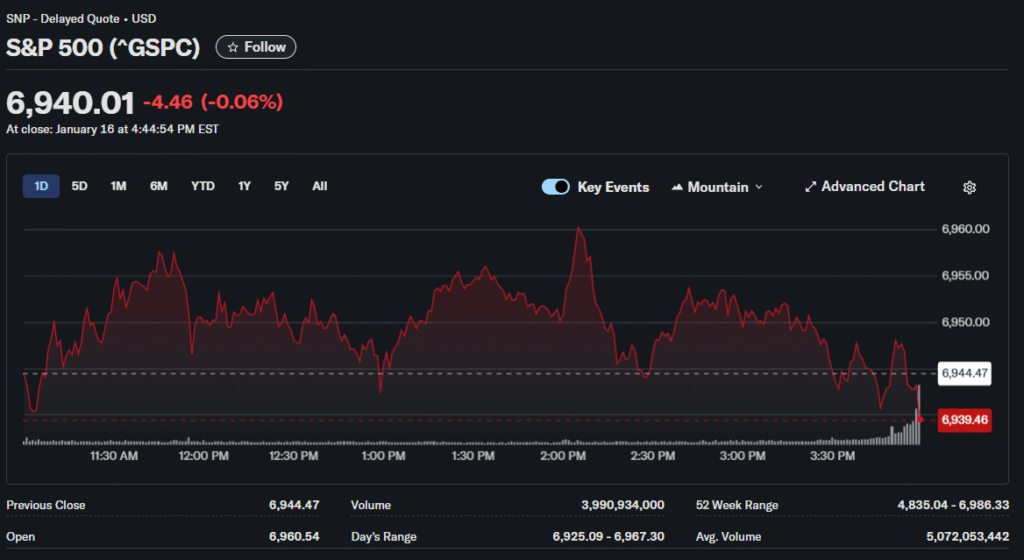

Trading resumes Tuesday after Martin Luther King Jr. Day closure as investors assess early 2026 trends and prepare for major earnings releases. The S&P 500 sits at 6,940 heading into the week with semiconductor stocks showing particular strength. Cyrosalnix lead finance experts examine how the extended weekend positions markets for the remainder of January.

Holiday Pattern Creates Setup

Markets closed Monday for the federal holiday marking the first full trading halt since New Year’s Day. Both the NYSE and Nasdaq observed complete shutdowns with no pre-market or after-hours activity. Regular sessions resume Tuesday at 9:30 AM Eastern Time running through the standard 4 PM close.

The three-day weekend created gaps between Friday’s closing prices and Tuesday’s opening levels. These gaps often produce volatility as pending orders accumulate during market closures. Institutional traders typically use extended weekends to reassess positions and adjust strategies.

January Effect Gains Attention

Historical patterns suggest markets often rally following the New Year and MLK Day break. This phenomenon known as the January Effect has shown 84% accuracy dating back to 1972. The first five trading days particularly matter as they tend to predict full-year direction.

The benchmark index already posted a 1% gain across the initial five sessions of 2026. This positive start historically translates to full-year advances roughly 83% of the time. Investors watch these early indicators while acknowledging past performance doesn’t guarantee future results.

Earnings Season Accelerates

Major technology companies report results in coming days creating potential catalysts for market moves. Intel kicks off tech earnings this week despite facing operational challenges. Apple, the Tesla CEO’s company, Meta, and Microsoft announce results the following week.

Banking sector earnings already revealed mixed messages about consumer credit and net interest income trends. Financial stocks face headwinds from proposed credit card rate caps and concerns about loan growth. Technology remains the primary driver of index-level performance.

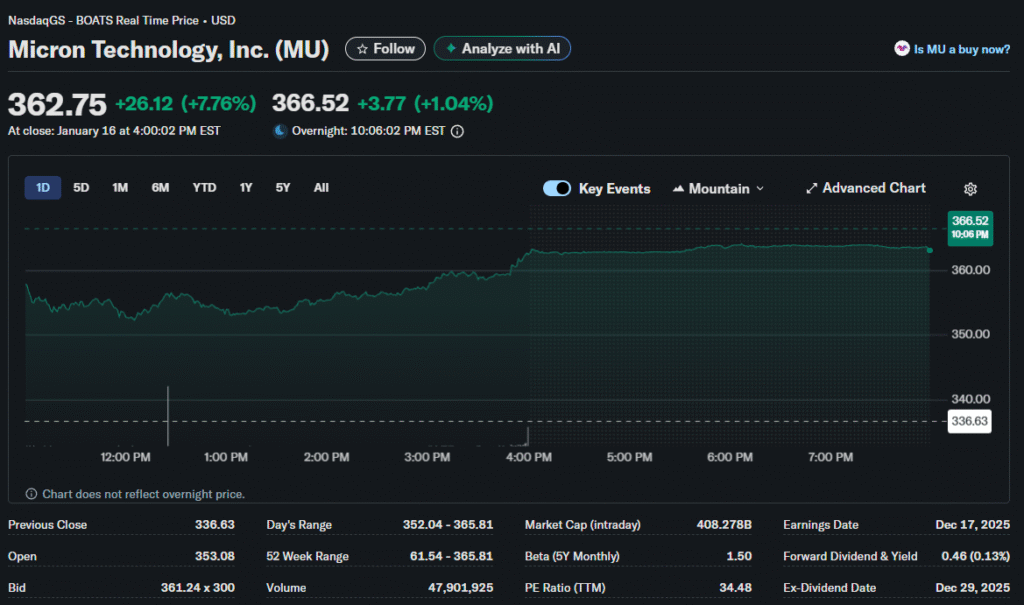

Semiconductor Strength Continues

Chipmakers rallied strongly to start 2026 following another exceptional year of AI-driven gains. Micron Technology jumped 10% while ASML surged 9% in early January trading. Lam Research and Intel both gained more than 6% as investors piled into the sector.

Taiwan Semiconductor Manufacturing reported 35% year-over-year profit growth beating analyst expectations significantly. The company boosted capital spending guidance for 2026 signaling confidence in sustained AI infrastructure buildout. This optimism lifted US-listed chipmakers across the board.

Valuation Concerns Persist

Bank of America strategists noted the S&P 500 has never been more expensive across multiple metrics they track. The index trades at elevated multiples relative to historical averages raising questions about sustainability. Risks abound in 2026 according to their assessment despite continued bullish sentiment.

However, many strategists maintain that strong corporate earnings growth can justify current valuations. Wall Street forecasters tracked by Bloomberg unanimously predict stocks rally for a fourth consecutive year. The consensus sees year-end targets clustering around 7,500 to 8,000 for the S&P 500.

Fed Policy Remains Focus

Monetary policy expectations continue influencing market direction as traders anticipate Federal Reserve decisions. Markets price in two quarter-point rate cuts during 2026 though the January meeting likely produces no change. Labor market weakness supports easing expectations despite persistent inflation concerns.

Fed Chair Powell faces ongoing political pressure while maintaining independence. The US President criticized the central bank chief publicly and threatened actions against Fed officials. These tensions create uncertainty around monetary policy frameworks that markets prefer to avoid.

International Markets Diverge

European markets reached record highs with the pan-European Stoxx 600 climbing during Monday trading. Asian markets showed mixed performance as regional factors outweighed US holiday impacts. The iShares MSCI Emerging Markets ETF hit an all-time intraday high dating back to 2003.

Global divergence creates opportunities for international diversification while complicating allocation decisions. Emerging markets outperformed US equities during 2025 reversing multi-year trends. Whether this rotation continues depends on dollar strength and growth differentials.

Technical Levels Matter

The S&P 500 pulled back from record territory posting two consecutive losing sessions before the holiday. Technical analysts watch support levels around 6,900 while resistance appears near recent highs. Volume patterns and breadth indicators provide additional clues about underlying market health.

The Nasdaq Composite showed relative weakness falling 1% in recent sessions as technology stocks faced selling pressure. Chip stocks reversed some losses but remained vulnerable to profit-taking after substantial gains. Sector rotation between growth and value continues as investors rebalance portfolios.

Week Ahead Brings Tests

Markets face multiple hurdles including key economic data releases and geopolitical developments. Producer price index numbers and housing data provide inflation and growth indicators. Consumer sentiment readings offer insights into spending patterns and economic confidence.

The trading week determines whether early 2026 momentum continues or markets consolidate recent gains. Extended weekend gaps combined with earnings catalysts create potential for significant moves. Investors balance optimism about AI-driven growth against valuation concerns and policy uncertainty.