Investors searching for overlooked opportunities in the online betting sector often focus on companies tied to U.S. sportsbooks and American sports leagues. However, not every compelling growth story originates in North America.

One lesser-known digital wagering company operating quietly outside the U.S. market has been delivering notable performance while avoiding many of the challenges facing its larger peers.

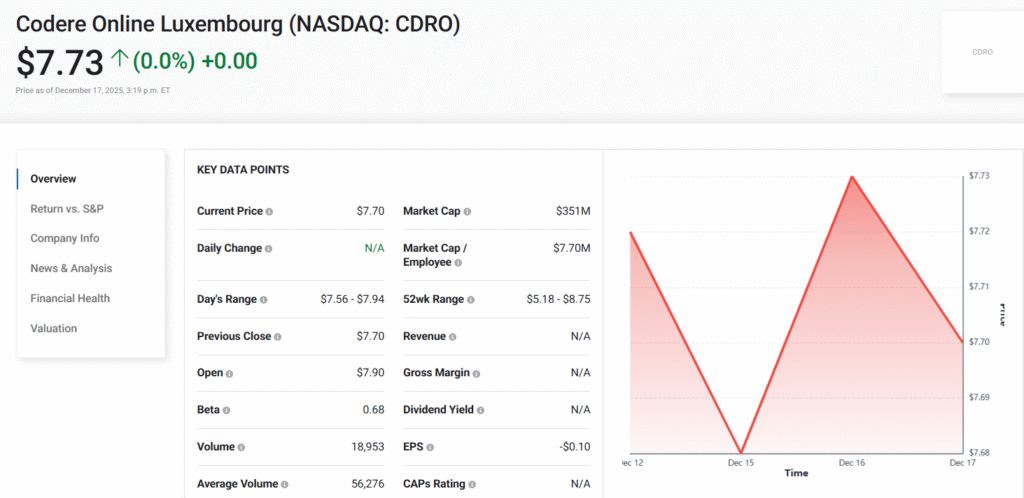

Codere Online Luxembourg (CDRO) is a small-cap online gaming operator that has remained largely out of the spotlight, yet its stock has gained close to 20% year to date, outperforming several well-known betting companies.

According to brokers at Arbitics, Codere’s defining characteristic may also be its most underappreciated strength: the company does not operate in the United States at all.

A Betting Stock Few Investors Track Closely

With a market capitalization of roughly $350 million, Codere Online sits firmly in small-cap territory. Unlike U.S.-focused operators such as DraftKings or Flutter Entertainment, Codere does not attract widespread attention from North American investors, largely because its business is concentrated elsewhere.

At first glance, avoiding the U.S. market might seem like a disadvantage. However, Codere’s recent performance suggests otherwise. While several U.S.-centric betting stocks have struggled with volatility, Codere has posted steady gains by focusing on international regions with different regulatory dynamics.

Insulation From U.S. Regulatory and Competitive Pressures

One reason Codere has remained relatively stable is its lack of exposure to current U.S. headwinds. In 2025, American sportsbook operators will face growing pressure from prediction markets and increased regulatory scrutiny at the state level.

Because Codere does not operate within the U.S., it avoids:

- State-by-state regulatory uncertainty

- Competition from U.S.-based prediction platforms

- Licensing risks tied to evolving legal interpretations

This insulation has allowed the company to operate with greater regulatory clarity while many larger peers contend with unpredictable policy shifts.

Concentration on High-Growth International Markets

Instead of competing in the crowded U.S. landscape, Codere focuses on online casino and sports betting markets across several international regions. Its most important markets include:

- Mexico

- Colombia

- Argentina

- Spain

The company also maintains exposure to Italy, South Africa, and the United Kingdom, but Latin America remains its primary growth engine.

These regions benefit from:

- Rising smartphone and internet penetration

- Younger demographic profiles

- Strong cultural interest in sports, particularly soccer

From a long-term perspective, these markets offer a longer growth runway compared with more mature betting environments.

A Less Obvious Play on Global Soccer Betting

Another factor investors may be watching is the 2026 FIFA World Cup, which is expected to drive a surge in global sports betting activity. While much of the attention often centers on U.S.-focused sportsbook operators, Codere’s footprint is concentrated in soccer-first markets, offering a different angle on potential World Cup demand.

Countries such as Mexico, Argentina, Colombia, and Spain are among the most engaged soccer audiences worldwide, with strong fan participation and high betting interest during major international tournaments. This geographic exposure could place Codere in a favorable position to capture wagering activity tied to the event, particularly compared with operators whose revenues are more closely linked to American sports like football or basketball.

As a result, the World Cup may act as a meaningful, though event-driven, tailwind for Codere’s international betting operations.

Valuation and Strategic Optionality

Codere’s valuation profile is another factor drawing increasing investor interest. Compared with larger, more widely followed betting operators, the stock is often considered modestly priced, especially given its exposure to emerging markets and the continued shift toward digital wagering across Latin America. As online betting adoption accelerates in these regions, Codere’s growth outlook may not yet be fully reflected in its share price.

Beyond organic growth, Codere also carries potential strategic value. As Latin America’s online wagering market matures, larger global betting companies may look to expand through acquisitions rather than building regional platforms from the ground up.

In that scenario, Codere’s existing licenses, established customer base, and on-the-ground presence in key markets could make it an attractive takeover candidate, adding another layer of long-term optionality for investors.

The Bottom Line

Codere Online may not be a household name, but its absence from the U.S. betting market, focus on high-growth international regions, and exposure to global sports betting trends clearly differentiate it from many rivals.

The company’s strong presence in soccer-driven markets, lower regulatory risk, and potential upside tied to the 2026 FIFA World Cup make it a noteworthy under-$10 stock within the online wagering sector.

For investors prepared to look beyond North America, Codere Online represents a distinctive global betting model with long-term growth potential rooted in expanding international demand rather than crowded domestic competition.