Investor sentiment toward the global payments sector deteriorated sharply after a major European fintech company reported results that fell short of market expectations, triggering a steep decline in its stock price. Analysts highlight that growth deceleration, currency pressures, and shifting regional demand trends are increasingly shaping investor outlook for digital payments firms, according to capital market experts at Yureplex.

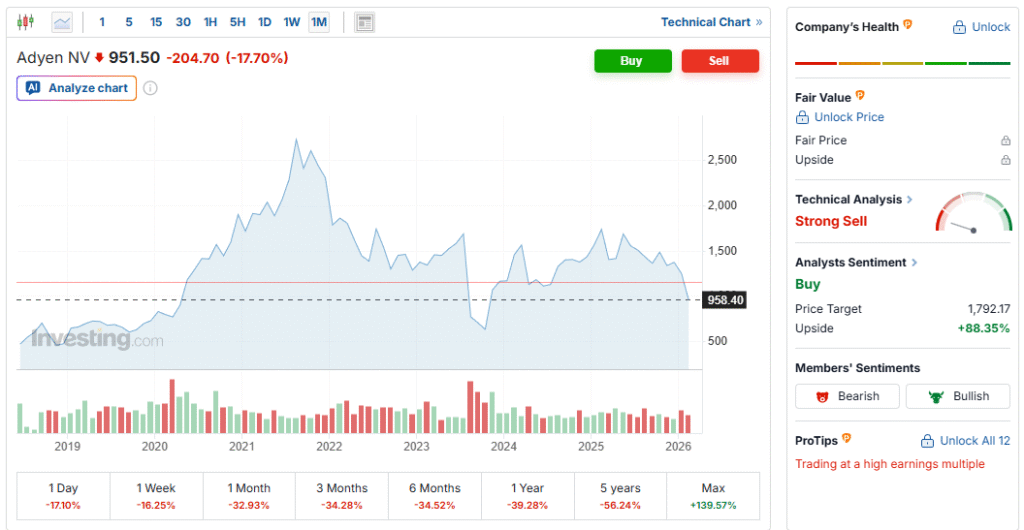

Shares of the Dutch payments processor dropped as much as 20% in early trading, reflecting strong market disappointment with both its forward revenue outlook and payment processing volumes. The sharp decline underscores how sensitive technology-driven financial companies have become to even modest changes in growth expectations.

Revenue Growth Slows Despite Continued Expansion

The company reported that net revenue increased 17% year over year, reaching approximately €1.27 billion during the reporting period. While this represents solid expansion, it fell short of investor expectations, reinforcing concerns that sector growth momentum may be moderating.

Management projected net revenue growth of 20% to 22% for the coming year, which also came below analyst forecasts of roughly 22.8%, further intensifying market caution.

Executives emphasized that the outlook remains supported by a strong client pipeline, continued onboarding of new customers, and ongoing business expansion. However, they acknowledged that macroeconomic uncertainty, slowing consumer spending, and volatile global demand patterns continue to influence overall transaction volumes.

Payment Processing Volumes Miss Expectations

Total processed transaction value reached approximately €745 billion in the second half of the year, below market expectations of around €771 billion. This shortfall played a critical role in the stock sell-off, as investors closely track transaction growth as a key measure of platform scalability, market penetration, and long-term competitiveness.

Market analysts noted that although results remained generally stable, they were insufficient to reverse negative sector sentiment, which has been building amid slowing fintech growth globally.

Regional Growth Disparities Become More Visible

Growth performance varied significantly across geographic regions, highlighting uneven global demand dynamics.

Revenue from both Europe and North America grew approximately 17%, reflecting stable business conditions in mature markets. However, expansion in Asia-Pacific was noticeably weaker, driven by slower activity among large online retail clients and softer e-commerce transaction volumes.

Currency fluctuations further impacted performance. A weaker U.S. dollar created negative translation effects, reducing reported revenue and tightening operating margins despite stable underlying business activity.

Market Sentiment Remains Fragile

The company’s stock decline reflects broader investor concerns about the sustainability of high growth rates within the global digital payments sector. Market participants have become increasingly cautious as interest rates remain elevated, consumer spending slows, and competitive pressures intensify across fintech platforms.

Shares have already experienced significant volatility in recent years. Notably, the stock suffered a major decline in 2023 following weaker-than-expected results, demonstrating the sector’s high sensitivity to earnings surprises.

Structural Challenges Facing Payment Platforms

Analysts emphasize that digital payments firms face several evolving structural risks that could influence long-term performance.

These include intensifying competition from both traditional financial institutions and emerging fintech startups, increasing regulatory oversight across global markets, and ongoing shifts in consumer spending behavior linked to broader economic cycles.

Companies must also continue investing heavily in technology infrastructure, cybersecurity, and compliance systems, which can place sustained pressure on profitability even during periods of revenue growth.

Industry Outlook Reflects Moderating Growth Expectations

While the long-term outlook for digital payments remains positive, recent developments suggest the sector may be entering a phase of more moderate and sustainable growth rather than rapid expansion.

Investors are now placing greater emphasis on profitability stability, operational efficiency, and consistent revenue performance, rather than prioritizing transaction volume growth alone.

Companies demonstrating strong client retention, diversified global exposure, and disciplined cost management are expected to maintain stronger investor confidence in this evolving market environment.

Long-term investor confidence will increasingly depend on stable earnings visibility and disciplined strategic execution, particularly as competition, regulation, and macroeconomic volatility continue reshaping global fintech growth expectations.

Investor Focus Shifts Toward Resilience

The latest results highlight how quickly market sentiment can shift when growth expectations change, even slightly. In a sector previously characterized by rapid expansion, high valuations, and aggressive growth forecasts, investors are increasingly prioritizing resilience, predictability, and financial stability.

As macroeconomic conditions remain uncertain, analysts expect continued volatility across fintech valuations, particularly for firms heavily exposed to global consumer spending cycles, currency fluctuations, and economic slowdowns.

Overall, the sharp market reaction underscores the growing importance of consistent growth delivery, realistic forward guidance, and effective cost management in sustaining investor confidence within the highly competitive digital payments landscape.

Looking ahead, market participants will closely monitor whether payment platforms can stabilize growth while protecting profitability margins. The ability to balance expansion with cost discipline, technological innovation, and geographic diversification will likely determine which companies remain competitive as the global fintech sector transitions into a more mature, efficiency-driven phase. Long-term investor confidence will increasingly depend on stable earnings visibility and disciplined strategic execution.