The precious metals market witnessed extraordinary turbulence on Friday as silver prices experienced whipsaw movements that revealed fundamental structural weaknesses. After plummeting 10% in early trading, the metal staged a dramatic reversal within hours, highlighting dangerous liquidity gaps that transform what should be a stable asset into a high-stakes gamble.

Senior commodity analysts at Yureplex investigated how January’s gains vanished in just days, creating volatility patterns unseen in over four decades.

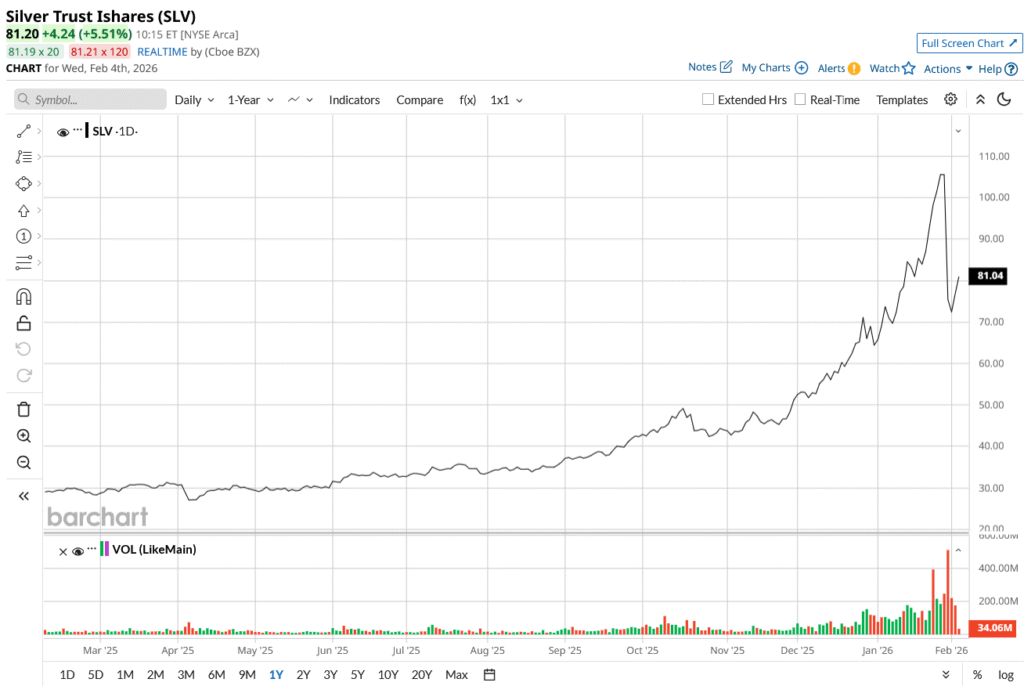

The metal’s trajectory tells a stark story. From peak valuations on January 29, silver surrendered roughly 40% of its value across three trading sessions. This wasn’t gradual profit-taking from satisfied investors. This was forced capitulation as overleveraged positions collapsed under their own weight.

The Liquidity Mirage

What makes recent trading particularly alarming is how quickly normal market functioning broke down. In healthy markets, willing buyers meet willing sellers at reasonable spreads. That mechanism failed spectacularly for silver.

Saxo Bank’s commodity strategy head Ole Hansen identified the core dynamic: as volatility surges, the very entities that normally provide market stability retreat. Spread widening happens precisely when tight pricing matters most. Balance sheet capacity gets pulled back when absorption is desperately needed.

Gold experienced similar pressure but maintained relative order thanks to deeper markets and broader participation. Silver’s smaller ecosystem couldn’t handle the stress test. The $64 per ounce lows on Friday morning demonstrated how quickly prices can spiral when intermediaries step aside.

Borrowed Money Burns Fast

Financial strategists traced the crisis to January’s speculative buildup. Exchange-traded products offering leveraged exposure attracted investors seeking amplified returns. Call option volumes swelled as participants bet on continued appreciation.

This created enormous synthetic exposure backed by relatively little actual capital. Borrowed money funded positions that looked profitable on paper until sentiment reversed. Then the unwinding began.

Margin requirements forced sellers into markets already falling. Those sales triggered protective stop-loss orders from other holders. Each wave of selling begat another, creating downward spirals that overwhelmed available buying interest.

The mathematics of leverage work beautifully during rallies. Every dollar committed controls multiple dollars of exposure, multiplying gains. That same mathematics becomes devastating when positions move against holders. Small declines trigger outsize losses, forcing exits that accelerate the very moves causing pain.

Technology Amplifies Everything

Comparing current events to 1980 provides important context. That era saw silver reach $50 amid the Hunt brothers’ attempted market corner before collapsing below $11.

Today’s volatility, while severe, hasn’t matched those extremes. However, modern market structure introduces new amplification mechanisms unknown four decades ago.

Algorithmic trading systems execute orders in microseconds based on technical signals. Leveraged ETF products must mechanically adjust holdings to maintain target ratios. Options markets create hedging flows as dealers manage risk exposure.

These innovations enable faster position building during rallies and more violent unwinding during crashes. Technology that promised improved efficiency sometimes magnifies instability.

January’s Perfect Storm Fades

Multiple tailwinds drove January’s surge. Geopolitical tensions elevated safe-haven demand. Questions around Federal Reserve independence sparked precious metals buying. Speculative momentum attracted trend followers.

That combination created powerful upward pressure. Participants piled into leveraged, too many bulls, insufficient skeptics.

When sentiment cracked at month-end, the reversal was savage. January 30 recorded silver’s largest single-day decline ever. Gold posted its worst performance since 2013 that same session. Markets have struggled to find equilibrium since.

The Spread Problem

Market makers quote bids and ask prices, earning the spread while managing inventory risk. This function requires capital and tolerance for temporary adverse moves.

During calm periods, tight spreads reflect competitive market making and adequate liquidity. Buyers and sellers transact near fair value with minimal friction.

Stress changes everything. Spreads widen dramatically as market makers protect themselves. The gap between what buyers offer and what sellers demand can expand by multiples.

Investors attempting exits face reality: selling at any available price often means substantial discounts to recent marks. This realization triggers panic and further selling pressure. The liquidity that appeared abundant during good times proves illusory when needed.

Where Prices Find Floor

Speculative positions eventually reach exhaustion. Leveraged longs get liquidated. Momentum traders exit. At some point, prices fall far enough that strategic buyers emerge.

For silver, industrial demand provides ultimate support. Manufacturers need the metal for tangible production purposes. Solar panel makers, electronics companies, and medical device producers represent real consumption.

However, that floor sits considerably below recent price levels. Industrial buyers won’t rush in at $64 when they expect lower prices ahead. Their demand activates much lower, offering little comfort to those who bought January’s peak.

Regulatory Questions Emerge

Senior analysts at Yureplex anticipate regulatory scrutiny following such extreme volatility. Leveraged products, position limits, and market maker obligations may face new examination.

Yet regulations cannot eliminate fundamental constraints. Silver’s market will always be smaller and less liquid than gold’s regardless of rule changes. Structural realities persist despite regulatory frameworks.

Investors bear responsibility for understanding these dynamics before committing capital. Recent losses delivered expensive education: precious metals can crash spectacularly when speculative excess meets liquidity constraints. Leverage and momentum magnify moves in both directions, and structural factors matter more than narrative when markets dislocate.