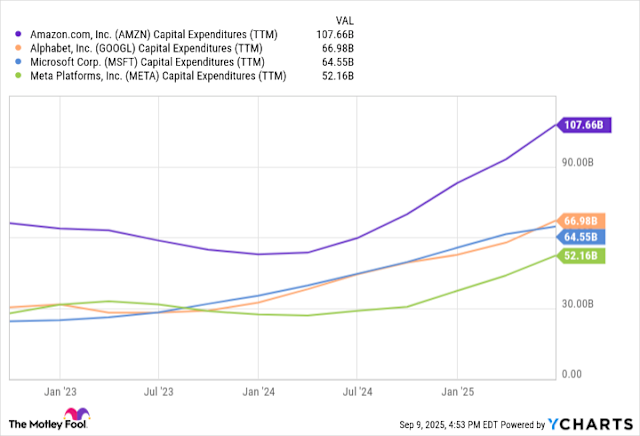

Technology giants are engaged in an unprecedented spending war, pouring hundreds of billions into artificial intelligence infrastructure while investors grow increasingly skeptical. The pattern emerged clearly this week as Amazon, Google, Microsoft, and Meta all announced massive capital expenditure increases for 2026.

Senior market analysts at Yureplex examined why similar strategies produced wildly different market reactions and what this divergence signals about investor confidence.

Amazon revealed plans to spend $200 billion on capital expenditures in 2026, up from $125 billion in 2025. Google followed with $185 billion earmarked for AI expansion, nearly doubling the $91.4 billion spent in 2025. Microsoft and Meta similarly increased their AI budgets, yet market responses varied dramatically.

The Stock Market Verdict

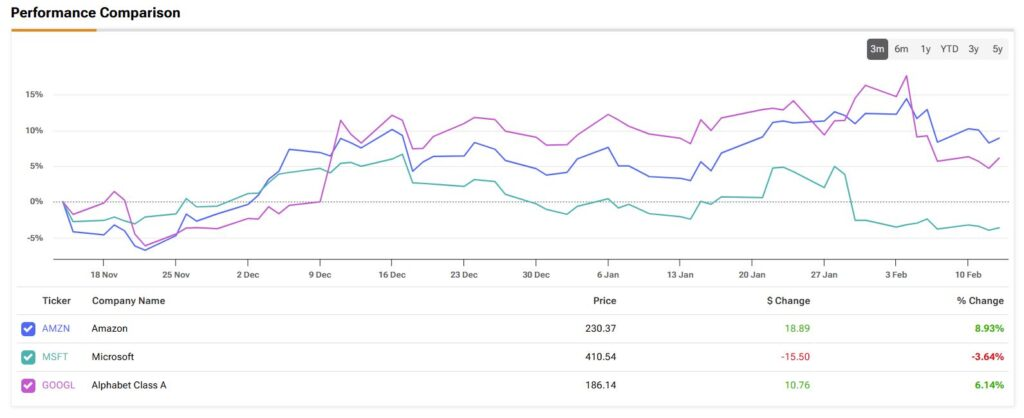

Amazon shares plunged 4.42% in regular trading and another 10.13% after hours following the announcement. Microsoft is down 17% year-to-date despite solid fundamentals. Google’s stock dropped 0.60% even after posting better-than-expected earnings and strong cloud growth.

Meanwhile, Meta’s shares climbed when announcing comparable AI spending increases. This inconsistency reveals that investors are evaluating execution risk and near-term profitability differently across companies.

Why Markets Are Selective

The divergent reactions stem from varying levels of confidence in each company’s ability to monetize AI investments. Meta demonstrated clear paths from AI features to advertising revenue and user engagement. Investors can trace spending to measurable business outcomes.

Amazon’s sprawling business model spanning retail, logistics, cloud, and satellite internet creates more execution risk. The company must succeed across multiple domains simultaneously while maintaining profitability in each.

Microsoft faces questions about whether AI features justify its Azure pricing premium over competitors. Google must prove AI improves search monetization despite potential disruption to its core advertising business.

AWS Shoulders the Burden

Amazon’s cloud division delivered $35.6 billion in quarterly revenue, exceeding expectations of $34.9 billion. This cash generation enables ambitious spending plans, but analysts question the sustainability.

Even AWS can’t indefinitely fund $200 billion annual capital expenditures while competitors aggressively court enterprise customers. Microsoft Azure and Google Cloud offer integrated AI tools and competitive pricing that pressure AWS market share.

The spending surge suggests Amazon recognizes it must invest now or risk losing ground. Yet the defensive nature of the investment makes investors nervous about returns.

Near-Term Profitability Takes a Hit

Amazon guided first-quarter operating income between $16.5 billion and $21.5 billion, missing the $22.2 billion consensus. The guidance miss, combined with the capex announcement, triggered the selloff.

Markets are recalibrating expectations across Big Tech. Investors previously tolerated spending if revenue growth remained strong. Now they demand evidence that AI investments generate measurable returns, not just vanity metrics.

Google’s Similar Struggle

Google reported strong cloud growth and beat earnings estimates, yet shares fell after revealing the $185 billion spending plan. The market reaction mirrors Amazon’s despite better near-term results.

This suggests investor skepticism extends beyond individual companies to the entire AI spending thesis. Questions emerge about whether returns justify the capital intensity or if companies are trapped in an arms race nobody wins.

Meta’s Different Playbook

Meta’s positive market reaction stems from clearer AI monetization. The company demonstrated how AI improves ad targeting, content recommendations, and user engagement. These features directly translate to revenue growth.

Facebook and Instagram already generate massive profits that fund AI research. The business model doesn’t require betting entire divisions on uncertain AI outcomes like cloud or retail companies do.

The Competitive Trap

Technology executives face a prisoner’s dilemma. If one company spends heavily on AI while competitors conserve capital, the spender risks losing market position. If everyone spends massively, margins compress across the industry.

Companies can’t unilaterally disarm without risking competitive disadvantage. Yet collective spending creates industry-wide profitability pressure that concerns investors.

Infrastructure Build vs. Application Layer

Much of the spending goes toward infrastructure: data centers, custom chips, and networking equipment. This creates moats through technical capabilities, but doesn’t guarantee monetization.

The application layer, actual AI products that customers pay for, requires different skills. Infrastructure strength doesn’t automatically translate to consumer or enterprise adoption.

Reading Future Earnings

The next few quarters will reveal which companies successfully bridge infrastructure investment to revenue growth. Markets will reward those showing clear ROI and punish those offering only spending updates.

Amazon needs to prove that $200 billion buys a competitive advantage. Google must show that AI improves search and cloud economics. Microsoft has to demonstrate that Azure customers pay premiums for AI features.

The Reckoning Ahead

Financial experts at Yureplex expect continued volatility as each earnings season brings spending updates and incremental progress reports. Companies that articulate clear monetization paths will outperform those relying on vague transformation narratives.

The AI arms race has entered a critical phase where spending alone no longer impresses. Investors demand evidence of returns commensurate with capital deployed. Big Tech must now prove its massive bets deliver profits, not just impressive technology demonstrations.