Amazon’s latest earnings report sent shockwaves through Wall Street, but not for the reasons most expected. The e-commerce and cloud computing behemoth announced plans to pour $200 billion into capital expenditures for 2026, a staggering 60% increase from the $125 billion earmarked for 2025.

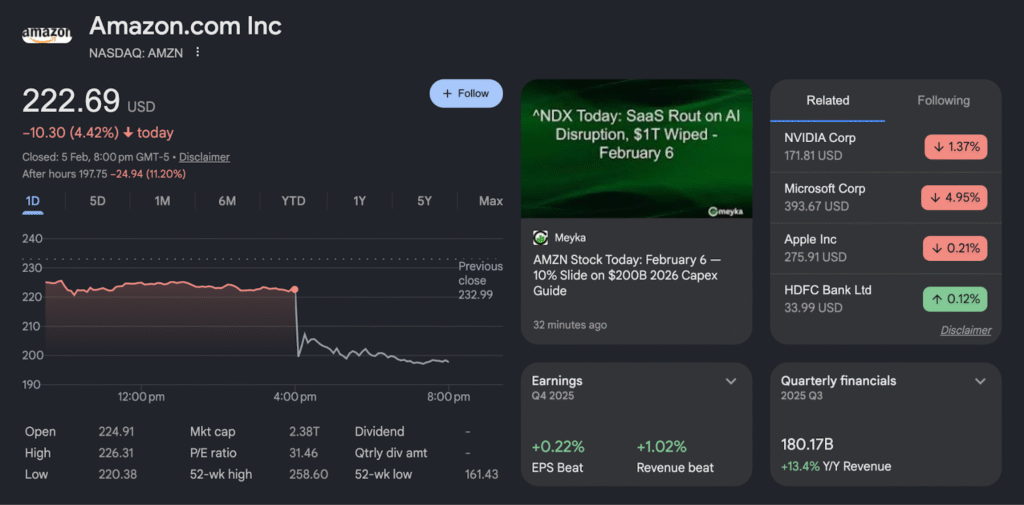

Senior financial analysts at Yureplex examined the fallout, which saw shares plummet 4.42% in regular trading and another 10.13% in after-hours sessions.

The spending spree comes as CEO Andy Jassy doubles down on artificial intelligence infrastructure, custom chips, robotics, and low-earth orbit satellites. Yet investors responded with panic rather than enthusiasm, wiping out billions in market value within hours of the announcement.

The Numbers Behind the Selloff

Amazon reported fourth-quarter earnings per share of $1.95 on revenue of $213.4 billion. While AWS revenue hit $35.6 billion, exceeding analyst expectations of $34.9 billion, the guidance for first-quarter operating income fell short. The company projected between $16.5 billion and $21.5 billion, missing the $22.2 billion consensus estimate.

This revenue miss, combined with the massive capital expenditure announcement, triggered immediate concerns about near-term profitability. Markets already jittery from similar announcements by Google and Microsoft couldn’t stomach another tech giant prioritizing AI infrastructure over immediate returns.

Why Markets Are Spooked

Financial experts point to a pattern emerging across Big Tech. Companies are simultaneously slashing headcount while ramming capital into AI projects with uncertain payoff timelines. Amazon’s decision to cut 16,000 jobs while spending $200 billion creates a narrative disconnect that troubles investors.

The timing compounds the problem. Google announced $185 billion in AI spending for 2026, nearly doubling its 2025 budget of $91.4 billion. Microsoft and Meta made similar commitments, yet market reactions varied wildly. Meta’s shares climbed while Microsoft dropped 17% year-to-date despite comparable strategies.

This inconsistent market response suggests investors are growing selective about which AI bets they’ll fund. Amazon’s execution risk appears higher given its sprawling business model spanning retail, logistics, cloud services, and now satellite internet.

AWS Carries the Weight

Amazon’s cloud division remains the profit engine funding these ambitious projects. AWS delivered solid growth, but analysts question whether even this cash cow can sustain a $200 billion annual burn rate while maintaining margins.

Competition intensifies as Microsoft Azure and Google Cloud aggressively court enterprise customers. AWS market share, while still dominant, faces pressure from rivals offering integrated AI tools and competitive pricing. The capital expenditure surge suggests Amazon recognizes it must spend now or risk losing ground in the AI arms race.

Retail Restructuring Signals Deeper Issues

Buried in the earnings announcement was news that Amazon is closing its Amazon Fresh and Amazon Go stores, replacing some with Whole Foods locations. This retreat from experimental retail formats indicates the company is pruning operations that don’t meet profitability thresholds.

The move contradicts earlier narratives about Amazon revolutionizing brick-and-mortar shopping through technology. After years of investment and hype, the company essentially admits these concepts didn’t scale economically. Investors now wonder if the AI spending spree might follow a similar trajectory.

Job Cuts Meet Spending Surge

The paradox of cutting 16,000 workers while committing $200 billion to infrastructure projects creates uncomfortable optics. Management frames the layoffs as removing bureaucratic layers and increasing ownership accountability. Yet the juxtaposition highlights how AI investments prioritize technology over human capital.

This shift reflects broader trends across technology companies. Flatter organizational structures and AI automation promise efficiency gains, but the transition period creates uncertainty. Employees face displacement while shareholders absorb massive capital outlays with delayed returns.

What Comes Next

Amazon’s stock performance will depend on whether AI investments will translate to revenue growth and margin expansion. The company needs to demonstrate that $200 billion in spending produces measurable business outcomes beyond vanity metrics like compute capacity or model parameters.

Investors want proof that AI features drive customer acquisition, retention, and higher transaction values. AWS clients need compelling reasons to choose Amazon’s AI stack over alternatives. Retail shoppers must see tangible benefits from AI-powered recommendations and logistics.

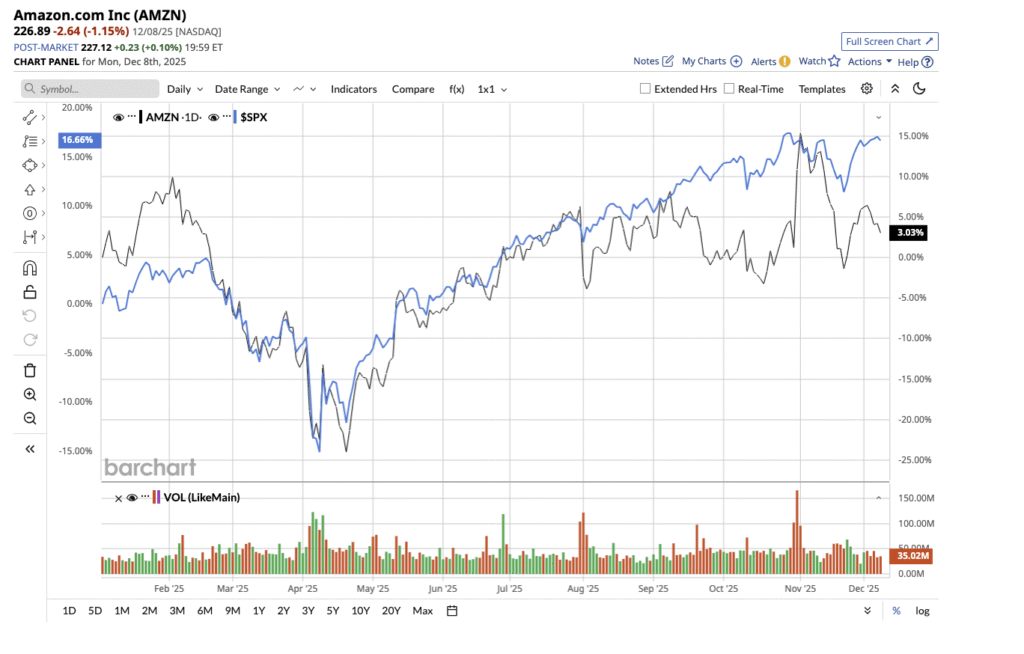

Reading the Market Temperature in 2026

The -3.6% year-to-date performance for Amazon shares pales compared to Microsoft’s -17% decline, but still reflects erosion of confidence. Markets are recalibrating expectations for Big Tech, demanding evidence that AI spending generates returns rather than just revenue growth.

Volatility will likely persist as each earnings season brings fresh spending announcements and incremental progress reports. Companies that show clear monetization paths will outperform those offering vague promises about transformative potential.

Amazon has the resources and technical talent to execute on its AI vision. Whether it has the patience of investors to see the strategy through remains an open question. The next few quarters will reveal if $200 billion buys a competitive advantage or just an expensive lesson in market timing.