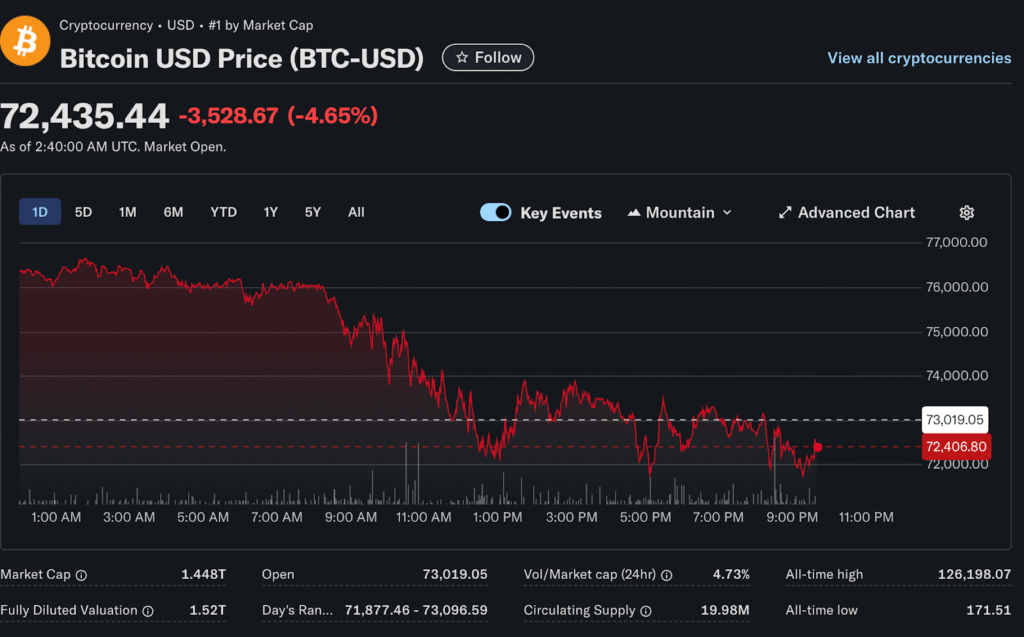

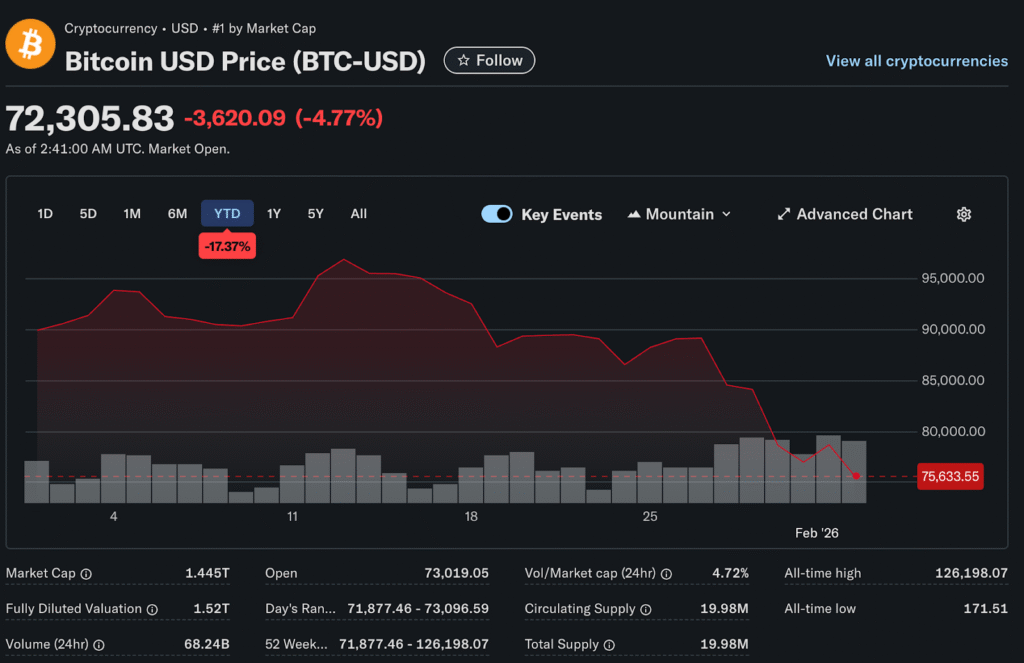

Bitcoin extended its selloff on Wednesday, falling more than 3% after breaking below $73,000. Senior finance analyst at Auralyex walks through how the cryptocurrency tumbled from above $83,000 over the weekend to $74,570 at the lows.

The decline pushed Bitcoin to its lowest level since April 2025. The cryptocurrency is down sharply from a record high of above $126,000 reached in October. Forced selling accelerated as technical support levels gave way.

Asian equity futures fell in early trading as the tech selloff gained pace. Hong Kong, South Korea, and Australia index futures all declined. The declines echoed the 0.5% fall for the S&P 500 in the U.S. session.

Technical Breakdown Triggers Additional Selling

The Nasdaq 100 saw its worst two-day rout since October. The index breached its 100-day moving average during Wednesday’s trading. Technical analysts view this level as a harbinger for potential additional losses.

Bitcoin’s correlation with risk assets remained strong as markets sold off. The cryptocurrency typically moves with technology stocks during volatility. This pattern persisted through recent turbulence.

Liquidations accelerated as Bitcoin fell through key support zones. Leveraged long positions stopped out automatically. This created cascading selling pressure that pushed prices lower.

Precious Metals Crash Weighs on Alternative Assets

The violent selloff in gold and silver spilled over to cryptocurrency markets. Both asset classes attracted speculation during recent rallies. Chinese retail investors participated heavily in both markets.

Gold had surged to near $5,600 per ounce before crashing. Silver peaked above $121 before plunging 28% in a single day. The precious metals correction prompted reassessment of all alternative assets.

Bitcoin has been trading as digital gold in recent months. The narrative supported prices during geopolitical tensions. However, the correlation broke down when real gold crashed.

Fed Chair Nomination Creates Policy Uncertainty

Kevin Warsh’s nomination as the next Federal Reserve chair added to market uncertainty. Investors debated implications for monetary policy and dollar strength. Bitcoin typically benefits from loose monetary conditions.

The Dollar Index rebounded from four-year lows following the announcement. A stronger dollar creates headwinds for dollar-denominated assets. Bitcoin faces pressure when the greenback rallies.

Interest rate expectations also shifted on nomination news. Markets reduced bets on additional Fed rate cuts. Higher rates increase the opportunity cost of holding non-yielding assets.

Institutional Demand Shows Signs of Cooling

Bitcoin ETF flows turned negative in recent sessions. Retail and institutional investors reduced exposure to cryptocurrency. The withdrawal of capital accelerated price declines.

Futures open interest declined from recent peaks. Traders reduced leverage across cryptocurrency derivatives. Lower open interest suggests positioning became less aggressive.

On-chain metrics showed long-term holders distributing coins. Wallets that accumulated at lower prices took profits. This selling pressure added to market weakness.

South Korean Market Volatility Spreads

South Korea’s Kospi index sank 5.26% on Monday in the worst day since April. The market had its worst session in months amid AI spending concerns. Korean tech and chip companies plummeted.

The selloff in South Korean equities coincided with Bitcoin weakness. Korean cryptocurrency exchanges saw heavy selling volume. Retail traders in Korea actively participate in both markets.

The country’s stock market soared 76% in 2025 on AI enthusiasm. Profit-taking after extraordinary gains created vulnerability. Bitcoin faced similar dynamics after the massive 2025 rally.

Analysts Debate Whether Bottom Is In

Some analysts argued that Bitcoin found support around the $74,000 to $75,000 levels. These price zones represented prior resistance that should now act as support. Technical reversal patterns could emerge.

Others warned that momentum remains negative across time frames. The cryptocurrency needs to reclaim $80,000 to stabilize. Further weakness below $70,000 could trigger another leg down.

Sentiment indicators showed extreme fear among cryptocurrency traders. Historically, such readings mark bottoms or near bottoms. Contrarian investors look for opportunities during panic selling.

Macro Environment Remains Challenging

Risk assets broadly faced selling pressure as investors fled to safety. Technology stocks led market declines. Software companies experienced the worst selloff in months.

The rotation out of speculative assets benefited defensive sectors. Utilities, consumer staples, and healthcare attracted flows. Bitcoin struggled in this risk-off environment.

Geopolitical tensions eased somewhat, removing one support for alternative assets. Markets focused more on fundamentals and less on tail risks. This shift hurt Bitcoin’s safe haven narrative.

Long Term Holders Maintain Conviction

Despite short-term volatility, long-term Bitcoin holders maintained positions. On-chain data showed minimal selling from wallets holding for over one year. Conviction remained strong among early adopters.

Institutional adoption continued despite price weakness. Companies added Bitcoin to corporate treasuries. Pension funds and endowments increased allocations modestly.

The infrastructure supporting Bitcoin matured significantly over the past year. Regulated exchanges, custody solutions, and derivative products expanded. This institutional framework supports long-term viability.

Market participants watch key technical levels for signs of stabilization. Bitcoin needs to base before attempting a recovery rally. The path forward depends on broader risk sentiment and macro conditions.