With economists split on the outlook for the U.S. and global economy, investors are increasingly focused on identifying stocks that can remain resilient during periods of slowing growth or a potential recession.

Brokers from Unirock Gestion have closely examined Walmart’s fundamentals and highlight its low-price, high-volume operating model as a key strength. This approach allows the retailer to attract budget-conscious consumers while maintaining steady traffic, even when spending tightens.

According to analysis, Walmart’s scale, cost discipline, and focus on everyday essentials position it to absorb economic pressure, even if market volatility intensifies in 2026 and beyond and consumer spending patterns continue to evolve.

Economic Uncertainty Puts Defensive Stocks in Focus

Concerns surrounding a cooling labor market, persistent cost pressures, and uneven consumer confidence have increased speculation that economic growth could slow meaningfully in the coming quarters. While a recession may not materialize immediately, history shows that economic downturns are inevitable, and when they arrive, equity markets rarely avoid volatility.

Importantly, not all companies respond to economic stress in the same way. Many discretionary retailers are already experiencing softer demand as consumers tighten spending. Walmart, however, operates under a fundamentally different, price-driven model that has historically performed well during periods of economic strain, as shoppers prioritize value, essentials, and affordability.

Understanding Walmart’s Core Business Model

Walmart operates a global retail network anchored by its flagship Walmart stores and its membership-based warehouse chain, Sam’s Club. The majority of revenue is generated through Walmart’s U.S. operations, which remain the backbone of the company.

Since opening its first store in the early 1960s, Walmart has built its brand around everyday low prices. According to brokers, this is not merely a marketing slogan; it is a deeply embedded operational strategy. Walmart maintains strict cost controls across procurement, logistics, labor optimization, and inventory management, allowing it to consistently underprice competitors.

In periods of economic stress, this pricing discipline becomes a competitive advantage as households actively seek ways to stretch their budgets.

Strategic Investments Strengthen Competitive Position

Walmart has not relied on price alone. Over recent years, the company has made substantial investments in technology and infrastructure to keep pace with, and in some cases, challenge Amazon.

Capital expenditures have been directed toward:

- Supply chain automation

- Same-day pickup and delivery services

- Customer-facing digital tools

- Data-driven inventory optimization

These initiatives improve convenience while preserving Walmart’s cost leadership, a combination brokers view as particularly resilient in uncertain economic conditions.

Consumer Behavior Signals Defensive Strength

Recent performance data supports this view. During Walmart U.S.’s fiscal third quarter, same-store sales increased 4.5%, driven by higher customer traffic and increased spending per visit. Notably, 1.8 percentage points of that growth came from traffic alone, suggesting more shoppers are actively choosing Walmart.

Management also noted an influx of higher-income consumers, a trend observed previously during the Great Recession when affluent households shifted spending toward value-oriented retailers. Analysts believe this dynamic could repeat itself in the next downturn, reinforcing Walmart’s revenue stability.

Stock Performance and Valuation Considerations

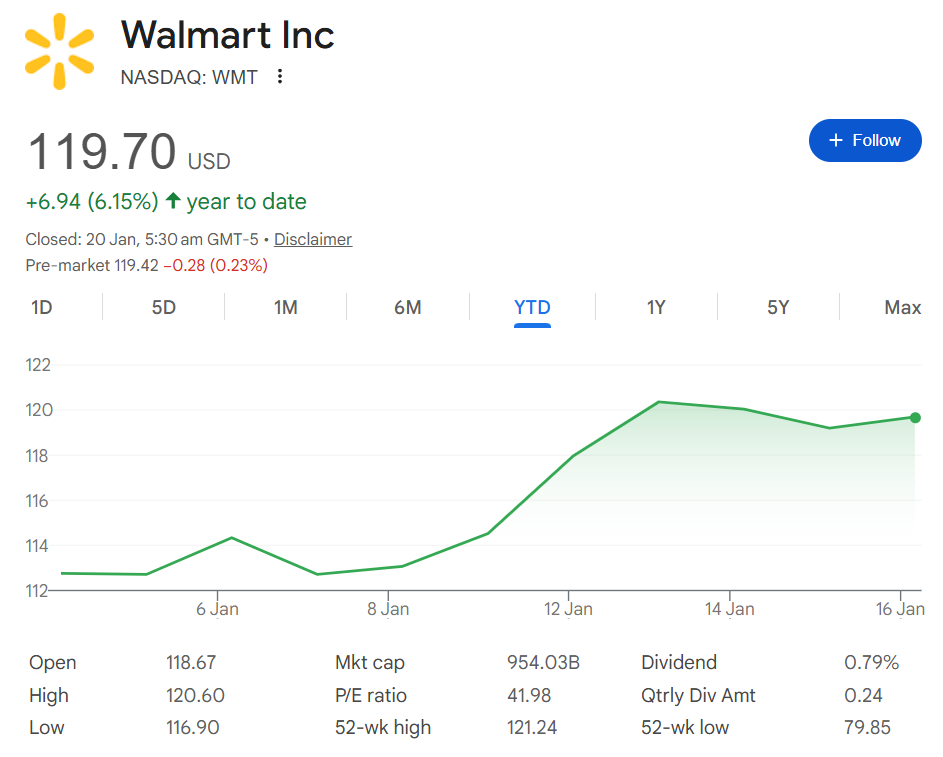

Walmart shareholders have been rewarded for this defensive consistency. Over the past year, the stock has gained 31.2%, significantly outperforming the S&P 500, which rose roughly 19% over the same period.

This performance, however, has pushed valuation higher. Walmart currently trades at a price-to-earnings ratio of approximately 42, up from 37 a year ago. By comparison, the broader market trades closer to a P/E multiple of 31.

At first glance, this premium may appear steep, especially for a mature retailer. But brokers argue that valuation should be considered in context.

Why a Premium May Be Justified

Unlike cyclical retailers that suffer sharp earnings declines during recessions, Walmart has demonstrated an ability to maintain traffic, protect margins, and even gain market share during economic slowdowns. Its scale, purchasing power, and logistical efficiency create barriers that are difficult for competitors to replicate.

Additionally, Walmart’s continued investment in digital capabilities positions it well for long-term shifts in consumer behavior, blending physical retail dominance with growing e-commerce relevance.

From a risk-adjusted perspective, brokers believe Walmart’s consistency across economic cycles justifies a higher-than-average multiple, particularly for investors seeking stability rather than aggressive growth.

Final Outlook

Walmart appears structurally well-equipped to handle the next economic downturn, whenever it may arrive. While no stock is immune to market-wide declines, Walmart’s:

- Price leadership

- Operational discipline

- Technology investments

- Proven recession performance

Make it a compelling defensive holding.

For long-term investors prioritizing durability and steady performance over short-term valuation concerns, analysts see Walmart as a stock built not just to survive economic stress but potentially to emerge stronger from it.