to maintain restrictive policy. Yet slow hiring could signal demand weakness rather than inflation normalization. The divergence between service strength and job creation creates analytical tension.

January Indicators Point Higher

The first five trading days delivered a 1% gain for the S&P 500. Historical patterns show positive returns in this period and predict full-year gains 83% of the time since 1950. Combined with January’s broader seasonal indicator, the setup appears constructive.

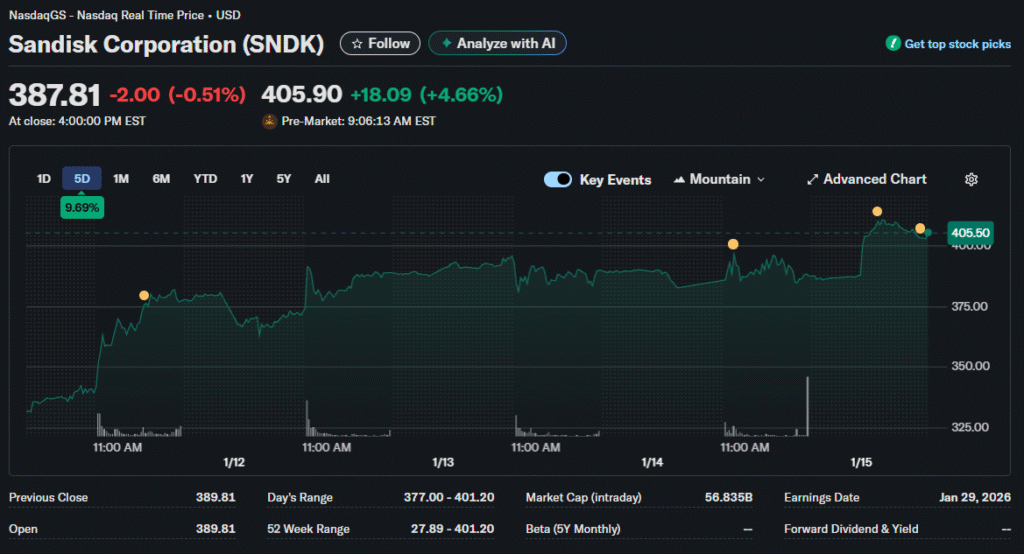

Top 2026 performers include Sandisk, up 32%; Moderna, up 19%; and LAM Research, up 16%. These gains span technology, biotechnology, and semiconductors. Breadth expansion beyond mega caps supports the bullish seasonal narrative.

Housing Stocks React to Policy Proposals

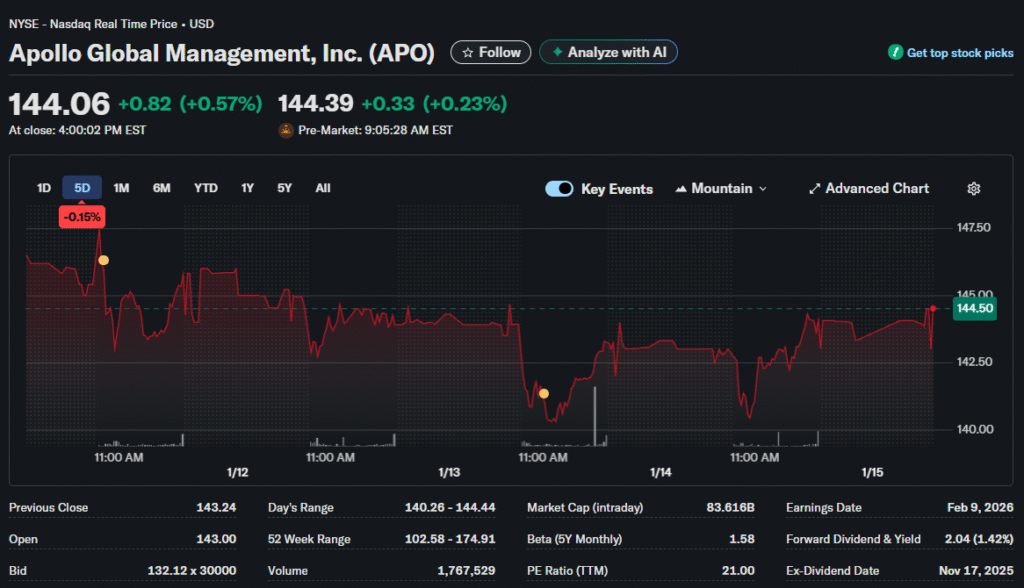

Institutional buyer restrictions triggered sharp declines in housing acquisition companies. Apollo Global Management fell 5.5% while American Homes 4 Rent dropped 4.3%. The proposals aim to reduce competition for individual homebuyers from well-capitalized institutions.

This policy discussion reflects broader concerns about affordability. Rising home prices, driven partly by institutional demand, have priced out traditional buyers. Markets are now weighing reduced growth opportunities against potential regulatory compliance costs.

Volume Patterns Signal Conviction

Trading volume surged across defense and small-cap names, confirming genuine reallocation rather than technical noise. Heavy volume on advancing stocks typically precedes sustained moves. Light volume rallies often reverse quickly when profit-taking begins.

The Dow Jones Industrial Average slipped 0.9% or 466 points to close at 48,996. Twenty-three components ended negatively, while seven finished positively. This internal weakness contradicts the small-cap strength, suggesting divergent views on the economic trajectory.

Energy Sector Lags Broader Rally

Consumer companies joined the rotation as investors bet on domestic spending strength. Energy stocks remained subdued despite geopolitical tensions that typically support crude prices. The divergence suggests traders expect supply increases to offset demand growth.

Materials weakness reflects concerns about global manufacturing activity slowing. Copper and aluminum prices face pressure from reduced industrial orders. These commodity signals conflict with optimistic equity market positioning.

Options Activity Shows Defensive Positioning

Put option volumes increased relative to calls, indicating hedging activity despite market gains. Smart money protects downside while maintaining upside exposure through stock ownership. This behavior suggests professionals remain cautious despite seasonal bullishness.

Volatility measures stayed elevated compared to recent months. The VIX index hasn’t collapsed despite market strength, signaling ongoing uncertainty. Sustained low volatility typically accompanies genuine bull market advances.

Looking Beyond Headlines

Surface level index stability masks significant capital flows underneath. Defense spending announcements, small cap strength, and sector rotation all point to changing market leadership. The January effect remains in play, but portfolio composition matters more than aggregate returns.

Investors should monitor whether defense stocks maintain momentum through budget implementation phases. Small cap sustainability depends on economic data confirming expansion rather than contraction. The gap between sector winners and losers will likely widen before consolidating.

Labor market cooling combined with services expansion creates a narrow path for soft landing scenarios. Rate sensitive sectors like real estate and banks face crosscurrents from policy uncertainty. Tactical positioning around these divergences offers better opportunities than passive index exposure.