Oil prices moved lower after recent gains as markets reassessed near-term supply risks following confirmation of high-level diplomatic talks involving a major OPEC producer, easing fears of imminent military escalation.

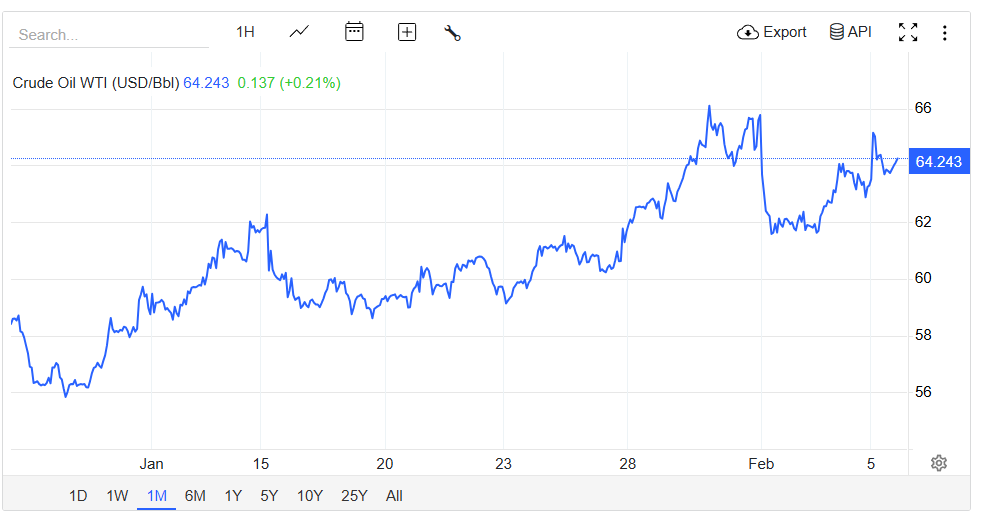

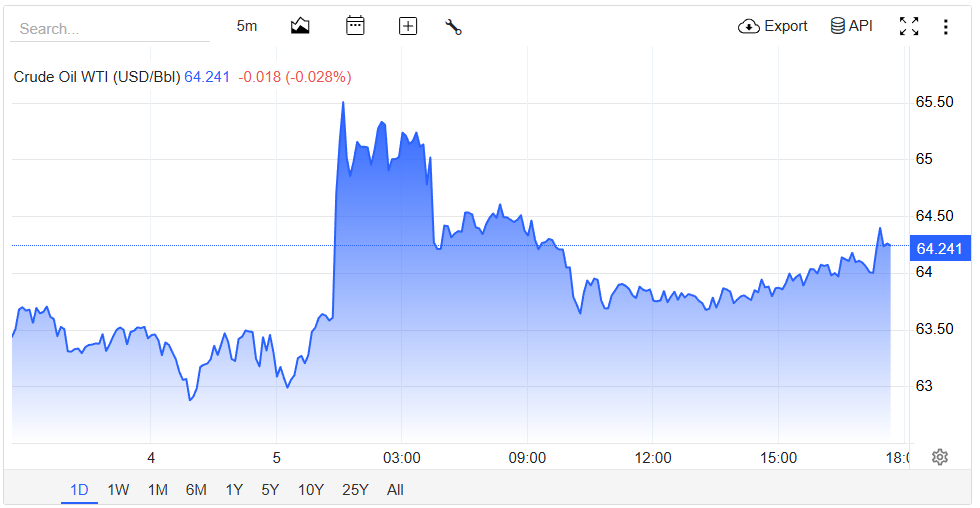

Brent crude drifted toward $68 per barrel, retreating after a 4.8% advance over the previous two sessions, while West Texas Intermediate slipped below $64 per barrel. The pullback reflects a cooling of geopolitical risk premiums that had recently supported prices, even as broader uncertainty remains elevated.

Finance analysts at Unirock Gestion note that while diplomatic engagement has softened immediate supply concerns, markets remain highly sensitive to headline risk, particularly when developments involve producers critical to global energy flows.

Risk Premiums Recalibrate After Diplomatic Confirmation

The confirmation of upcoming talks helped calm fears of near-term supply disruption from a key Middle Eastern energy supplier, prompting traders to lock in profits after a strong rally. Oil markets had rallied earlier this week as investors priced in the possibility of escalating tensions affecting a region that accounts for roughly one-third of global crude production.

Despite the easing of immediate risks, uncertainty persists around whether negotiations can meaningfully narrow differences. As a result, a residual risk premium remains embedded in prices, reflecting the fragile balance between diplomacy and unresolved geopolitical friction.

These overlapping risks continue to complicate pricing, making oil markets vulnerable to abrupt shifts driven by diplomacy, supply data, or broader risk sentiment.

Price Action Reflects Cautious Market Positioning

Oil’s decline marks its first pullback in three sessions, highlighting how quickly sentiment can shift when perceived risks change. Recent price action suggests that traders remain tactical, responding rapidly to developments rather than committing to longer-term directional exposure.

Market participants continue to view oil as vulnerable to sudden volatility spikes, particularly given the concentration of supply in geopolitically sensitive regions. As a result, short-term positioning remains light, with many traders favoring flexibility over conviction.

Inventories Provide Limited Counterbalance

On the supply side, recent data showed that U.S. crude inventories fell to their lowest level in roughly a month, offering some support to prices. However, the drawdown was smaller than market expectations, limiting its impact on sentiment.

Refined product data painted a mixed picture, reinforcing the view that demand remains uneven across regions and sectors. This has contributed to a market environment where inventory signals are closely watched but not yet strong enough to offset broader macro and geopolitical influences.

Cross-Asset Weakness Adds Pressure

Oil’s pullback also coincided with a broader decline across commodities. Precious metals sold off sharply, with silver experiencing steep losses and gold retreating amid volatile trading. The synchronized weakness suggests a wider reassessment of risk across asset classes rather than oil-specific pressure alone.

This broader context has reduced oil’s ability to decouple from other markets in the short term, reinforcing correlations during periods of heightened uncertainty.

Recent trading behavior suggests that energy markets are increasingly reacting to macro liquidity conditions rather than isolated supply narratives. As volatility rises across equities, metals, and currencies, oil has become more sensitive to portfolio-level risk adjustments, particularly among institutional participants managing cross-asset exposure.

Positioning data indicates that speculative length has been reduced in recent sessions, reflecting a preference for capital preservation over directional bets. Rather than anticipating sustained upside, many traders appear focused on protecting gains accumulated during the recent rally. This has resulted in faster profit-taking whenever prices approach short-term resistance levels.

In parallel, options markets are pricing in wider near-term trading ranges, signaling expectations of continued price swings rather than a smooth directional trend. Elevated implied volatility suggests that participants are preparing for abrupt moves driven by headlines, inventory releases, or shifts in geopolitical tone.

From a structural standpoint, oil remains caught between competing forces. On one hand, ongoing production discipline among major exporters continues to support medium-term price stability. On the other, concerns around global demand growth and uneven economic momentum are limiting confidence in a sustained breakout.

In such phases, momentum-driven rallies often fade unless reinforced by clear demand signals or persistent supply disruptions.

As a result, market behavior increasingly reflects tactical positioning rather than long-term conviction, reinforcing the expectation that volatility will remain a defining feature of oil trading in the near term.

Short-term price action is therefore likely to remain reactive, with traders responding quickly to headlines, inventory data, and diplomatic signals rather than committing to sustained directional exposure until clearer macro alignment emerges.

Outlook: Volatility Likely to Persist

Looking ahead, oil prices are expected to remain highly responsive to diplomatic headlines, inventory data, and macro signals. While recent developments have reduced immediate fears of supply disruption, the absence of lasting resolution keeps volatility elevated.

Until clearer signals emerge around sustained demand strength or durable geopolitical stability, oil markets are likely to trade within a headline-driven range, with sentiment shifting rapidly as new information surfaces.