Main Street investors discovered a harsh reality this week: institutional endorsement doesn’t eliminate risk. Exchange-traded funds tied to Bitcoin and alternative cryptocurrencies collapsed, devastating portfolios of everyday investors who believed Wall Street’s involvement meant digital assets had finally matured.

Trading specialists at Yureplex examined how regulatory approval and familiar brokerage wrappers masked fundamental volatility that veteran crypto traders already understood.

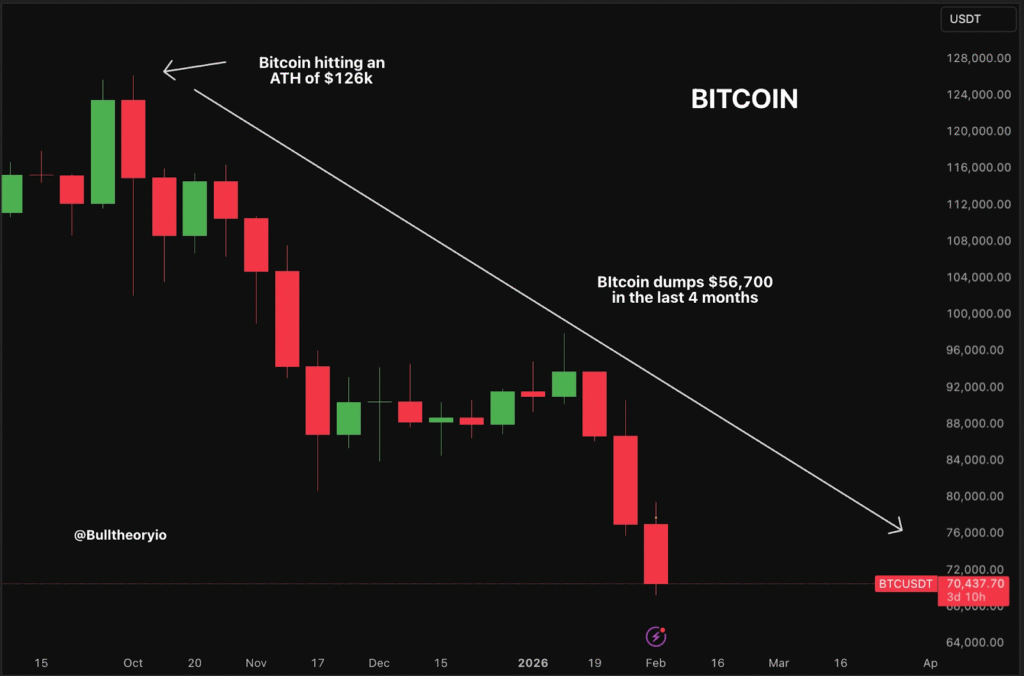

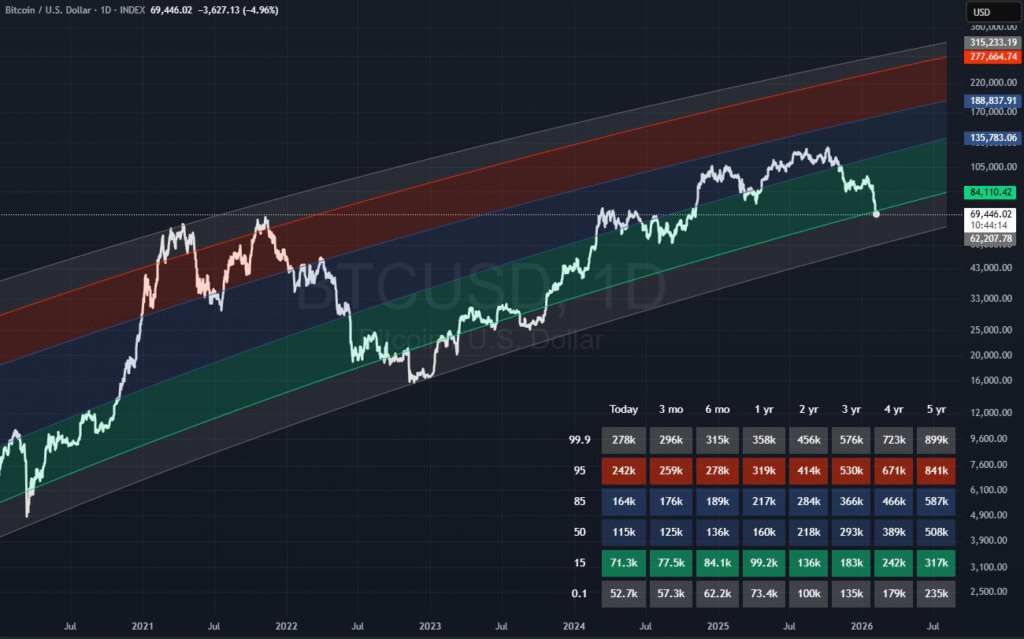

The numbers tell a brutal story. Bitcoin surrendered 50% from peak valuations, settling near $63,000. Alternative cryptocurrency indexes performed even worse, with tracking measures showing 67% declines from October heights. A single week erased at least $700 billion across digital asset markets.

The Safety Illusion Shatters

Regulatory clearance created powerful psychological effects. When government agencies approved crypto ETFs, many interpreted this as validation of the underlying assets themselves. The logic seemed sound: surely regulators wouldn’t greenlight products tied to worthless speculations.

That reasoning proved flawed. Approval processes evaluate disclosure adequacy and structural compliance, not investment merit. Regulators don’t endorse quality; they ensure transparency. This distinction escaped investors accustomed to traditional finance, where regulatory scrutiny often correlates with legitimacy.

Financial product manufacturers moved swiftly once approvals arrived. Fund companies launched vehicles spanning risk spectrums from Bitcoin-only conservative plays to exotic altcoin baskets. Marketing emphasized accessibility and institutional-grade infrastructure.

Brokerage platforms made purchasing simple. No crypto wallets required. No exchange account setups. No private key management. Just click buy like any stock or bond fund. This convenience attracted demographics that previously avoided crypto’s technical complexities.

Underwater and Unprepared

Glassnode’s crypto analytics reveal that average U.S. Bitcoin ETF buyers entered positions around $84,100. Current trading levels leave this cohort nursing substantial unrealized losses.

Nate Geraci from NovaDius Wealth Management observed that political alignment with crypto doesn’t suspend market physics. Downside volatility remains regardless of which administration occupies the White House.

Market analysts emphasized psychological dimensions exceeding pure financial impacts. Seasoned cryptocurrency participants endured multiple boom-bust cycles, developing emotional resilience through experience. This latest wave entered after establishment validation, believing institutional frameworks eliminated the wild west dynamics.

Their assumptions collapsed alongside prices. The mental framework that prompted their investments, Wall Street involvement equals stability, proved false. This cognitive dissonance compounds financial pain.

Conviction Evaporates Quickly

Long-term crypto believers built positions through research into blockchain technology, decentralization philosophy, and monetary theory. Their convictions withstood turbulence because fundamental theses remained intact despite price fluctuations.

Recent ETF buyers followed different paths. Financial advisors recommended allocations. Mainstream financial media covered regulatory approvals positively. The investing public presumed maturation from fringe speculation to a legitimate asset class.

When purchased assets crater, the foundation supporting conviction matters enormously. Those who understand underlying technology and use cases can maintain positions through volatility. Those who bought because “Wall Street says it’s okay now” lack such anchors.

Exit pressure builds as the reasoning supporting purchases evaporates. If institutional packaging was the investment thesis, institutional packaging failing to prevent losses destroys that thesis.

Liquidity Becomes Liability

ETF structures were marketed as improvements over direct crypto ownership. Instant liquidity during market hours. No counterparty risks from exchanges. Familiar tax reporting. Professional custody.

These advantages flip into disadvantages during panics. The same instant liquidity enabling easy entry facilitates rapid exit. Investors don’t need to navigate exchange interfaces or wait for settlement periods. Selling happens with a single click.

Three consecutive months witnessed outflows totaling over $12 billion from U.S. Bitcoin ETFs, according to Deutsche Bank tracking. November saw $7 billion depart, December another $2 billion, and January topped $3 billion. The steady exodus contradicts narratives about patient institutional capital providing price stability.

Altcoin Products Multiply Misery

Bitcoin at least enjoys name recognition, established history, and clear positioning as a digital gold aspirant. Smaller cryptocurrencies lack even these attributes.

Regulators approved ETFs tracking alternative tokens despite many lacking functional products or sustainable economics. The 67% wipeout in these indexes devastated retail holders who assumed regulatory approval meant vetted quality.

Clearance processes examined fund structures and disclosure documents, not whether underlying tokens served genuine purposes. Many altcoins remain purely speculative vehicles driven by narrative and social media hype rather than utility.

Retail investors couldn’t distinguish between regulatory approval of fund mechanics versus endorsement of holdings. This confusion proved expensive.

Fee Extraction Continues

Wall Street firms collect management fees regardless of fund performance. Annual expense ratios compound whether portfolios gain or lose value.

Retail participants absorb all downside volatility while product manufacturers extract predictable revenue. Launch timing concentrated institutional gains during rallies as new funds attracted inflows. Distribution timing concentrated retail pain as purchases occurred near peaks before crashes.

This pattern mirrors criticisms cryptocurrency advocates historically leveled at traditional finance. Instead of democratizing access to wealth creation, institutional crypto products replicated existing power dynamics with new assets.

Reassessing Allocations

Many investment advisors recommend clients evaluate crypto holdings against actual risk tolerance rather than the marketed positioning. Products sold as portfolio diversifiers instead moved in lockstep with technology stocks during selloffs.

Common 5-10% allocation recommendations assumed low correlation with traditional assets. Recent behavior demonstrated a high correlation exactly when diversification matters most, during broad market stress.

Loss aversion psychology makes equivalent percentage declines feel worse than comparable gains feel good. A 50% drop inflicts more psychological damage than a 50% rally provides satisfaction, complicating rational portfolio management.