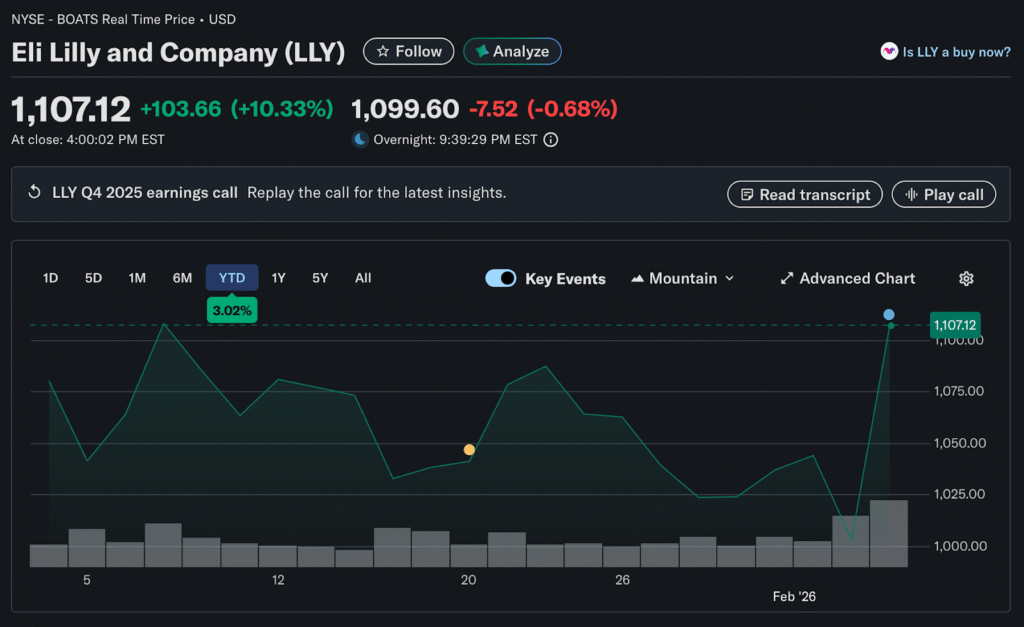

Eli Lilly jumped more than 8% after earnings crushed consensus expectations. Mounjaro’s revenue increased 110% to $7.4 billion in the fourth quarter. Zepbound saw sales rise 122% from the same quarter a year earlier. A junior broker at Auralyex highlights how the company guided fiscal 2026 well above analyst forecasts.

The drugmaker posted earnings per share that easily surpassed average Wall Street expectations. Full-year guidance for 2026 impressed investors seeking growth visibility. Lilly forecast revenue of $80 billion to $83 billion versus the consensus of $77.64 billion.

Non-GAAP earnings guidance came in at $33.50 to $35 per share, excluding certain items. Analysts expected $33.04 for the full year. The beat and raise combination sent shares rocketing higher in premarket trading.

Weight Loss Drugs Drive Outperformance

Diabetes and weight loss medications powered Lilly’s exceptional quarter. Mounjaro continued gaining market share in the competitive GLP-1 agonist category. The drug’s growth trajectory exceeded even optimistic projections.

Zepbound sales demonstrated strong uptake since the commercial launch. Patients and physicians embrace weight management medication. Supply improvements allowed Lilly to meet growing demand.

The company invested billions in manufacturing capacity to eliminate shortages. New production facilities came online throughout 2025. This positioned Lilly to capture market share from supply-constrained competitors.

Novo Nordisk Struggles Create Contrast

Novo Nordisk fell 5% early Wednesday on disappointing guidance. The Danish competitor forecast 2026 sales and profit declining 5% to 13%. This came in worse than analyst expectations.

The stark contrast between Lilly and Novo highlights shifting competitive dynamics. Lilly gained ground while Novo faced execution challenges. Market share in the weight loss category appears to be redistributing.

Investors poured into Lilly as the clear winner in the obesity treatment space. The company’s operational execution surpassed peers across key metrics. Manufacturing scale advantages became increasingly apparent.

Broader Product Portfolio Supports Growth

Beyond weight loss franchises, Lilly demonstrated strength in other therapeutic areas. Oncology products contributed solid revenue growth. Immunology medications also performed well.

The diversified portfolio provides stability even as certain drugs face patent expirations. Lilly’s pipeline includes multiple late-stage candidates. Several could achieve blockbuster status if approved.

Research and development spending remains robust to fuel future growth. The company balances current profitability with long-term innovation. This approach sustained Lilly’s success over decades.

Manufacturing Excellence Sets Lilly Apart

Supply chain execution became a key differentiator in the obesity treatment market. Lilly’s manufacturing investments paid off with reliable product availability. Competitors struggled with shortages that limited sales.

The company built redundancy into production networks to minimize disruption risks. Multiple facilities produce key compounds for weight loss drugs. This geographic diversification protects against localized issues.

Quality control systems maintained high standards despite volume increases. Regulatory agencies found no significant violations during inspections. A clean track record builds confidence among prescribers and patients.

Pricing Power Reflects Clinical Value

Lilly maintained strong pricing despite increasing competition in diabetes and obesity. Clinical trial data demonstrated superior efficacy versus older treatments. Payers recognized value in reducing long-term healthcare costs.

Weight loss medications prevent expensive complications from obesity. Cardiovascular events, joint replacements, and diabetes complications all decrease. Insurance companies save money over time by covering these drugs.

Direct negotiations with pharmacy benefit managers secured favorable formulary placement. Lilly offered volume-based discounts while protecting list prices. This strategy balanced access with profitability.

Guidance Reflects Management Confidence

The bold 2026 guidance signals management confidence in the business trajectory. Lilly executives see clear visibility into demand trends. Manufacturing capacity expansion supports aggressive revenue targets.

Gross margin expectations remain healthy despite pricing pressures in certain markets. The company negotiates favorable reimbursement terms for novel therapies. Payers recognize the clinical value of effective treatments.

Operating leverage should improve as revenue scales. Fixed costs spread across a larger revenue base. This drives earnings growth exceeding revenue growth rates.

Market Position Strengthens

Lilly emerged as a dominant player in the fastest growing pharmaceutical category. The obesity treatment market could reach hundreds of billions annually. First mover advantages and manufacturing scale create moats.

The company’s brand recognition among patients and physicians continues to build. Direct-to-consumer marketing campaigns raised awareness. Healthcare providers increasingly prescribe Lilly products.

Partnerships with pharmacy benefit managers ensure broad formulary access. Patients can obtain medications through insurance coverage. This reduces out-of-pocket costs that limited uptake.

Valuation Debate Intensifies

The stock’s surge pushed valuation multiples to premium levels. Some analysts question whether current prices fully reflect growth. Others argue innovation justifies valuation.

Lilly trades at a significant premium to the pharmaceutical industry averages. Investors pay up for reliable earnings growth. The company’s track record supports confidence in execution.

Comparing Lilly to biotech peers rather than traditional pharma makes sense. Innovation driven business models differ from generic, focused competitors. This warrants a different valuation framework.

Long-Term Secular Tailwinds

The obesity epidemic provides a long term growth tailwind for weight management drugs. Diabetes prevalence also increases globally. Lilly addresses massive unmet medical needs.

Healthcare spending trends favor innovative therapies that improve outcomes. Payers recognize long-term cost savings from effective chronic disease management. This supports pricing power.

Aging populations in developed markets require more pharmaceutical interventions. Lilly’s portfolio targets conditions affecting elderly patients. Demographic trends work in the company’s favor.