Turning $100,000 into $1 million over a decade is rare, but select growth stocks can offer that kind of upside under the right conditions. Arbitics highlights that small-cap and mid-cap companies often provide greater return potential than large-cap stocks because they have more room to scale their businesses and expand market share. While these opportunities come with higher volatility, they can reward investors willing to take a long-term, risk-aware approach.

By focusing on companies positioned in fast-growing industries with strong revenue momentum and clear expansion strategies, investors may improve their chances of achieving outsized returns. Below are two growth-focused stocks that stand out as potential candidates for delivering substantial gains by 2035, provided execution and industry trends remain favorable:

1. Cipher Mining: Leading AI Infrastructure

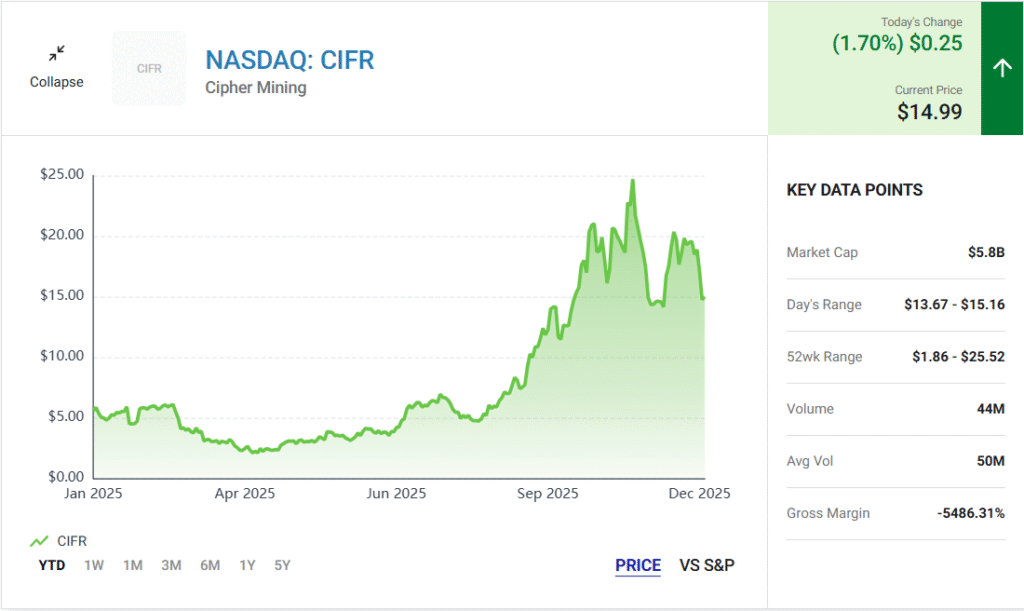

Cipher Mining (CIFR) is quickly becoming a leader in AI infrastructure, which has significant potential given the growing demand for artificial intelligence in numerous sectors. Originally focused on Bitcoin mining, Cipher Mining has pivoted to AI computing infrastructure, positioning itself at the intersection of crypto and AI, two of the hottest industries today.

Recently, Cipher Mining secured a 15-year deal with Amazon to provide 300 megawatts of computing capacity, valued at $5.5 billion, averaging $367 million per year. With a 3.2-gigawatt pipeline, Cipher Mining is set to support at least nine more deals of similar magnitude. Additionally, Cipher has secured a 10-year contract with Fluidstack, an AI cloud platform backed by Alphabet, valued at $3 billion.

As the company continues to build out its data centers, Cipher Mining is well-positioned to benefit from the increasing demand for AI infrastructure. With the likes of Amazon, Fluidstack, and Alphabet likely to require more gigawatts for AI computing, Cipher Mining stands to capitalize on the long-term growth in AI infrastructure.

With a market cap under $10 billion and its high-value contracts, Cipher Mining has significant upside potential. For those looking to capitalize on the crypto and AI booms, Cipher Mining is an excellent pick.

2. Ondas Holdings: Rapid Growth in Autonomous Drones

Another exciting growth stock is Ondas Holdings (ONDS), a company specializing in autonomous drone systems. Ondas has experienced incredible growth, with revenue surging more than sixfold year-over-year. Despite its small market cap of $3 billion, Ondas has proven its ability to scale quickly, especially in the military drone sector.

In Q3 2025, Ondas reported $10.1 million in revenue. While this might seem modest to value investors, the company’s exceptional growth rate and strategic positioning make it a prime candidate for high-risk, high-reward investments. Ondas’ revenue grew 60% quarter-over-quarter, and it is targeting $36 million in revenue for 2025, with a longer-term goal of $110 million by 2026.

Ondas has raised its full-year revenue forecast multiple times, now aiming for $36 million, up from the previous $25 million estimate. Its success in securing multiyear government contracts adds credibility to its growth outlook.

Despite the higher risk associated with its sector, Ondas’ growth trajectory, its autonomous drone technology, and the increasing demand for AI-powered drones make it a compelling investment for long-term growth.

Is This the Right Time to Buy?

Both Cipher Mining and Ondas Holdings represent exciting opportunities in high-growth industries. As small-cap and mid-cap stocks, they offer the potential for returns that larger companies simply cannot match. However, this article points out, high-risk stocks like these come with the potential for volatility, especially in emerging sectors like AI infrastructure and autonomous drones.

If you’re looking to build a portfolio with the potential for massive growth, these two companies should be considered for their strong market positions, strategic partnerships, and industry trends.

Conclusion: A Smart Bet for the Long Term

Cipher Mining and Ondas Holdings represent two promising growth stocks with the potential to turn $100,000 into $1 million by 2035. Many financial experts highlight that small-cap and mid-cap stocks like these are well-positioned for long-term growth, particularly in sectors like AI infrastructure and autonomous drone technology.

While both stocks carry high risk, their strong growth rates, strategic partnerships, and industry tailwinds provide a solid foundation for long-term success. If you’re willing to embrace volatility for the chance at substantial returns, Cipher Mining and Ondas Holdings are worth watching closely over the next decade.